Lockheed Martin (LMT) Q4 Earnings Top Estimates, Sales Rise Y/Y

Lockheed Martin Corporation LMT reported fourth-quarter 2021 adjusted earnings of $7.24 per share, which surpassed the Zacks Consensus Estimate of $7.23 by 0.1%.

The company reported GAAP earnings of $7.47, which increased 17.1% year over year.

For 2021, adjusted earnings were $22.04 per share, which missed the Zacks Consensus Estimate of $22.56 by 2.3%.

Operational Highlights

In the reported quarter, net sales amounted to $17.73 billion, which surpassed the Zacks Consensus Estimate by 0.4%. The top line increased 4.1% from $17 billion reported in the year-ago quarter.

In 2021, Lockheed Martin’s total revenues grew 2.5% year over year to $67.04 billion. Full-year revenues came almost at par with the Zacks Consensus Estimate.

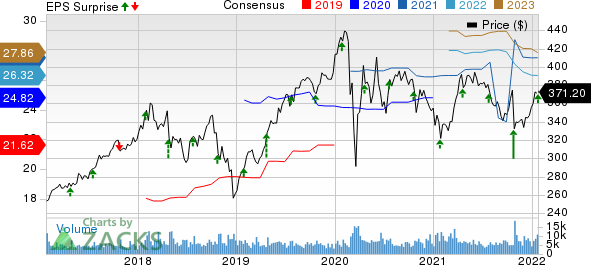

Lockheed Martin Corporation Price, Consensus and EPS Surprise

Lockheed Martin Corporation price-consensus-eps-surprise-chart | Lockheed Martin Corporation Quote

Backlog

Lockheed Martin ended 2021 (on Dec 31, 2021,) with $135.36 billion in backlog compared with $147.13 billion at the end of 2020. Of this, the Aeronautics segment accounted for $49.12 billion, while Rotary and Mission Systems contributed $33.70 billion. Meanwhile, Space Systems and the Missiles and Fire Control segments contributed $25.52 billion and $27.02 billion, respectively.

Segmental Performance

Aeronautics: Sales increased 6% year over year to $7.13 billion, primarily due to higher net sales from the F-35 program and classified contracts.

The segment’s operating profit improved 13% year over year to $820 million. Operating margin expanded 70 basis points (bps) to 11.5%.

Missiles and Fire Control: Quarterly sales increased 12% year over year to $3.22 billion due to higher net sales for integrated air and missile defense programs, and tactical and strike missile programs.

The segment’s operating profit improved 17% year over year to $438 million, while operating margin expanded 60 bps to 13.6%.

Space Systems: Sales decreased 10% year over year to $2.92 billion in the fourth quarter. The decrease was primarily due to lower net sales for the Atomic Weapons Establishment program as it was no longer included in the company's financial results beginning in the fourth quarter of 2021. Also, lower net sales from commercial civil space programs contributed to lower sales of the segment.

The segment’s operating profit decreased 16% to $308 million. Operating margin contracted 90 bps to 10.5% in the quarter under review.

Rotary and Mission Systems: Quarterly revenue increased 6% to $4.46 billion on a year-over-year basis. The increase was primarily due to higher net sales for various C6ISR programs, integrated warfare systems and sensors (IWSS) programs, and training and logistics solutions programs.

The segment’s operating profit rose 10% to $448 million in the fourth quarter. Operating margin expanded 40 bps to 10% in the reported quarter.

Financial Condition

Lockheed Martin’s cash and cash equivalents totaled $3.60 billion at the end of 2021 compared with $3.16 billion at the end of 2020.

Cash from operations at the end of 2021 amounted to $9.22 billion compared with $8.18 billion a year ago.

Guidance

Lockheed Martin issued its financial guidance for 2022.

The company currently expects to generate revenues worth approximately $66 billion for 2022. The Zacks Consensus Estimate for full-year revenues, which is pegged at $66.29 billion, is slightly more than the company’s guidance.

Earnings per share are anticipated at $26.70 for 2022. The Zacks Consensus Estimate for the company’s full-year earnings, which stands at $26.32 per share, lies below LMT’s guidance range.

Zacks Rank

Lockheed Martin currently has a Zacks Rank #4 (Sell). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Q4 Defense Releases

Boeing BA is slated to release its fourth-quarter 2021 results on Jan 26. Boeing has a four-quarter average negative earnings surprise of 219.73%.

The long-term earnings growth rate of BA stands at 4%. The Zacks Consensus Estimate for Boeing’s fourth-quarter sales and earnings is pegged at $16.9 billion and a loss of 15 cents per share, respectively.

General Dynamics GD is scheduled to release its fourth-quarter 2021 results on Jan 26. It has a four-quarter average earnings surprise of 3.15%.

General Dynamics boasts a long-term earnings growth rate of 9%. The Zacks Consensus Estimate for GD’s fourth-quarter sales and earnings is pegged at $10.7 billion and $3.37 per share, respectively.

Northrop Grumman NOC is slated to release its fourth-quarter 2021 results on Jan 27. The long-term earnings growth rate of Northrop is pegged at 7.9%.

Northrop has a four-quarter average earnings surprise of 14.74%. The Zacks Consensus Estimate for NOC’s fourth-quarter sales and earnings is pegged at $8.9 billion and $5.95 per share, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Boeing Company (BA) : Free Stock Analysis Report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Northrop Grumman Corporation (NOC) : Free Stock Analysis Report

General Dynamics Corporation (GD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research