Insider Insights: For Investment Bankers, Pay Soars Along With Hours

Salaries are rising for investment bankers, but so are hours worked, according to the Wall Street Oasis 2022 Investment Banking Industry Report.

If the big takeaway from Wall Street Oasis’ 2022 Consulting Industry Report was that there are great consultancy careers to be made outside the MBB (McKinsey, Bain and BCG), the takeaway from the Investment Banking Industry Report is this: You can have a truly astronomical salary as a new investment banker, or you can have a manageable work-life balance. It’s increasingly hard to have both.

Data from WSO’s 2022 Investment Banking Industry Report, reported by employees actually working in the field, shows that while salaries are rising a couple of years into the pandemic, the working hours required to get those high salaries are also through the roof.

Patrick Curtis

Investment banks are having a harder time holding on to analysts who often work 80 or more hours a week at some places. That attrition problem has forced the banks to compete with consulting firms for interns and first year analysts, driving up salaries at consulting firms, and driving them up even more so for starting bankers, Patrick Curtis, founder and CEO of Wall Street Oasis, tells Poets&Quants.

“It’s a work-life balance thing, and it’s a new generation thing where younger people actually value that more. It’s one thing to hear you’re going to work 80 to 90 hours per week, it’s another to live it,” Curtis says. “The banks are losing a lot of kids even after that first bonus cycle, and private equity firms are more than happy to snatch up good talent early on. People are even joining startups, or working in corporate development or corporate finance.”

REPORT METHODOLOGY

WSO is an online community, news site, and career center for people working and aspiring to work in finance related fields. It has almost 900,000 registered users who report a trove of data on the companies where they work. WSO’s 2022 Investment Banking Industry Report takes this user-reported data to provide insight into nearly 20 different metrics job hunters would be strapped to find anywhere else: How many hours employees work per week, for example, or the percentage of interns who are offered full-time jobs.

WSO’s reports are constantly changing based on new information users report to the WSO Company Database which includes more than 50,000 submissions across thousands of companies. The report we are looking at today is up-to-date as of this month and includes year-to-date data as well as data for the prior two years. Because of this, some of the latest trends reported by users won’t start showing up until later reports. (WSO uses Bayesian statistics to create percentiles for companies with few observations.)

Read more about WSO’s report methodology here.

WHICH INVESTMENTS BANKS PAY THE MOST?

For those chasing the highest paycheck, the salaries and the bulge brackets are indeed eye popping.

