Brits save £870bn as pay grows but Brexit deters spending

The British public has more than £870bn in savings with major high street banks, new figures show.

Increased wages and lower consumer spending have pushed up savings by 2.6% in November compared to a year earlier, according to UK Finance.

Real wages have been squeezed since the financial crisis a decade ago, but an employment boom has pushed up pay over the past year as workers’ bargaining power has grown.

The figures published on Monday also suggest greater political and economic uncertainty has made consumers more cautious about spending, with Brexit dampening consumer confidence.

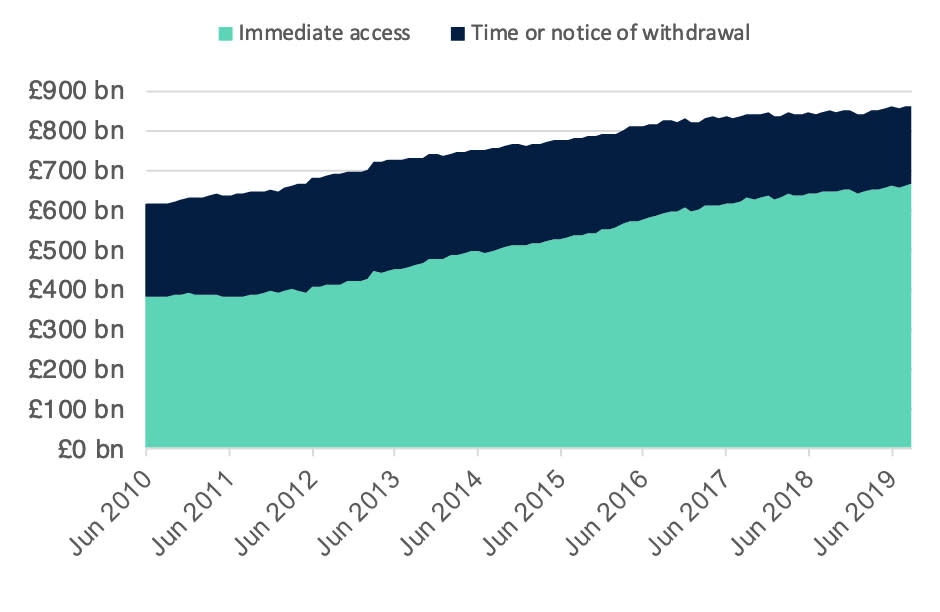

Bank customers are increasingly holding their cash in easy-access current or savings accounts, with more than three-quarters of the total £870.4bn held in such accounts last month.

READ MORE: How much people earn in different parts of the UK

Holding cash in such instant accounts risks inflation eroding the value of the country’s savings, as interest payments are typically lower than in accounts with more limited access.

But increased uncertainty over short-term household finances is thought to be behind the trend, with a 1.4% annual decline in funds stored in more restricted but more lucrative accounts.

Returns on traditional savings accounts are also still low by historical standards, with policymakers across the world using record low interest rates in a bid to revive weak growth.

“While low investment returns play a part, quick access to disposable income in uncertain economic times is the driving force for individuals when managing household budgets,” UK Finance said in a separate report earlier this month.

Credit card spending also dropped by 3.3% year-on-year to £10.9bn in November, and overdraft borrowing slid by 0.8%.

READ MORE: 140,000 UK retail jobs lost in worst year for quarter of a century

The latest UK Finance figures only cover savings held with members Barclays, Lloyds, HSBC, RBS, Santander UK, TSB, and Virgin Money.

They also show increased numbers of mortgage approvals for home purchases, in a sign of resilience in the property market despite a slowdown in recent years.

New residential mortgages approved by the major banks increased by 6.8% over the year to 43,589 in November 2019. Remortgages also soared 12.7% to 34,653.

But the value of loans fell as the slowdown has curbed price growth, with £23.1bn in gross mortgage lending in November. That marked a 3.3% decline on the same month a year earlier.

READ MORE: UK workers face ‘longest pay squeeze in centuries’