Inflation surges to 39-year high. How much more are you paying and what's the damage for Biden?

- Oops!Something went wrong.Please try again later.

WASHINGTON – Inflation surged again in November, reaching a 39-year-high and undercutting President Joe Biden's push to get credit for an otherwise improving economy with low unemployment and a booming stock market.

The consumer price index increased by .8% in November over last month, the U.S. Bureau of Labor Statistics reported Friday, a smaller jump than the .9% spike in October. Yet it left inflation 6.8% higher than a year earlier, the largest 12-month increase since 1982.

Over the past year, as the U.S. has battled the COVID-19 pandemic, the cost of energy, food, transportation and other must-haves spiked. The reasons include supply chain breakdowns, labor shortages and a sudden burst of spending after widespread lockdowns.

More: CPI report released: Consumer prices jumped 6.8% in November, the fastest inflation spike since 1982

For weeks, the White House downplayed rising inflation as a temporary issue, but Treasury Secretary Janet Yellen this month said she's "ready to retire the word transitory."

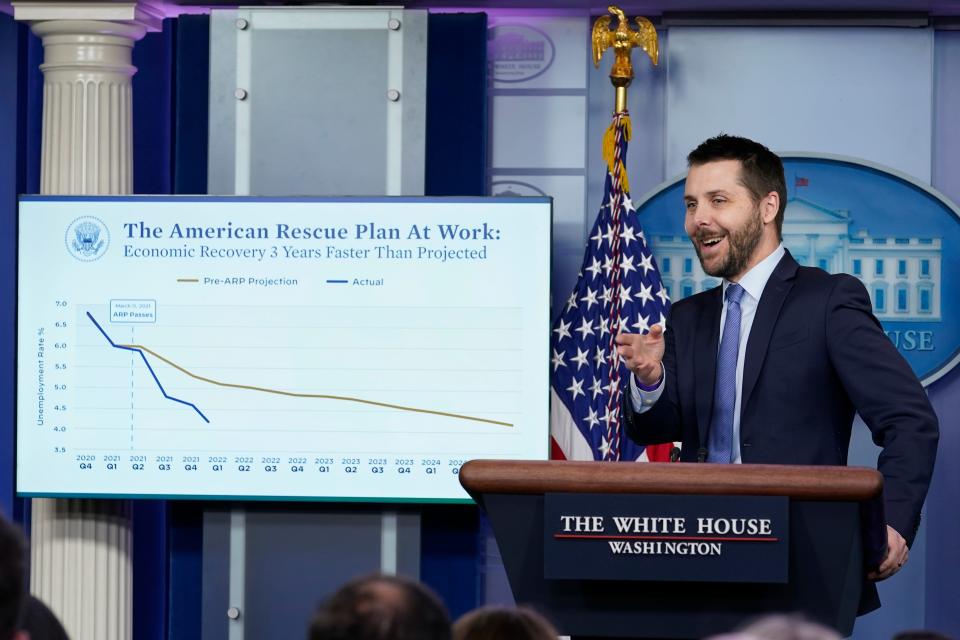

Still, the White House has predicted prices will fall again in 2022, and they've grown increasingly frustrated over media coverage they argue ignores economic gains under the president. That includes unemployment that has fallen to 4.2%, a faster decline that projected, 6 million new jobs added since January and unemployment insurance claims last week that dropped to 184,000, the lowest since 1969.

Biden told reporters Friday he believes prices have peaked. "I think you'll see it change sooner, quicker, more rapidly than most people think. Every other aspect of the economic is racing ahead."

"But inflation is affecting people's lives," Biden said, calling it a "top goal" of his administration to reduce costs. "It's a real bump in the road. It does affect families. You walk in the grocery store and you're paying more for whatever you're purchasing. It matters."

More: What is driving US inflation to a 39-year high? The reasons and solutions are complicated

Brian Deese, director of Biden's National Economic Council, on Thursday said "real household income" – even accounting for inflation – is $350 higher a month for American families than before the pandemic. He said the U.S. is positioned to deal with the challenges on prices because strengths in the labor market, household balance sheets and economic growth.

Deese said the November consumer index report doesn't capture a recent 9-cent decline in gas prices. While the price of gasoline increased 6.1% from October to November, the average price of a gallon of regular gallon of gasoline Friday was $3.335, according to AAA, down from $3.417 the previous month.