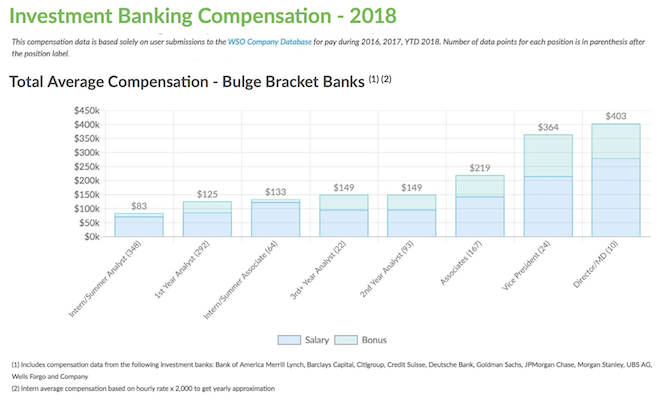

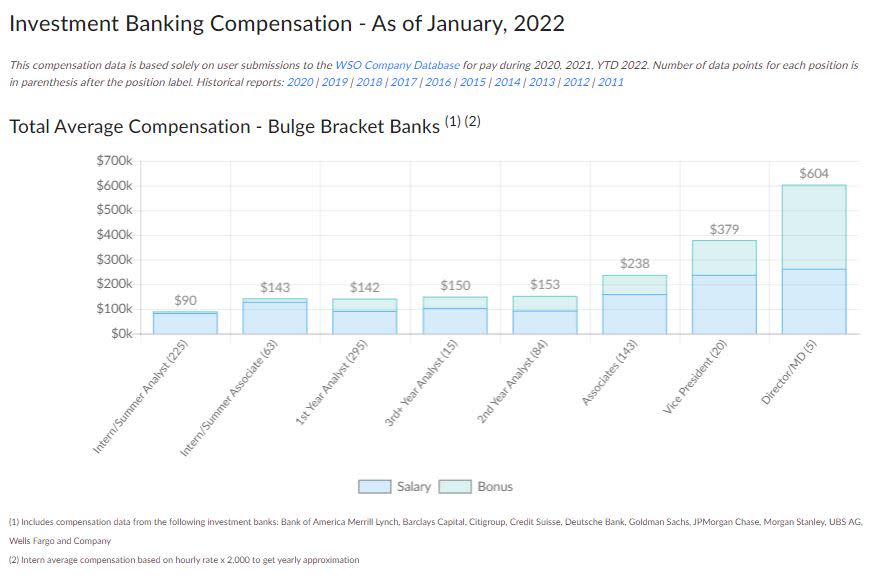

Since 2018, compensation has soared at 10 bulge banks: Bank of America Merrill Lynch, Goldman Sachs, Barclays Capital, Credit Suisse, Deutsche Bank, JPMorgan Chase, Citigroup, Morgan Stanley, and UBS. For first-year analysts, average compensation (salary plus bonus) has gone from $125,000 in 2019 to $142,000 in 2022, a nearly 14% increase. You can see the comparative salary trends in the two charts below, 2018’s on top, 2022’s below.

2018 Bulge Bracket Bank average compensation. Source: Wall Street Oasis 2018 Investment Banking Industry Report

2022 Bulge Bracket Bank average compensation. Source: Wall Street Oasis 2022 Investment Banking Industry Report

Of the 10 bulge bracket banks, Credit Suisse had the highest competition, according to WSO’s user-reported data. Starting base salary for the firm’s summer analysts is $104.7K with a $9.8K signing bonus. Summer associates make an average of $153K with an average bonus of $21.6K. The one reporting Vice President brought home $350K in salary along with a $100K bonus.

On the other end of the spectrum, UBS AG paid the lowest average salaries starting at $68,500 for summer analysts (with a $2,000 bonus) and rising to $195,000 for vice presidents (with a $70,000 bonus).

WSO’s data dives much deeper, and you can break its pay data down by sex and race, to see which firms live up to their DEI mantras. Find the full compensation data here.

NEXT PAGE: Investment banks with best opportunities for career advancement

Source: Wall Street Oasis 2022 Investment Banking Industry Report

WHICH INVESTMENT BANKS ARE BEST FOR CAREER ADVANCEMENT?

The Company Reviews section of the WSO report provides employee perspectives on a host of metrics linked to company culture and what it’s like to actually work there. Insights are based on 30,205 user submissions about experiences at their particular banks.

