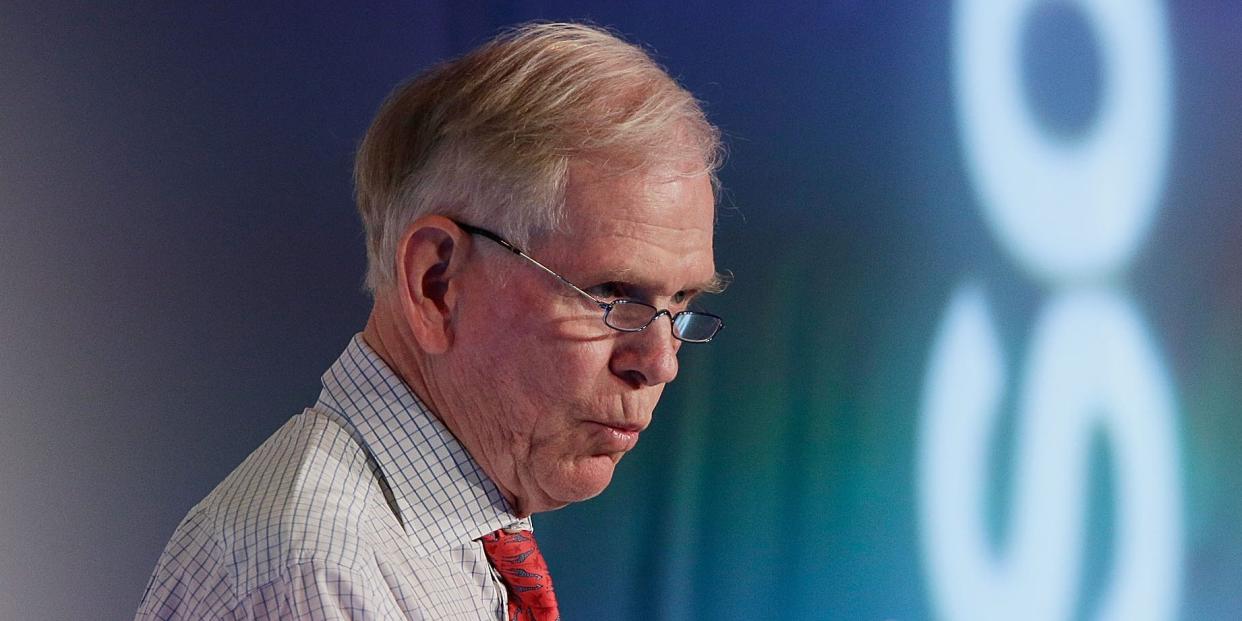

Legendary investor Jeremy Grantham flagged a 'superbubble' in asset prices and predicted a historic market crash. Here are his 8 best quotes of 2022.

- Oops!Something went wrong.Please try again later.

Jeremy Grantham flagged a "superbubble" in asset prices and warned of an epic market crash last year.

The GMO cofounder and market historian also panned bitcoin and predicted a global housing slump.

Here are Grantham's 8 best quotes of 2022.

Legendary investor Jeremy Grantham rattled Wall Street last year by sounding the alarm on a "superbubble" in asset prices, and predicting it would end with an epic market crash.

The market historian and GMO cofounder also trashed bitcoin, warned of a global slump in house prices, and urged investors not to be fooled by short-lived rallies.

Here are Grantham's 8 best quotes of 2022, lightly edited for length and clarity:

1. "Most of the superbubbles go below trend and stay there for quite a while. This time, trend is at most 2,500. It will be hard to prevent the market from declining to that level." (January 26) (Grantham's S&P 500 forecast suggests the benchmark stock index could plunge another 34% from its current level of around 3,800 points.)

2. "We have a market today which feels superficially like 2000, and I think it's going to play out initially like 2000. Then the deflationary effects on the economy and the stock market will result in a world rather like the 1970s, where all assets are simply much lower priced than they are today." (May 9)

3. "We are really messing with all of the assets, and this has turned out, historically, to be very dangerous." (May 18) (Grantham pointed to the soaring prices of stocks, bonds, housing, energy, metals, and food.)

4. "There's nothing as quick and spectacular as a bear market rally. With hindsight they signify very little, but at the time they frighten the pants off bears and they give hope that all is over, all is forgotten, and it's back to the races." (July 29)

5. "Bitcoin is not a good reserve of value, as we've seen. It's terrible for a currency exchange. It's expensive to transact, but worst of all, it is deadly to the environment. It's incredibly energy intensive to give you a speculative instrument to wager on, that's it. The fact that it takes our precious energy and has a carbon footprint is the worst crime of all, and the sooner it goes away, the better." (July 29)

6. "Each cycle is different and unique — but every historical parallel suggests that the worst is yet to come." (August 31)

7. "I believe the housing markets around the world will spend the next big chunk of time unraveling and causing all manner of, perhaps, unexpected problems." (September 1)

8. "This is a more dangerous-looking moment in global economics than even the madness of the housing bubble of 2007. The deterioration in fundamentals on a global basis looks absolutely shocking." (September 8)

Read the original article on Business Insider