Invitae: A Huge Genomics Opportunity

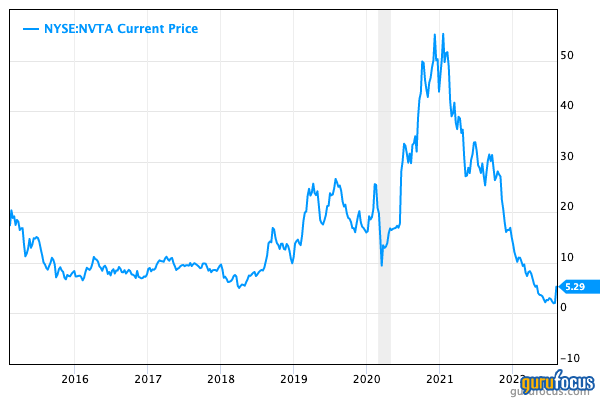

Invitae Corp. (NVDA) is a leading genomics testing company which was founded in 2010. Its stock price followed the standard Covid-19 boom and bust cycle alongside many peers in 2020 and 2021, which had nothing to do with the underlying company and should thus be discarded from consideration. However, in the past couple of days following the company's second quarter 2022 earnings report, which was released on Aug. 9, the stock price has popped by 157%. Let's take a look at just what investors liked about the recent earnings report, and why I believe Invitae is an excellent opportunity in the genomics space.

Business model

Invitae is a leading health care company which specializes in genomic testing. The cost for genomic sequencing has declined from an eye-watering $100 million in 2001 to less than $1,000 per day. The low prices now make it accessible for the average person to have genomic testing and discover which diseases they may be prone to getting, such as cancer, and mitigate the risks early.

In the future, researchers in this field claim it will even be possible to create designer babies in which bad disease-causing genes such as those from hereditary conditions could be removed. Despite the ethical concerns, the genomics market is forecasted to grow from $27.81 billion in 2021 to $95 billion by 2028, achieving a 19.4% compound annual growth rate, according to a study by Fortune Business Insights.

Invitae's total patient population shown strong growth, reaching 3.1 million people as of the most recent earnings results, with 62% now offering their data for sharing.

Invitae also has a digital health platform which acts as the bridge between mainstream medicine and genomics. This enables doctors to refer patients for genomic testing and makes it accessible to the average person.

Second quarter results

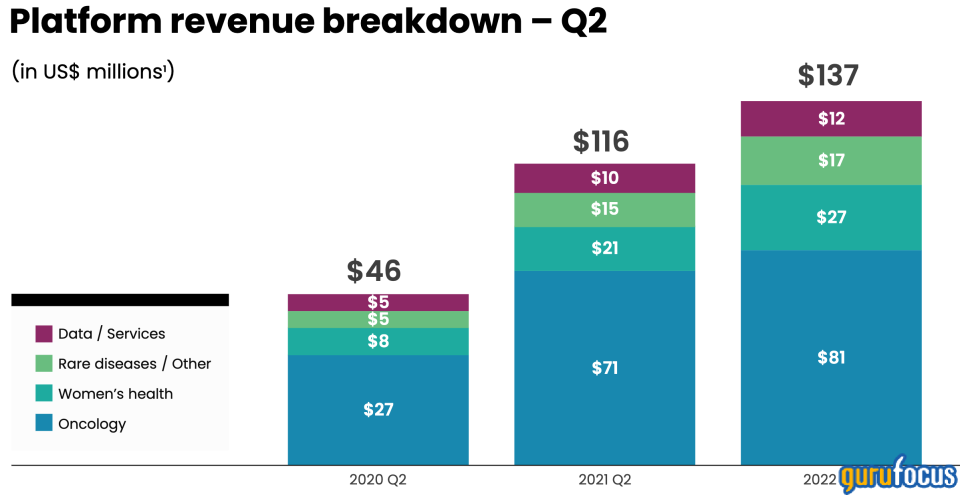

Now for the reason why the stock is popping: Invitae reported strong results for the second quarter of 2022. The company generated $136.6 million in revenue, up 17.5% year over year, beating analyst estimates by $571,000. This was driven by strong growth in active health care provider accounts, which increased by 25% year over year to 20,217. Active pharma and commercial partnerships also grew by 52% year over year to 232, which drove growth in lab services and data platforms.

