Jim Simons Likes Cogent, But Can We Trust Its Dividend?

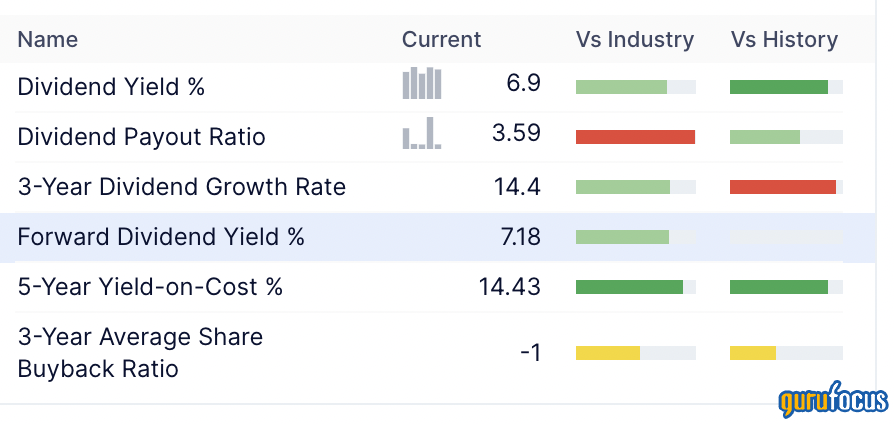

If you run a stock screener for corporations paying a dividend of more than 6% that have a GF Score of more than 80, youll get back a relatively short list. Cogent Communications Holdings Inc. (NASDAQ:CCOI) is one of the few stocks on that list, and it looks good on several fronts, at least until you see a dividend payout ratio of 359%. That should make investors instantly suspicious about its sustainability.

Warning! GuruFocus has detected 7 Warning Signs with CCOI. Click here to check it out.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

Yet, guru Jim Simons (Trades, Portfolio) at Renaissance Technologies owns more than 2 million shares of the stock and added more in the second quarter. His firm is not alone among institutional investors, who as a class collectively hold almost 76% of the company's shares outstanding.

About Cogent

The Washington, DC-based company provides low-cost, high-speed Internet access, private network services and data center colocation space.

According to its 10-K for 2021, it is a facilities-based provider, meaning it operates on its own infrastructure rather than over leased or rented cabling. It also means it does not depend on local phone or cable companies for Internet access and private network services.

It serves mainly small and medium-sized businesses located in multi-tenant office buildings. Typical customers include law and financial services firms, as well as advertising and marketing companies, health care providers, educational institutions and other professional services.

Competition

Cogent reported in its 10-K that it faces competition from incumbent telephone and cable companies, as well as facilities-based network operators. It also argued that it has numerous competitive advantages, including:

Low cost of operation

Greater control and superior delivery

High-quality, reliable service

Large addressable market

Balanced high-traffic network

A proven and experienced management team.

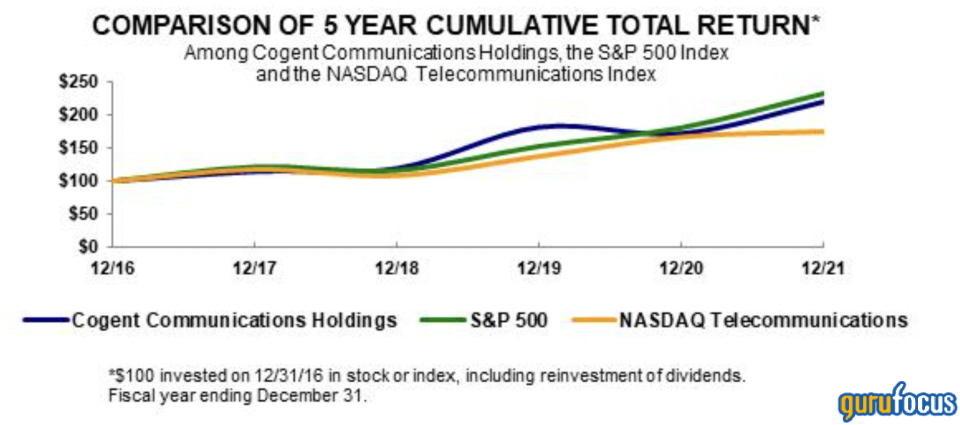

Over the past five years, it has generally outperformed its peer index, but trailed the S&P 500:

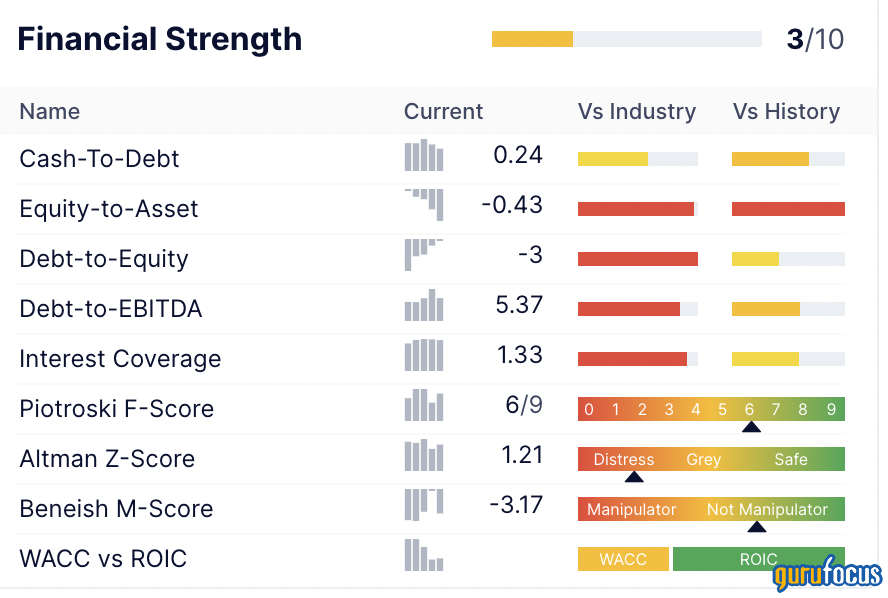

Financial strength

Cogent carries a significant amount of debt, especially in relation to its operating income, so it has a low interest coverage ratio.

Perhaps thats to be expected considering this is a telecommunications industry player. These companies need to make major infrastructure investments up front, then go on to collect rents on those investments for years and years to come (unless disruptive technologies take hold).

Looking specifically at its total assets and total long-term debt and capital lease obligations, we see:

Total assets at the end of 2011: $597.7 million

Total assets at the end of 2021: $984.6 million

Long-term debt and capital lease obligations 2011: $374.6 million

Long-term debt and capital lease obligations 2021: $1.232 billion

No short-term debt at the end of 2011 and 2021.

So, the company has grown its debts faster than its assets.

On a more positive note, the company has been creating value for shareholders. Its return on invested capital is nearly double its weighted average cost of capital; ROIC is 12.06% versus WACC of 6.66%.

Profitability

The company gets a high GuruFocus profitability rank based on a strong operating margin, a good Piotroski F-Score, high consistency of profitability and the predictability rank of 4.5 out of 5 stars.

With the exception of its ROIC, Cogents profitability is not industry-leading, but it manages to keep up with or beat industry averages.

Reflecting the consistency of profitability, it has been profitable in nine of the past 10 years.

Growth

Because of its historical stability and anticipated revenue and earnings per share growth, Cogent gets an industry-leading score for growth. Projected EPS growth is particularly attractive. Past growth has been more anemic on the top-line, but EPS growth has still been strong.

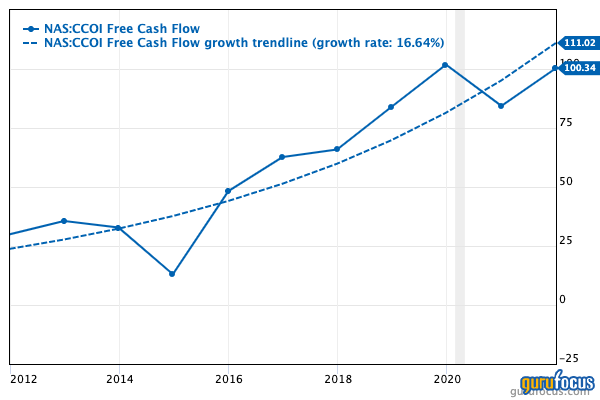

If we assess this as a dividend stock, I'd like to see serious free cash flow growth. The three-year growth rate shown on the table below is weak, but thats because of one bad year in 2020. On a 10-year basis, FCF growth looks much more powerful. That kind of FCF growth should give some comfort about the dividend being sustainable.

Dividends and share repurchases

Now we get to the elephant in the room: can the company keep paying its dividend?

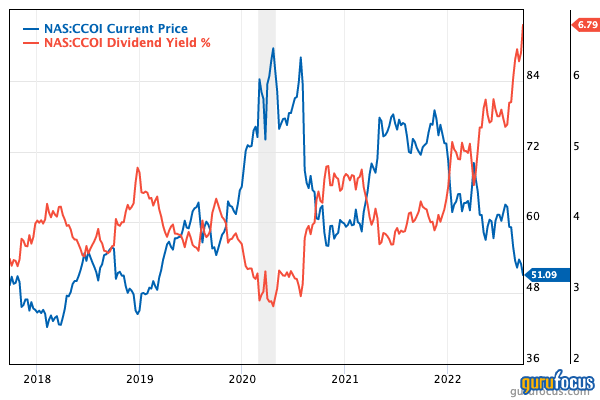

As discussed at the top of this article, Cogent has a generous dividend yield. In part, thats because the share price has tumbled:

Its also because the company has grown the dividend an average of 15.80% per year over the past five years.