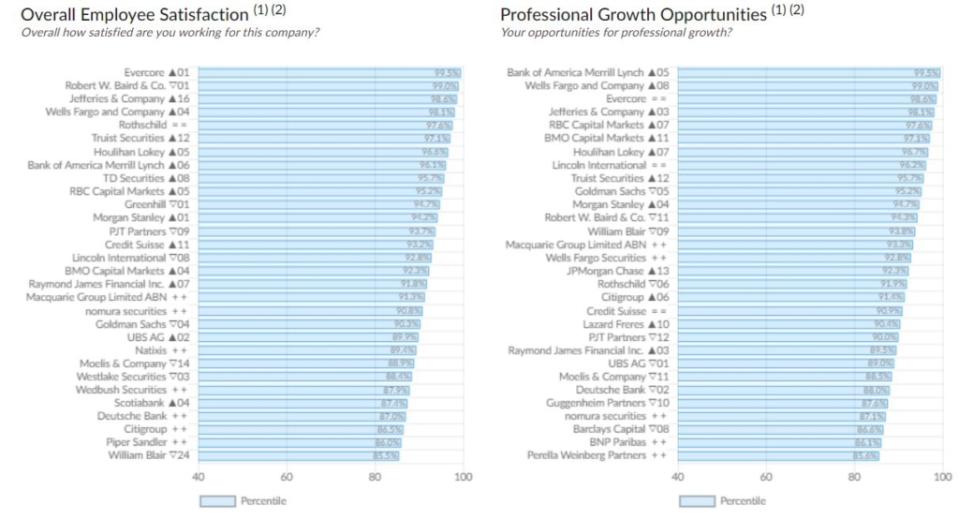

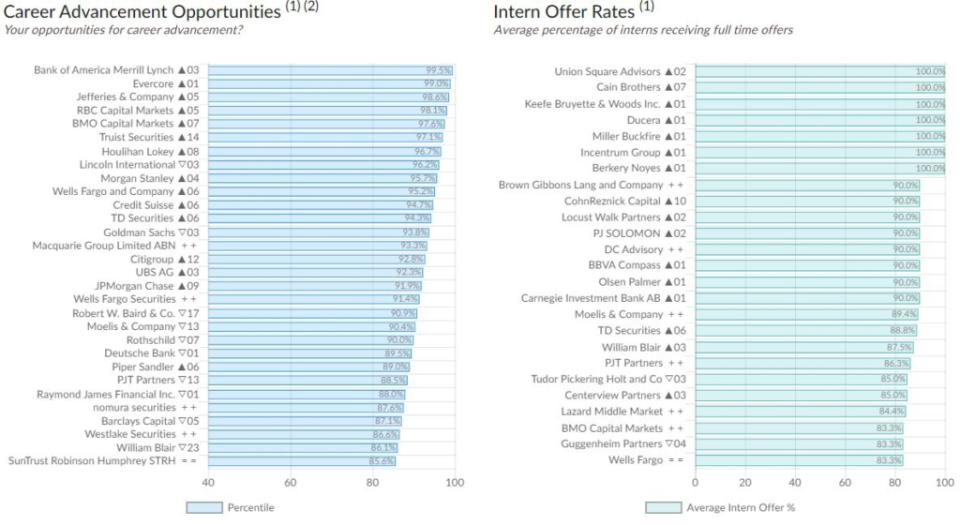

For career advancement, we’ll highlight employee perceptions of four metrics: (1) their company’s professional growth opportunities, (2) overall satisfaction, (3) advancement opportunities, and (4) intern offer rates. There are other metrics you can explore here.

Employees of Evercore, a global independent bank headquartered in New York City, ranked in the top three in most of the company review metrics, including No. 1 in overall employee satisfaction, proudest employees, teamwork, and best perceived pay relative to similar jobs elsewhere. Employees also ranked it No. 2 in career advancement, communication, leadership, and likely to recommend the firm to others; and No. 3 in professional growth opportunities and competence of senior management.

Overall Employee Satisfaction (see chart top left): Second behind Evercore, Robert W. Baird & Company fell one place to No. 2 with a 99% percentile score in employee satisfaction. Jefferies & Company rose 16 places to No. 3 with 98.6% followed by Wells Fargo (98.1%) and Rothschild (97.6%).

Professional Growth Opportunities (see chart top right): Employees of Bank of America Merrill Lynch ranked it the best (99.5 percentile) for having opportunities for professional growth within the firm, up five places from last year. Wells Fargo rose 8 places to the second spot (99%), followed by Evercore (98.6), Jefferies & Company (98.1%) and RBC Capital Markets (97.6%).

Career Advancement Opportunities (see chart bottom left): Bank of America rose three places from last year for the top spot in this category with a 99.5 percentile while Evercore rose one spot with 99%. They were followed by Jefferies & Company (98.6%), RBC Capital Markets (98.1%) and BMO Capital Markets (97.6%).

