How Marsèll Built Its Reputation in Footwear Without Sneakers

MILAN — Footwear firm Marsèll has developed its own recipe for success — and except for the few ingredients cofounder and creative director Marco Cima deemed as “secret,” he has reasons to believe culture and an entrepreneurial bent played a role.

In 2021, the company, headquartered in the Riviera del Brenta, the footwear manufacturing hub in the Veneto region, posted sales of 14.4 million euros, up 60 percent versus 2020 and 28 percent compared to 2019, coming out of a quagmire that harked back to Barneys New York filing for Chapter 11 in 2019, which resulted in the brand reporting losses of 1 million euros.

More from WWD

The brand is known for its sophisticated, and at times off-beat, men’s and women’s styles, a redux of classics with an arty bent. Think penny loafers with ruched toes; monk-like, round-toed mules, and thin-soled desert boots. It has never produced sneakers or emblazoned its logo on designs, which makes its ongoing growth stand out even more.

Established in 2001 and envisioned as a brand offering timeless shoes inspired more from mid-19th-century design than fashion trends, it also jumpstarted its own production facilities.

“We established ourselves in the district when everybody else was relocating production abroad seeking lower costs. By contrast, we firmly believed in local production and artisanship,” Cima said.

It should come as no surprise, he said, that positioning and price point reflect those of luxury labels, which returned to manufacture their footwear in the region sometime later in the past decade.

“In the first 10 years in business our way was clear, for our approach was unusual. Then big corporations went on a buying spree of local know-how, guaranteeing the system’s survival but also limiting the entrepreneurship of smaller companies,” he said.

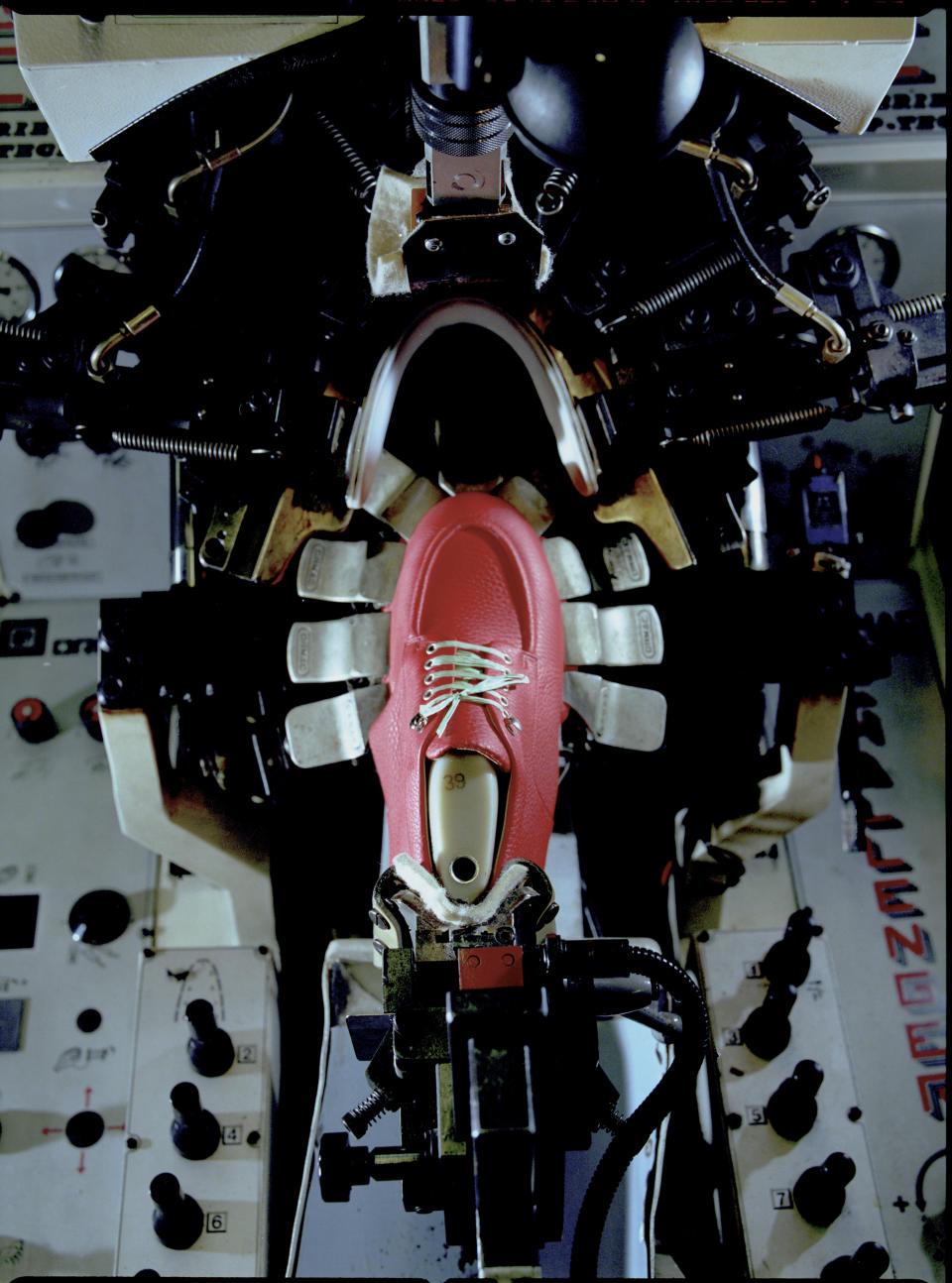

Mattia Balsamini/Courtesy of Marsèll

“Our vision was clear, the potential output, not so much,” echoed Andrea Rossi, cofounder, vice president and chief commercial officer. “Everybody thought we were foolish, we turned from a nimble commercial entity into a heavily [structured] industrial company.”

Cima said they have often been approached by private equity funds but have repeatedly turned down offers as they didn’t want to lose their independence.

“We are a little pearl generating relatively significant figures, despite not having the marketing prowess of bigger corps,” he said.

Reinvention and creativity have always been at the core of the company, which since the advent of the social media revolution around 10 years ago found its own marketing strategy in culturally relevant projects.

In 2016, the company unveiled Marsèll Paradise, a multifunctional space in Milan devoted to art exhibitions, book presentations, installations and replete with a book shop and library, drawing a diverse mix of artists, designers and creatives to use the space as their own. Most recently, for Milan Design Week, it hosted a site-specific installation by artist Matylda Krzykowski called “You Don’t Want Space, You Want to Fill It,” which investigated the idea and perception of space in contemporary culture.

“Over the past few years, we committed to building international bridges, strengthening the dialogue between Milan and foreign creatives and cultures,” said Loris Moretto, head of communications. “We tend to support independent projects.”

Courtesy of Marsèll

As with arts and culture projects, fashion collaborations with the likes of Eckhaus Latta, Rotate and Vitelli stemmed from mutual respect.

“There is never a speculative bent geared at drawing audience or spur traffic behind these strategies; it’s more about joining forces to make things together,” Cima said.

Collaborations have helped the brand get international recognition. It generates 80 percent of its revenues outside Italy, with North America accounting for between 30 and 35 percent of sales, Asia for 35 percent and Europe for 20 percent.

Lacking a brick-and-mortar retail component, the brand’s wholesale operations are flanked by a proprietary e-commerce site, which accounts for 36 percent of sales.

In 2022, Rossi said the company should reach the 16.5-million-euro revenue mark, backed by strong sales of the fall 2022 and spring 2023 collections.

Sign up for WWD's Newsletter. For the latest news, follow us on Twitter, Facebook, and Instagram.