IDEX (IEX) Beats Q3 Earnings Estimates, Revises 2021 View

IDEX Corporation IEX reported impressive results for the third quarter of 2021. Its earnings surpassed estimates by 1.88% and sales beat the same by 2.15%.

The company’s adjusted earnings in the reported quarter were $1.63 per share, surpassing the consensus estimate of $1.60. The bottom line grew 16.4% from the year-ago figure of $1.40 on the back of sales growth and an improvement in the operating margin.

Revenue Details

In the quarter under review, IDEX’s net sales were $712 million, reflecting year-over-year growth of 22.5%. The top line gained from contributions of 7% from acquired assets, 1% from foreign-currency translation and 15% from organic sales.

Also, the company’s revenues surpassed the Zacks Consensus Estimate of $697 million.

Orders in the quarter totaled $774.2 million, reflecting year-over-year growth of 36%. Organically, orders increased 28%, and acquired assets and foreign-currency translation positively impacted orders by 7% and 1%, respectively.

The company currently reports under three business segments, results of which are discussed below:

Revenues from Fluid & Metering Technologies totaled $251.3 million, increasing 13.8% year over year. Organic sales were up 7%, and acquisitions and foreign-currency translation added 6% and 1%, respectively.

Revenues from Health & Science Technologies totaled $302.3 million, reflecting year-over-year growth of 37.2%. Organic sales in the quarter increased 24% year over year, while acquisitions boosted sales by 12% and forex tailwinds were 1%.

Revenues from Fire & Safety/Diversified Products totaled $159.1 million, rising 12.9% year over year. The results were positively impacted by a 12% increase in organic sales and a 1% gain from foreign-currency translation.

Margin Profile

In the quarter under review, IDEX’s cost of sales increased 21.5% year over year to $400.5 million. The adjusted gross profit was $320.7 million, up 27.5% year over year, while the adjusted gross margin increased 180 basis points (bps) to 45%. Supply-chain headwinds, inflation in raw materials and effective pricing actions impacted the gross margin results.

Selling, general and administrative expenses increased 25.4% year over year to $147.2 million. It represented 20.7% of revenues. Adjusted earnings before interest, tax, depreciation and amortization (EBITDA) in the quarter under review increased 27.7% year over year to $199.4 million. Also, the adjusted EBITDA margin grew 110 bps year over year to 28%.

The adjusted operating income was $173.1 million, up 29% year over year, whereas the margin was 24.3%, up 120 bps. Interest expenses in the quarter dipped 10.7% year over year to $9.5 million.

Balance Sheet and Cash Flow

Exiting the third quarter, IDEX’s cash and cash equivalents increased 12.9% sequentially to $806.5 million. Long-term debt was $1,190.1 million versus $1,189.8 million in the previous quarter.

In the first three quarters of 2021, the company raised $499.4 million from 3.00% senior notes issued and made payments of $350 million for 4.20% senior notes.

In the first nine months of 2021, IDEX generated net cash of $402.2 million from operating activities, decreasing 1.4% from the prior-year period. Capital used for purchasing property, plant and equipment was $45.5 million versus $39.4 million in the first nine months of 2020. Free cash flow was $356.7 million, down 3.2% year over year.

In the first three quarters of 2021, the company paid out dividends totaling $120.3 million and refrained from repurchasing any shares. Notably, it distributed $114.3 million as dividends and bought back shares worth $110.3 million in the year-ago period.

Outlook

For fourth-quarter 2021, IDEX anticipates earnings of $1.55-$1.58 per share and year-over-year growth in organic sales of 9-10%. Output is expected to be in line with the third quarter, while targeted investments will be given priority. Logistics issues will likely be concerning.

For 2021, the company anticipates adjusted earnings of $6.30-$6.33 per share compared with the previously mentioned $6.26-$6.36. Organic sales are predicted to grow 11-12% (maintained).

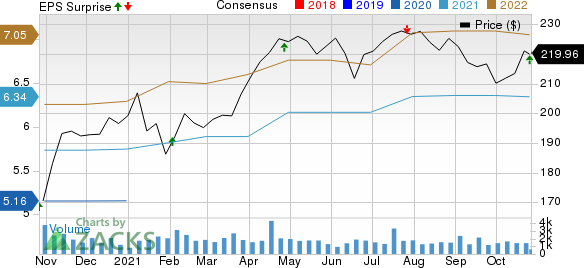

IDEX Corporation Price, Consensus and EPS Surprise

IDEX Corporation price-consensus-eps-surprise-chart | IDEX Corporation Quote

Zacks Rank & Stocks to Consider

With a market capitalization of $16.8 billion, the company currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Zacks Industrial Products sector are HeritageCrystal Clean, Inc. HCCI, Nordson Corporation NDSN, and AZZ Inc. AZZ. All companies presently sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, earnings estimates for these companies improved for the current year. Further, earnings surprise for the last reported quarter was 33.90% for HeritageCrystal, 14.15% for Nordson, and 16.92% for AZZ.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AZZ Inc. (AZZ) : Free Stock Analysis Report

IDEX Corporation (IEX) : Free Stock Analysis Report

Nordson Corporation (NDSN) : Free Stock Analysis Report

HeritageCrystal Clean, Inc. (HCCI) : Free Stock Analysis Report

To read this article on Zacks.com click here.