Intern offer rates (see chart bottom right): If you’re looking for an internship that will turn into a full-time job these seen companies had 100% of interns (that reported to WSO) received full-time offers: Union Square Advisors, Cain Brothers, Keefe Bruyette & Woods; Ducera, Miller Buckfire, Incentrum Group, and Berkery Noyes. The only Bulge Bracket Bank on the top-of list was Wells Fargo with 83.3% of interns getting offers.

Source: Wall Street Oasis 2022 Investment Banking Industry Report

NEXT PAGE: Investment banks with the best work-life balance

Source: Wall Street Oasis 2022 Investment Banking Industry Report

WHICH INVESTMENT BANKS HAVE THE BEST WORK-LIFE BALANCE?

About 10 years ago, when there was a rash of high-profile deaths of investment banking interns who’d worked multiple all-nighters in a row. Many of the larger banks instituted policies that required workers to take at least some time off each week, or each month at the very least, Curtis says.

Then, little by little, banks became a bit more lax about those policies. The market got hot and COVID hit and everyone went to work from home. Bankers could work even longer hours without grabbing too much attention and managers were happy to let them.

“The banks were exploding with deal volume and there were billions of dollars at stake,” Curtis says. “I think MDs thought, ‘Well, I suffered when I was an analyst and we can close on this $20 million revenue if we just work hard. COVID just exacerbated it because things became more impersonal, and it was more lonely for the analysts. One of the best parts of the analyst program is that even though you’re working crazy hours, you had that camaraderie in the bullpen. That doesn’t happen when you’re alone in your room or you’re working in your parents’ house.”

Because WSO’s industry reports are based on year-to-date data plus the two previous years, these work-life balance metrics largely cover the first two years of the pandemic. And, the average hours worked reflected the work-from-home rush.

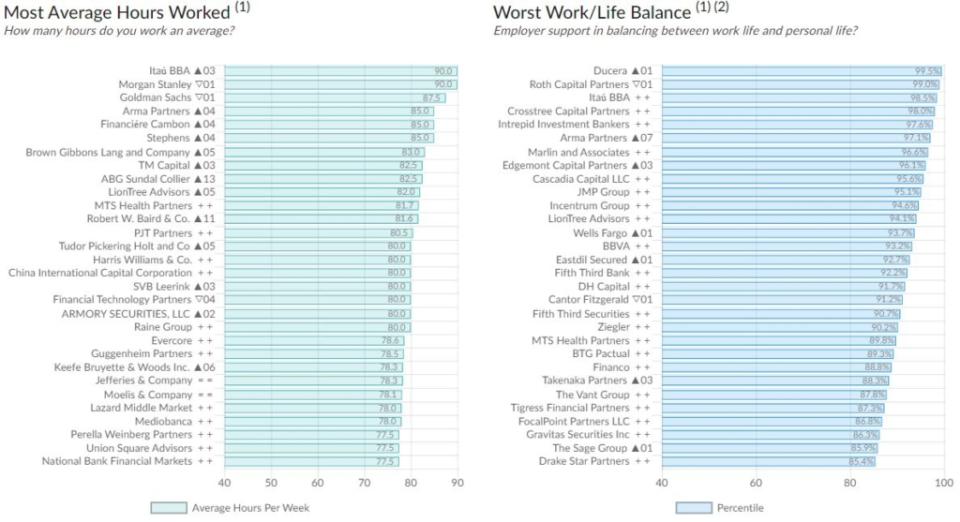

In fact, in this year’s report, employees at two companies – Itau BBA and Morgan Stanley – reported working an average of 90 hours per week. Goldman Sachs employees reported working 87.5 hours per week. In all, employees at 20 banks reported working 80 or more hours per week. (In 2019, the year before the pandemic sent most employees to their home offices, the most reported hours per week was 88.8 at BTG Pactual, followed by 88.3 at Miller Buckfire, and 87.5 at Agentis Capital.)

