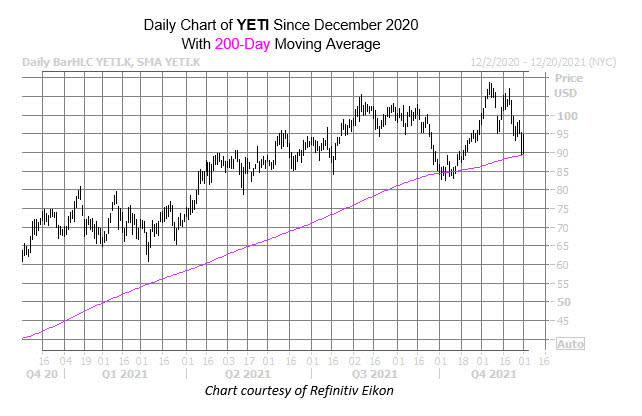

Key Trendline Could Save Yeti Stock Yet Again

The shares of drinkware manufacturer Yeti Holdings Inc (NYSE:YETI) have been cooling since a mid-November run-up that put the stock back near its Nov. 5 record peak of $108.82. Despite this pullback, the stock is up 32.4% year-to-date, and just came within one standard deviation of a trendline we highlighted ahead of the firm's earnings report a few weeks ago. At last glance, the equity is down 2.9% at $89.48.

The trendline in question is YETI's 200-day moving average, with six similar occurrences happening during the past three years. According to data from Schaeffer's Senior Quantitative Analyst Rocky White, 83% of one-month returns have been positive, with the stock averaging a 7.2% pop during that time period. From where the stock currently sits, a similar move would put it just below the $96 mark.

Yeti got a mixed response from analysts after last month's earnings, in which it shared profits and revenue that exceeded estimates. The 12-month consensus price target of $112.35 remains at a lofty 24.8% premium to current levels, while eight of the 12 in coverage call the stock a "buy" or better.

Additionally, Yeti stock's 14-day Relative Strength Index (RSI) stands at 26 -- putting it firmly in "oversold" territory. This suggests a short-term bounce could be on its way.