It turns out the size of the dividend is a sticky point. Cogent has a dividend payout ratio of 359%, calculated by dividing the dividends per share by the earnings per share without non-recurring items. If the result is getting near 100%, most investors become cautious; with a payout thats 3.59 times as great as EPS without NRI, then income investors should run, not walk, in the opposite direction.

Yet, the company has three guru investors, including one with a significant stake. It also enjoys the support of numerous professional investors who run institutional investment firms, and insiders as well.

What these investors may do is base their payout ratios on cash flow from operations (Cogent is a capital-intensive company) rather than earnings per share.

For 2021, cash flow from operations was $170.2 million while cash flow for dividends was $150.3 million. That works out to a dividend payout ratio of 88.30%, which is high but sustainable.

There is not much to see for share buybacks. On a trailing 12-month basis, there are 47 million shares outstanding, and for the past 15 years the count has fluctuated between 45 million and 48 million.

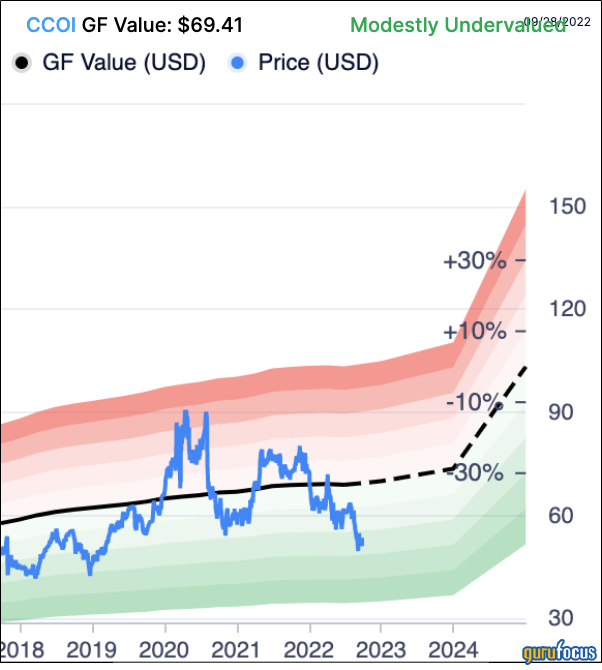

Valuation

Despite all the red bars on the GuruFocus valuation table, Cogent gets a high ranking because its price-to-GF-Value ratio. At the close of trading on September 28, the share price was $53.91 and the GF Value was $69.41.

Therefore, the stock is considered modestly undervalued:

Compared to the rest of the telecom industry, it is overvalued on both a price-earnings and PEG ratio basis.

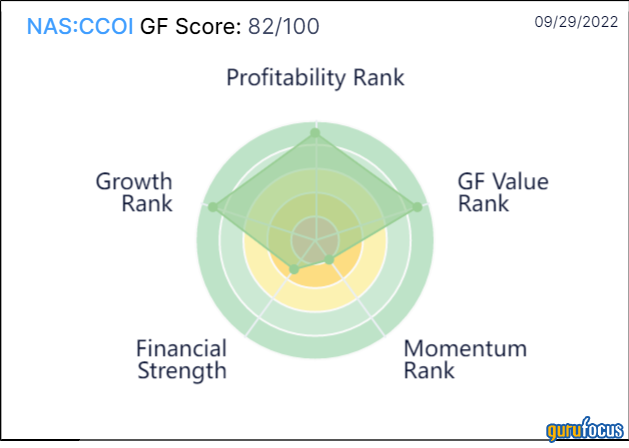

Thanks to strong marks for profitability, growth and GF Value, the stock receives a relatively strong GF Score:

Gurus

Three of the investment gurus followed by GuruFocus had positions in Cogent at the end of the second quarter:

Jim Simons (Trades, Portfolio) of Renaissance Technologies added 6.82% during the quarter to his already substantial holding. At the close of trading on June 30, according to his firm's latest 13F report, he owned 2,312,056 shares, representing 4.82% of Cogents shares outstanding and 0.17% of his firm's 13F equity portfolio.

Chuck Royce (Trades, Portfolio) of Royce Investment Partners made no changes in the quarter and finished with 16,276 shares.

Joel Greenblatt (Trades, Portfolio) of Gotham Asset Management bought 5,008 shares to create a new holding.

Institutional investors in total owned 75.84% of shares outstanding as of the latest round of 13Fs and mutual fund reports. That works out to 36.42 million shares. Insiders held another 12.34% of the stock, which is substantial.

Conclusion

When pursuing above-average dividend yields, its always wise to check the dividend payout ratios. Anything above 100% could mean trouble ahead.

However, a dividend yield is not the only reason to buy a stock, and the gurus above certainly seem to find the stock attractive anyway. Moreover, due to different operating styles, some types of companies, like telecoms, might be better assessed using different metrics for their dividends.

For income investors who are comfortable with doing their own accounting, Cogent may be a company worth considering. It is a solid and growing company with an attractive dividend. However, for those who don't understand the industry or how it's paying that crazy-high dividend, it might be best to steer clear.

This article first appeared on GuruFocus.