The consensus among experts, according to Deese, is that consumer prices will "moderate going into 2020."

What is inflation?: Concerns swirl amid increase in prices for food, energy, cars and more

Here's how the inflation is playing out for Americans and Biden politically:

I noticed my grocery bill is higher. Am I imagining things?

Nope.

The price of food at home is up 6.4% over the past 12 months. That includes an 12.8% increase in the price of meat, poultry, fish and eggs. The price of beef is $20.9% higher than a year ago.

It's the largest 12-month increase in grocery prices since 2008, according to the Bureau of Labor Statistics.

Not everything is spiking. While the price of pork rose by 2.2% from October, the price of eggs declined by 2.7%.

Are wages covering the price increases?

It depends on your individual situation.

Many companies raised their minimum wages in recent months as they grapple with labor shortages, including Walmart, Target, CVS and Starbucks.

Those wage increases help workers pay for the extra cost of goods, but the higher pay may translate into price hikes, as well, as companies look to make up the cost.

Unsnarling a supply chain: Before busy holiday season, Biden lays out efforts to ease supply chain congestion

Overall, the average American worker's wage increase has been usurped by price increases. Real average hourly earnings – a metric that accounts for the impact of wage and price increases – declined by .4% from November 2020 to November 2021, according to the Bureau of Labor Statistics.

Accounting for the fact that the average workweek shrunk slightly during that period, real average weekly earnings declined by 1.9% in November.

What does surging inflation mean for Biden politically?

For Biden, who has seen his approval numbers sink since August, the rising inflation has handcuffed his ability to get credit for an otherwise improving economy.

It presents a major warning sign for Democrats, who face an uphill battle to reclaim control of the Senate and House in next year's midterm elections.

Polling pain: Inside Biden's falling poll numbers: 5 reasons why the president's approval ratings have dropped

The president has argued "the Biden economic plan is working," pointing to unemployment that has dropped since he took office and rising wages. He's tied that progress to actions he took to vaccinate Americans and pass a $1.9 trillion COVID-19 rescue plan in March.

"Let's talk about inflation," Biden said during a trip to Kansas City this week. "It's real. There is inflation." He pointed to his social-spending proposal, the Build Back Better bill, which he said would "ease long-term inflationary pressures in the economy" by reducing child care, health care and other costs.

There are several positive economic trends that historically boost presidencies: The USA added 531,000 jobs in October, although followed by a a disappointing 210,000 new jobs in November, new claims for unemployment benefits dropped to the lowest in 52 years; and a strong stock market The Dow Jones Industrial Average has been hovering around. 36,000.

Those gains are getting overshadowed by rising inflation, which Republicans have seized on for months.

Republicans – not Biden – are winning the messaging battle.

Only 31% of registered voters approved of Biden's handling of the economy in a poll last month from USA TODAY/Suffolk University, compared with 60% who said they disapproved. An NPR/Marist poll this week found Biden's approval rating is 42%. In the USA TODAY poll, economy and inflation both ranked among the top five of the areas voters said they would like to see Biden address over the next year.

Losing voters: How Democrats lost voters in Virginia and New Jersey, and what it means for 2022

Does surging inflation mean the economy is struggling?

Economists said rising prices at the gas pump and grocery store are the result of a pandemic still posing challenges after the rise of the COVID-19 delta variant – not an indicator of an economy getting worse.

Mark Zandi, chief economist of Moody's Analytics, said the inflation surge should be short-lived. He predicted costs will start dropping in early 2022, and "by this time next year, certainly by 2023," the USA should return closer to normal inflation.

"I think this is entirely the result of the delta wave of the pandemic, and if it sticks to the script, I think inflation will moderate. We're seeing the worst of inflation right now," Zandi said.

The pandemic upended supply chains, which led to higher prices on goods. For example, Zandi said, the pandemic forced the closure of a Malaysian semiconductor plant that produces chips for the Ford F-150, the most popular vehicle in the USA. It meant fewer cars produced and a surge in vehicle prices.

"It's a shock to the supply side of the economy that lowers growth and raises inflation," he said.

Job growth: Economy adds 531,000 jobs in October as COVID-19 cases drop, unemployment falls to 4.6%

Companies in the retail and hospitality industries raised wages to fill worker shortages, passing costs on to the consumer, he said, while rising energy costs resulted from increasing demand.

In an economic recovery, he said, inflation rebounds slower than the gross domestic product and jobs. He noted that the last two dynamics have already happened.