If you’re an aspiring banker but would like a little more balance in your career and personal pursuits, WSO’s report has several employee-reported metrics surrounding lifestyle. You’ll notice that some of the top-paying firms don’t necessarily score particularly high in these metrics. That’s the tradeoff aspiring investment bankers have to make: An astronomical salary or a manageable workload.

Hours Worked Per Week (see chart top left): After Itau, Morgan Stanley and Goldman Sachs, three companies averaged 85 hours per week. These were Arma Partner, Financiere Cambon, and Stephens. Brown Gibbons Lang and Company averaged 83 hours, while ™ Capital and ABG Sundal Collier averaged 82.5 hours per week.

Worst Work/Life Balance (see top right): Companies that employees ranked worst for work/life balance included Ducera (up one spot from last year with a 99.5 percentile) and Roth Capital Partners (99%). Three companies appeared in the worst five for the first time: Itau BBA (also worst in hours worked per week), Crosstree Capital Partners and Intrepid Investment Bankers. Arma Partners rose seven places in the worst balance list, ranking No. 6 with a 97.1 percentile.

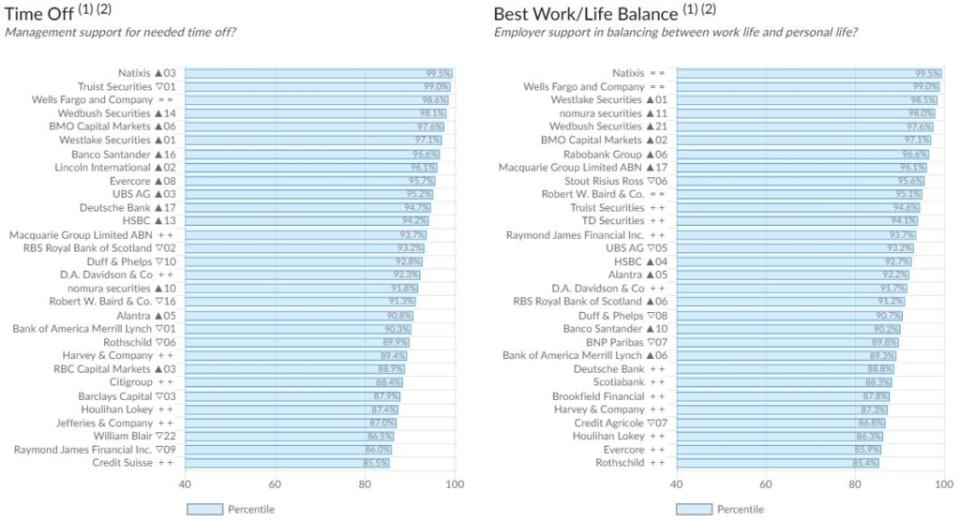

Management Supports Needed Time Off (see chart bottom left): At the other end of the spectrum, the companies most likely to support an employee’s request for needed time off were Natixis, up three from last year with 99.5 percentile. They were followed by Truist Securities (99%) Wells Fargo (98.6%) Wedbush Securities (which rose 14 spots) and BMO Capital Markets (97.6%).

Best Work/Life Balance (see top right): Not surprisingly, most of the companies that employees say are supportive of time off also offer the best work/life balance. They are Natixis, Wells Fargo, Westlake Securities, Nomura Securities (up 11 spots from last year) and Wedbush Securities (up 21 spots.)

Source: Wall Street Oasis 2022 Investment Banking Industry Report

DON’T MISS: USC MARSHALL PARTNERS WITH INDIAN B-SCHOOL FOR SUPPLY CHAIN MASTER’S and POETS&QUANTS’ MOST POPULAR STORIES OF 2021

The post Insider Insights: For Investment Bankers, Pay Soars Along With Hours appeared first on Poets&Quants.