JPMorgan Slips Despite 4th-Quarter Revenue and Earnings Beat

- By James Li

Shares of JPMorgan Chase & Co. (NYSE:JPM) slipped approximately 2% on Friday following the release of its fourth-quarter 2020 earnings results.

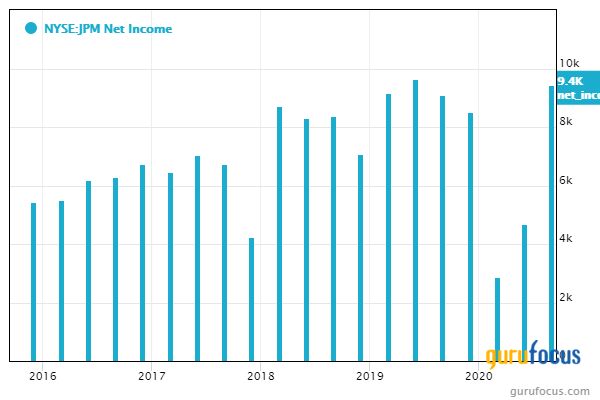

For the quarter, the New York-based bank reported net income of $12.14 billion, or $3.79 in earnings per share, compared with net income of $8.52 billion, or $2.57 in earnings per share, for the fourth quarter of 2019.

Bank reports strong revenues even after excluding net reserve releases

JPMorgan Chase Chairman and CEO Jamie Dimon said that the bank concluded a "challenging" year with record revenues driven by the bank's "diversified business model and dedicated employees." The bank reported record income despite setting aside $2.9 billion in net reserve releases. Adjusted net earnings of $3.07 per share, which excludes the 72-cent boost in reserve releases, outperformed the Refinitiv consensus estimate of $2.62 per share.

Dimon added that while the reserve releases resulted from "positive [coronavirus] vaccine and stimulus developments," the reserve calculations stem from "multiple, multiyear hypothetical probability-adjusted scenarios" that can introduce quarterly volatility in revenues. The CEO added that JPMorgan's credit reserves of over $30 billion "continue to reflect significant near-term economic uncertainty."

Stock falls on down day for U.S. markets

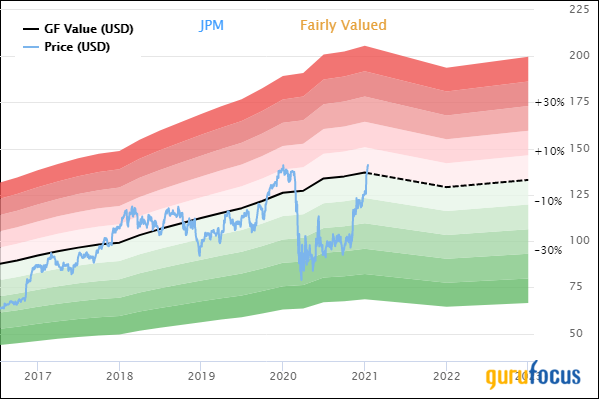

Shares of JPMorgan Chase hit an intraday low of $137.01, down approximately 2.9% from the previous close of $141.12. Despite this, the stock is fairly valued based on a price-to-GF Value ratio of 1.02.

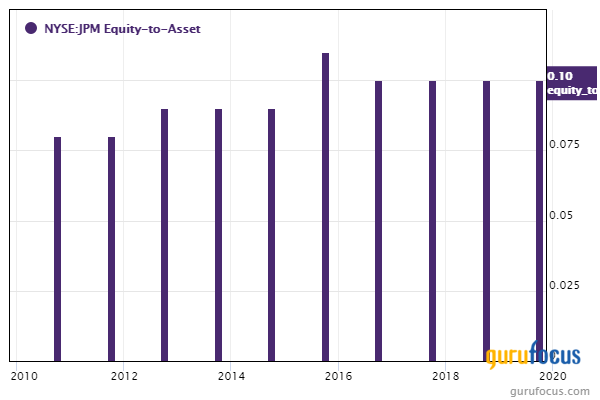

According to GuruFocus, JPMorgan's equity-to-asset and debt-to-equity ratios are underperforming over 64% of global competitors, suggesting moderately high use of financial leverage.

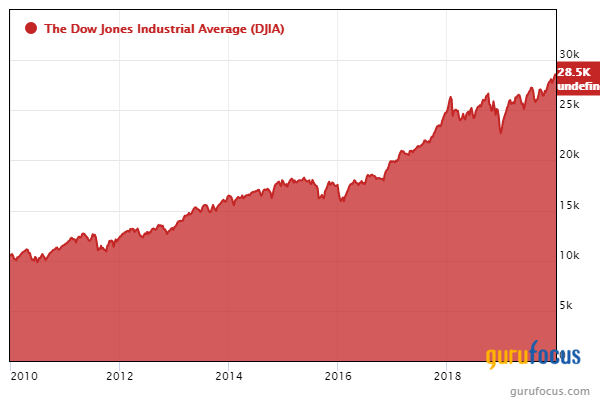

The Dow Jones Industrial Average hit an intraday low of 30,612.17, down 378.85 points from Thursday's close of 30,991.52 as investors monitored news regarding President-elect Joe Biden's new coronavirus stimulus plan and accelerating coronavirus cases and casualties around the globe.

See also

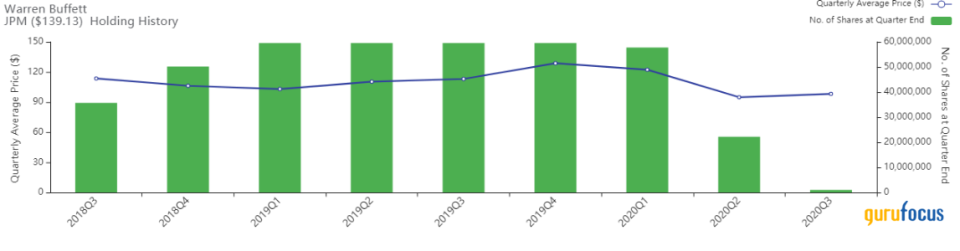

Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway Inc. (NYSE:BRK.A)(NYSE:BRK.B) discarded over 95% of its JPMorgan Chase holding during the September 2020 quarter, leaving just 967,267 shares. However, Berkshire's fourth-quarter 2020 portfolio has not come out yet since the deadline is 45 days after the quarter ends.

Disclosure: No positions.

Read more here:

4 Peter Lynch Growth Stocks With Good Financial Strength

GameStop Blasts Off on Solid December Sales Performance

Daniel Loeb Target Intel Appoints Tech Leader as New CEO

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.