Merck's Selloff Is an Overreaction

The stock market has overreacted to the recent negative developments for Merck & Co. (NYSE:MRK), in my opinion. The ostensible cause of the recent fall in Merck's stock price is because of the less compelling efficacy data for its Covid-19 antiviral treatment as compared to data for rival Pfizer Inc. (NYSE:PFE).

Both companies tested their respective antiviral pills in non-hospitalized, unvaccinated, mild-to-moderate Covid patients who were at risk of developing severe disease. According to the study, Merck and Ridgeback Biotherapeutics' antiviral drug Molnupiravir reduced the risk of hospitalization and death by roughly 30% when patients began taking the drug within five days of symptoms beginning. In comparison, Pfizer's antiviral drug, Paxlovid, cut down on the same risk by 89% when patients began the two-pill regimen within three days of symptoms appearing.

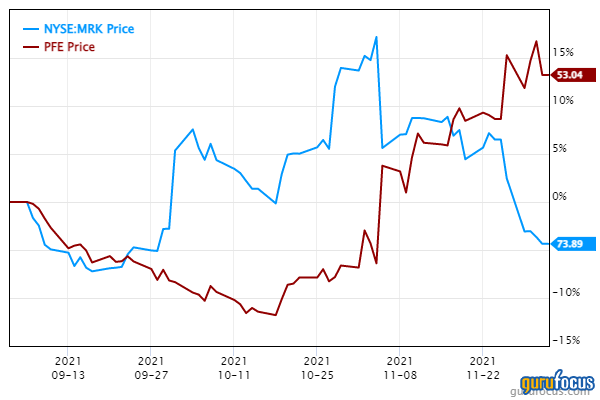

The results sent Merck's stock into a tailspin while Pfizer's stock shot up. The movements of these two stocks over the last three months are captured by the chart below:

Molnupiravir, which has already been approved in the U.K., was recommended for U.S. approval by the FDA expert panel earlier this week, and Pfizer's pill is also expected to be approved in the next few weeks. Merck already has a deal with both the U.S. and U.K. governments to supply both countries with millions of doses and is unlikely to have any problems selling millions more around the world.

It's not an either/or situation, since Pfizer is unlikely to be able to produce enough pills for the entire world. Both therapies will coexist and may even in the future be used together to delay development of resistance in the virus. So, for investors to bid up Pfizer and sell off Merck is illogical. Both these pills are stunning scientific achievements and have the potential to change the trajectory of the pandemic by keeping most people out of the hospital if given early enough in the infection. While vaccines remain the first line of defence, these Covid-19 antivirals will likely become a solid second line of defence.

Moreover, while Pfizer's regimen looks more effective initially, the drugs have not been tested in a head-to-head comparative trial, so it's premature to say that Merck lost the race by just looking at the headline numbers, as they have not been tested in similar patient populations and have been tested in different clinical trial protocols.

The drugs work by different mechanisms of action, and it is likely both will have a place in therapeutics. The stock market reaction to Pfizer appears to be rational and the stock market reaction to Merck appears to be overly pessimistic in light of this.

Unlike Pfizer, which owns its drug Paxlovid, Merck will have to share the risks and rewards with partner Ridgeback. So, both the upside and downside for Molnupirvir is limited. Merck also isn't solely reliant on developing Covid-19 therapies. It is a well-established pharmaceutical giant with many successful drugs and treatments to its name. Merck's short- and medium-term success depends on the performance of its oncology (anti-cancer) franchise led by Keytruda, which is now second biggest drug in history.

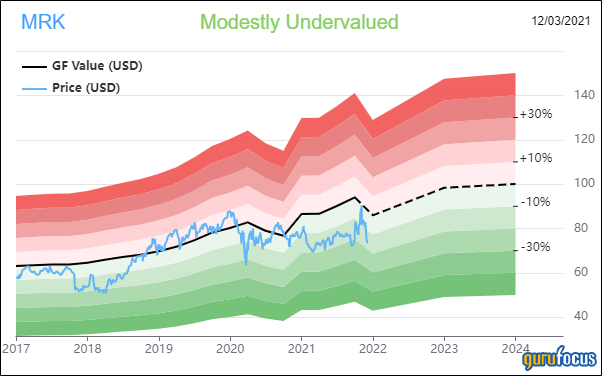

After the recent selloff, Merck is now undervalued according to the GF value chart:

In my opinion, both Merck and Pfizer are buys at this point due to future upside from their Covid-19 antivirals. Pfizer has achieved outstanding success in both the Covid-19 vaccine arena and now with Paxlovid. While Merck trails behind on the effectiveness of its Covid-19 treatment, it has done equally well on the vaccine front, and it is now undervaled to boot.

This article first appeared on GuruFocus.