Is Li & Fung Limited’s (HKG:494) CEO Overpaid Relative To Its Peers?

Spencer Fung has been the CEO of Li & Fung Limited (HKG:494) since 2014. This report will, first, examine the CEO compensation levels in comparison to CEO compensation at companies of similar size. Next, we’ll consider growth that the business demonstrates. Third, we’ll reflect on the total return to shareholders over three years, as a second measure of business performance. This process should give us an idea about how appropriately the CEO is paid.

View our latest analysis for Li & Fung

Want to help shape the future of investing tools? Participate in a short research study and receive a 6-month subscription to the award winning Simply Wall St research tool (valued at $60)!

How Does Spencer Fung’s Compensation Compare With Similar Sized Companies?

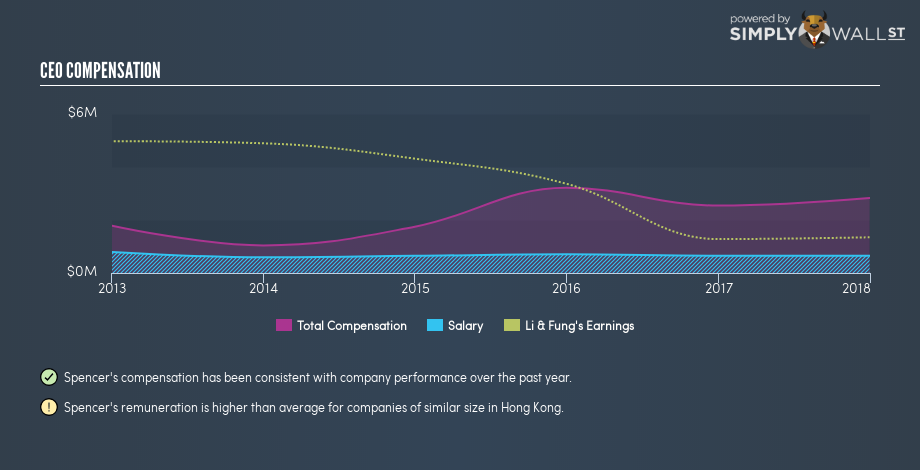

Our data indicates that Li & Fung Limited is worth HK$11b, and total annual CEO compensation is US$2.8m. (This figure is for the year to 2017). While this analysis focuses on total compensation, it’s worth noting the salary is lower, valued at US$653k. We examined companies with market caps from US$1.0b to US$3.2b, and discovered that the median CEO compensation of that group was US$486k.

As you can see, Spencer Fung is paid more than the median CEO pay at companies of a similar size, in the same market. However, this does not necessarily mean Li & Fung Limited is paying too much. A closer look at the performance of the underlying business will give us a better idea about whether the pay is particularly generous.

You can see, below, how CEO compensation at Li & Fung has changed over time.

Is Li & Fung Limited Growing?

On average over the last three years, Li & Fung Limited has shrunk earnings per share by 45% each year. In the last year, its revenue is down -2.5%.

Sadly for shareholders, earnings per share are actually down, over three years. This is compounded by the fact revenue is actually down on last year. It’s hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration.

You might want to check this free visual report on analyst forecasts for future earnings.

Has Li & Fung Limited Been A Good Investment?

Given the total loss of 61% over three years, many shareholders in Li & Fung Limited are probably rather dissatisfied, to say the least. So shareholders would probably think the company shouldn’t be too generous with CEO compensation.

In Summary…

We compared total CEO remuneration at Li & Fung Limited with the amount paid at companies with a similar market capitalization. As discussed above, we discovered that the company pays more than the median of that group.

Earnings per share have not grown in three years, and the revenue growth fails to impress us.

Arguably worse, investors are without a positive return for the last three years. Some might well form the view that the CEO is paid too generously! If you think CEO compensation levels are interesting you will probably really like this free visualization of insider trading at Li & Fung.

Of course, the past can be informative so you might be interested in considering this analytical visualization showing the company history of earnings and revenue.

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.