If the pandemic fades, "then these problems iron out," he said.

How much are energy prices fueling inflation?

A good amount. The energy index – the government's gauge for the prices Americans pay for gasoline, heating and other energy – has soared 33.3% over the past year. It's up 6.1% over last month, according to the Bureau of Labor Statistics, and $1.17 more than a year ago.

Americans pay nearly 58.1% more for gas than last year at this time, according to the Bureau of Labor Statistics, the largest 12-month increase since 1980.

Though gasoline prices often fall in the winter as demand declines, the price of heating your home is likely to spike this year.

Pain at the pump: Gas prices are at a 7-year high. Here's how smartphone can help save on fuel

In November, U.S. prices of natural gas up about 25% over that point in 2020.

For years, natural gas prices had been low because of a huge increase in output in the USA. A combination of factors, including rising demand overseas as other countries transition off coal, led to a global spike in the price of natural gas.

"Nobody's been paying close attention to their natural gas heating bill," said Rob Thummel, an investment manager focusing on energy at Tortoise Capital. "In fact, in a lot of cases, your bills have been going down."

That blissful period has come to an end. Thummel predicted that if it's a normal winter, the average customer's bill could increase by 50% to 75%.

Will holiday shopping be more expensive?

Definitely.

Retailers facing labor shortages increased wages, and they're not likely to fully absorb the extra costs. They're also dealing with supply chain challenges that, in some cases, limit the availability of products.

The bottom line: Expect higher prices and fewer sales on apparel, toys and sporting goods.

"This past year has provided retailers with the unexpected opportunity to adapt their pricing strategies," Cowen retail analyst Oliver Chen said Tuesday in a research note. "The dual forces of supply-chain disruptions and inflation has allowed retailers to take price increases and, arguably more importantly, reduce the frequency and depth of markdowns. We believe retailers could take advantage of the current environment to adjust the consumer mindset to no longer shop for promotions."

Can the Federal Reserve fix this?

This might be beyond the Fed's reach.

Normally, the Federal Reserve would increase interest rates to rein in inflation, but that might not strike at the heart of the problem.

"Rate hikes might not be enough to reverse inflation because the sources of inflation involve supply-chain bottlenecks and fiscal spending, which are two areas that the Federal Reserve doesn't control," Nancy Davis, portfolio manager of the Quadratic Interest Rate Volatility and Inflation Hedge Exchange-Traded Fund (ETF), said in a written analysis.

How much do car prices factor in?

A lot. The spike in car prices has an outsize impact on the broader rate of inflation.

The average prices of used cars and new cars jumped 31.4% and 11.1%, respectively, over the past 12 months.

The global chip shortage sparked by the pandemic constrained automotive production, leading to fewer vehicles and higher prices.

Sticker shock: Some new-car buyers pay more than sticker price: Pickups, SUV shortage causes ripple effect

The average price of new vehicles reached an all-time high in November for the eighth straight month, clocking in at $46,329, according to Cox Automotive's car valuation service Kelley Blue Book.

Average new-vehicle prices could continue rising in the coming months before leveling off around $50,000, estimated Kevin Roberts, director of industry insights and analytics at car buying site CarGurus.

Who is most affected by surging costs?

Not surprisingly, the nation's most significant surge in inflation in nearly 40 years disproportionately affects the poor and working class.

Americans in the bottom one-third of income distribution feel the pressure of higher costs the most, according to Zandi, because they have less of a financial cushion.

That reality is compounded by the fact that inflation affects pocketbook expenses such as food and gas.

Although low-income Americans built up some savings through coronavirus relief checks and Biden’s child tax credits, Zandi said, rising inflation forced them to spend that money quickly.

Those most affected often include families of color or rural white Americans in low-wage industries such as hospitality, retail, health care, child care, recreation or personal services. Zandi said inflation is generally not an issue for Americans with the top one-third of wealth.

"Your high-income households, they've got a lot of savings, assets and cash," he said.

Is the price of everything skyrocketing?

Luckily, no. The good news is that many areas of the economy are not experiencing significant price increases.

The cost of medical care, for example, rose only 2.1% over the past year. Given the impact of health care costs on Americans' pocketbooks, that's a relief.

Reach Joey Garrison on Twitter @joeygarrison.

This article originally appeared on USA TODAY: Inflation, measured by consumer price index, spikes. What that means.