Source: Invitae investor materials

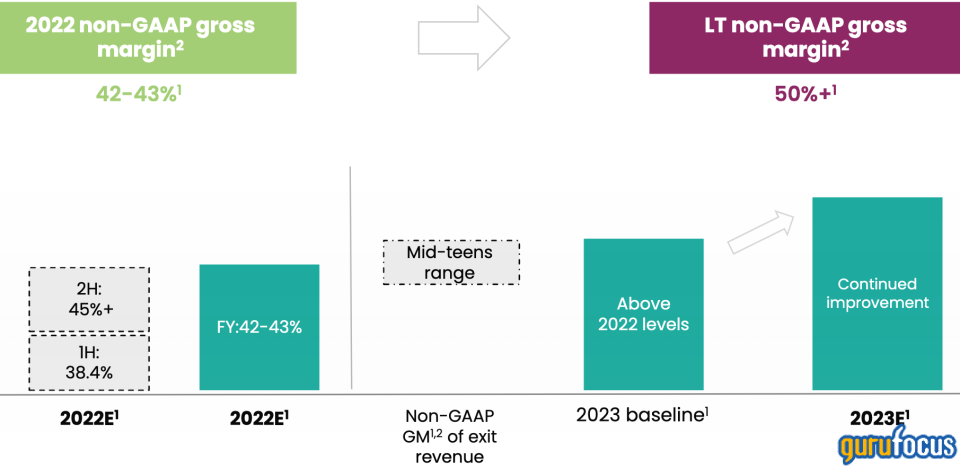

Gross profit was $26.3 million on a GAAP basis, or $54.7 million on a non-GAAP Basis. The non-GAAP gross margin increased to 40.1%, up from 36.6% a year ago. The company is forecasting continued growth, projecting that the non-GAAP gross margin will exceed 50% in the long term.

Source: Invitae investor materials

The companys total operating expenses ballooned in the second quarter to $2.5 billion, which was mainly driven by a one-off asset impairment. The good news is $2.3 billion of this impairment was really a paper loss resulting from a goodwill writedown after a decline in the stock prices of its marketable security investments/acquisitions. This is a common trend I have noticed across many earnings calls this quarter as the high inflation and rising interest rates have tanked many previously-overvalued stocks. Excluding this expense, operating expenses would be $200 million, which would still be 146% of revenue.

Without the one-time expenses, the company reported an adjusted loss per share of 68 cents compared to analysts' expectations for an adjusted loss per share of 76 cents.

Its cash burn has also improved slightly with a decrease of 13.2% year over year to $147 million.

Management has recently announced a realignment plan to extend the companys cash runway up until the end of 2024:

"We recently announced our strategic realignment plan, as we step into our company's next chapter. The planned changes are broad and necessary to continue driving us toward our goal of using our industry leading genetic testing, and advanced technologies, to transform healthcare for today and tomorrow.

We have the roadmap and the pieces in place, and execution of our plan is top of mind as we fuel our testing business and make focused investment in delivering the future of personalized, genetically-driven health care."

Valuation

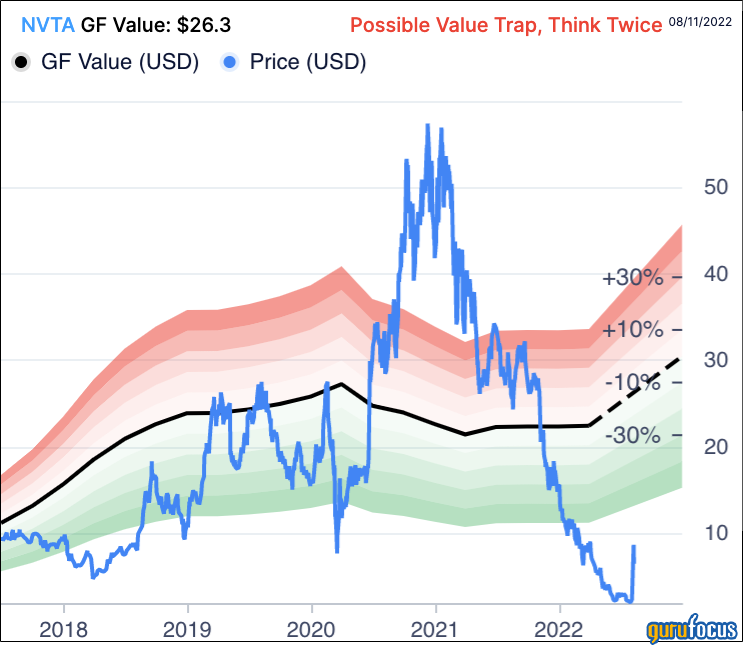

Invitae is trading at a price-sales ratio of 3.9, which is 58% cheaper than its five-year average.

The GF Value chart indicates a fair value of $26.30 per share for the stock, which is much higher than the current share price of around $5, but rates it as a potential value trap due to the continuing lack of profitability and poor financials.

Final thoughts

Invitae is an innovative company which is at the cutting edge of genomics technology. The company is poised to ride the growth in the genomics industry and has recently produced some solid results. However, the companys cash burn is an issue, and the stock is still quite risky because of its terrible financial situation.

This article first appeared on GuruFocus.