Why rents could be set to rise across the UK

The cost of renting privately could be set to rise across the UK, according to the Royal Institute of Chartered Surveyors (RICS).

The body is warning that the supply of homes on the rental market could continue to dry up because UK prime minister Boris Johnson’s new government “seems to be concentrating on increasing home ownership.”

A drop in the number of landlords looking to let properties “seems likely to squeeze rents higher,” according to a RICS’ survey of its members published on Thursday.

The level of tenant demand for rental properties is at its highest since the end of 2016, but reforms to stamp duty, letting fees and eviction rules are blamed by surveyors for pushing landlords out of the sector.

Expectations that rents will rise soon are at the highest in the three years among RICS member residential surveyors, who advise on property and construction.

READ MORE: UK house prices are falling - but Brexit may not be to blame

Simon Rubinsohn, chief economist of RICS, called for more properties to be built for rent and not only built to buy.

Various ‘Help to Buy’ schemes have been a flagship of the Theresa May and David Cameron governments, with financial support for first-time buyers a priority as property has become increasingly unaffordable for the young.

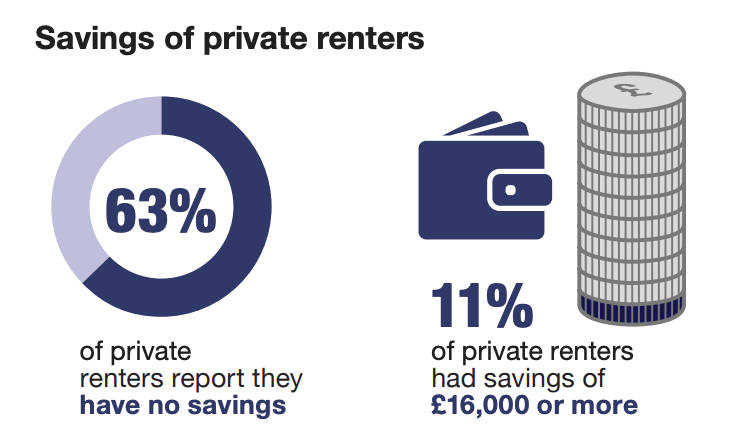

But high costs in the private rental sector can also have a knock-on effect on aspiring homeowner’s ability to save for a deposit to buy a home.

Yahoo Finance UK revealed last month private renters spend twice as much of their incomes on rent as homeowners do on mortgage payments.

Recent figures from the government’s English Housing Survey show the majority (67%) of private tenants say they have no savings at all.

Ryan Williams, a chartered surveyor in the West Midlands, said “meddling in stamp duty,” a government crackdown on letting fees and reforms to the law on evictions were to blame for landlords leaving the sector.

READ MORE: Private tenants pay twice as much as homeowners do on mortgages

“Lettings are still very busy, stock is low as landlords are selling up due to tenant fee ban. New investors are currently thin on the ground,” said Chris Clubley, a chartered surveyor in Yorkshire.

Rubinsohn added: “The lettings market data continues to send a very strong message that institutions need to upscale their build to rent pipeline to address the shortfall resulting from the decline in appetite from buy to let investors.

“It is significant that the near-term rental expectations indicator has climbed to a three-year high."

He added that wider indicators on the property market were “pretty much flatlining,” with the number of newly agreed home sales slipping in July and increased expectations of declines in property prices.

READ MORE: Pound hovers at two-year lows as government attacks EU over Brexit deal