Interest Rate Watchers Prepare For Valentine's Day CPI Report

Interest rate watchers are preparing for the effects of the government’s consumer price index (CPI) report on long- and short-term bond yields.

Inflation increases or decreases for January, as measured by the CPI, are being released on Feb. 14.

The January jobs report was strong enough that some analysts suggest that the Federal Reserve is more likely to raise rates. An inflation rate rise for that month would add pressure for such a move and surprise a few investors.

Here’s a look at that market based on the different yield charts across the spectrum of time frames. It’s impossible to predict what might happen and how much the new inflation numbers will affect the bond market and rate-sensitive sectors in the stock markets, but it’s possible to examine recent ranges and estimate.

The 30-year yield:

The chart shows basis points so that the current reading of 36.72 means 3.672%. A higher-than-expected inflation number on Tuesday is likely to take the 30-year yield higher — possibly much higher. The previous peak yield of 4.4% could be approached under these circumstances. A lower-than-expected inflation number could take the yield to below the recent 3.5% low.

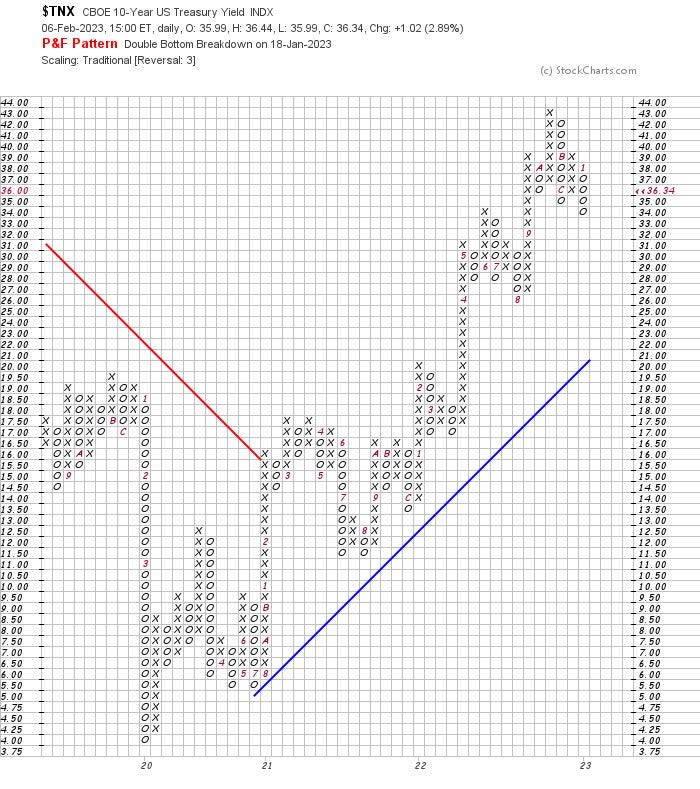

Here’s how the 10-year yield looks right now:

It’s a similar type of pattern as the 30-year yield: The yield at 3.634% is on the low end of the recent range. A greater-than-expected inflation metric on Tuesday is likely to take this higher, back up toward the 4.3% area. A lower-than-expected inflation reading could drop the 10-year yield back toward or below the 3.4% spot.

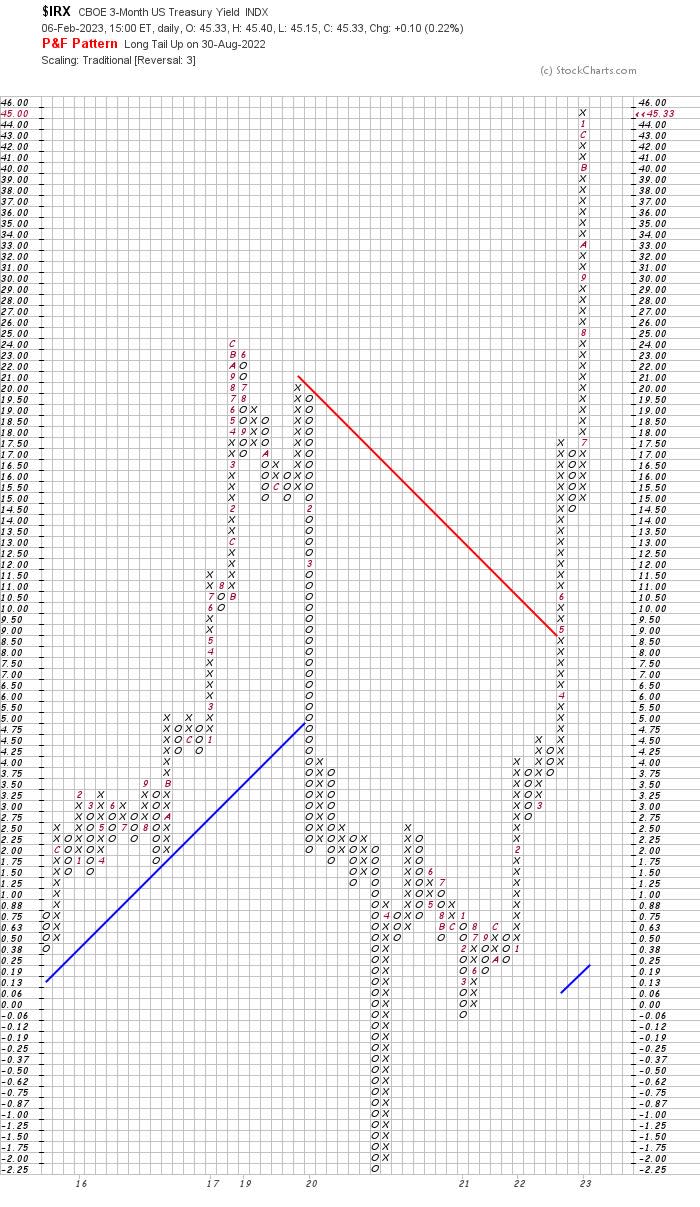

Here’s how the three-month Treasury yield looks:

At 4.533%, the very short-term Treasury yield is already at the top end of its recent range. Tuesday’s inflation reading for January could take this above that level if it comes in higher than expected. A lower-than-expected inflation number could bring the three-month yield back to reality.

Other factors could move these yields such as Russian President Vladamir Putin’s plans for Ukraine or unexpected Chinese balloons over America. All other things being equal — and they never are — it’s the consumer price index for January, to be released on Tuesday, that’s likely to move things next week.

Not investment advice. For educational purposes only.

Weekly REIT Report: REITs are one of the most misunderstood investment options, making it difficult for investors to spot incredible opportunities until it’s too late. Benzinga’s in-house real estate research team has been working hard to identify the greatest opportunities in today’s market, which you can gain access to for free by signing up for Benzinga’s Weekly REIT Report.

Check Out More on Real Estate from Benzinga

Analysts Are Bullish On Industrial Real Estate: Here Are 2 Private Market Offerings To Gain Exposure

Don't miss real-time alerts on your stocks - join Benzinga Pro for free! Try the tool that will help you invest smarter, faster, and better.

This article Interest Rate Watchers Prepare For Valentine's Day CPI Report originally appeared on Benzinga.com

.

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.