Howmet Aerospace Stock Set to Bounce Off Bullish Trendline

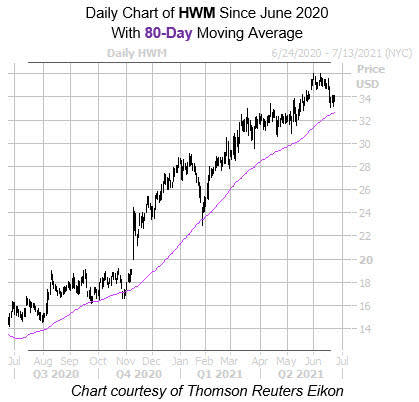

Manufacturing name Howmet Aerospace Inc (NYSE:HWM) is up 0.6% at $34 at last check. The security has been steadily climbing up the charts since March 2020 to notch a June 8, 13-year high of $36.03, and has added 126.1% year-over-year. More recently, the equity has taken a breather, though this pullback has placed HWM near a key trendline with historically bullish implications. In other words, the stock could surge higher still.

Taking a closer look, the security just came within one standard deviation of its 80-day moving average, after sitting comfortably above this trendline since January. According to data from Schaeffer's Senior Quantitative Analyst Rocky White, three similar signals have occurred in the past three years. HWM enjoyed a positive return one month later each time, averaging a 22.4% gain. From its current perch, a similar move would put the security over the $41 mark, which is a level shares haven't crossed since 2008.

Additional tailwinds could come in the form of a shift in the options pits, which lean bearish. This is per the stock's 10-day put/call volume ratio of 5.48 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), which stands in the 97th percentile of its annual range. This suggests puts are being picked up at a quicker-than-usual clip.