How the S&P 500 reasonably climbs 79% to 5300: Morning Brief

Monday, September 9, 2019

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

Market multiples say stocks are going up

The P/E multiple on stocks is above average, suggesting stocks look a little pricey. But does that mean stocks are doomed to fall soon? NO!

The price-to-earnings (P/E) ratio is the simplest, most popular and probably most intuitive way to measure value in the stock market. You calculate it by taking the price of the stock market and divide it by 12 months’ worth of earnings. If the P/E is above some long term average, the market is arguably expensive.

Currently, the S&P 500 is trading at a forward P/E – which is calculated based on next-12 month earnings – of around 16.6. According to Factset, this is higher than the five-year average of 16.5 and the 10-year average of 14.8. In other words, the market looks like it’s just above fair valued.

But, who knows what that means for the near term? For folks who follow the market closely (or read Yahoo Finance regularly), it’s not news that a low P/E doesn’t mean stocks will go up right away or that a high P/E doesn’t mean stocks will drop soon. (And to be clear, stocks don’t have to fall to get cheaper. That’s math.)

In fact, the P/E statistically tells you almost nothing about what’s gonna happen in the next year in the market.

The long term picture, however, is much different.

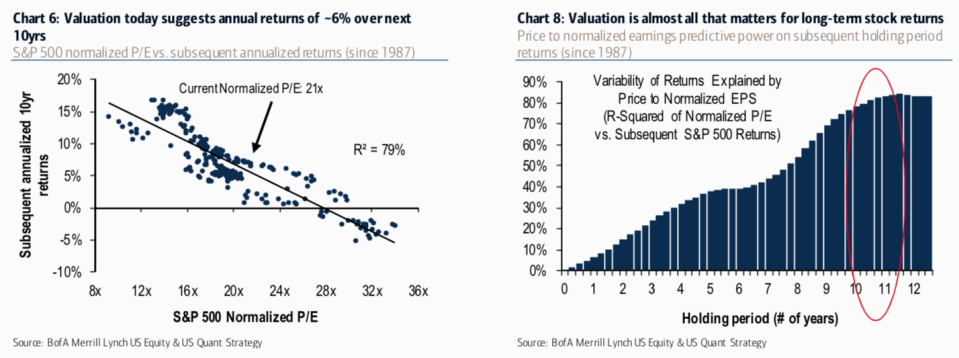

“Our work suggests that while the valuation of the S&P 500 may not explain returns over the next year or two, over the next 10 years, the Price to Normalized earnings ratio of the S&P 500 has explained ~80% of the variability of market returns,” Bank of America Merrill Lynch’s Savita Subramanian said in a recent note to clients.

“Based on a historical regression, using today’s price to normalized earnings ratio yields an expected annual price return of 6% for the S&P 500 over the next 10 years,” she added.

And with that modest 6% annual return over 10 years, assuming history repeats, you get to about 5300 on the S&P 500.

By Sam Ro, managing editor. Follow him @SamRo.

What to watch today

From Yahoo Finance

Reporter Alexis Keenan will preview and recap U.S. Securities and Exchange Commission Chairman Jay Clayton’s appearance from the Economic Club of New York at noon ET. Yahoo Finance will livestream Clayton’s speech.

Editor-at-large Brian Sozzi’s interview with Kimberly-Clark CEO Michael D. Hsu will air on The First Trade, which starts at 9 a.m. ET.

Former Homeland Security Secretary Tom Ridge will appear on The Ticker, which begins at 2 p.m. ET.

Top news

Recession fears ease as UK grows faster than expected [Yahoo Finance UK]

Apple, Foxconn say they overly relied on temporary workers in China [Reuters]

China's August exports shrink as tariff war hurts US sales [Bloomberg]

Thousands disrupted as BA pilots stage biggest walkout in airline's history [Yahoo Finance UK]

YAHOO FINANCE HIGHLIGHTS

Investigation: How sellers exploit Amazon’s loopholes to sell unsafe products

US and China need to go back to the original trade deal: Peter Navarro

How tech-savvy Kevin Johnson is creating 'the next generation' of Starbucks

Correction: Reporter Alexis Keenan will preview and recap U.S. Securities and Exchange Commission Chairman Jay Clayton’s speech from the Economic Club of New York at noon ET. Yahoo Finance will livestream Clayton’s speech.

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.