House passes bill to stop coming 'tidal wave' of failing pensions

The retirement of more than one million people is at risk, thanks to multiemployer pension plans on the verge of failure.

On Wednesday evening, the House passed the Rehabilitation for Multiemployer Pensions Act, a bill aimed at solving the problem — but the bill faces an uphill battle in the Republican-controlled Senate.

Lawmakers and experts warn if the pension plans run out of money, retirees won’t get the benefits they were promised and millions of people will be pushed into poverty.

How did we get here?

“The situation is no fault of the workers,” said Rep. Bobby Scott (D-VA), chairman of the House Education and Labor committee.

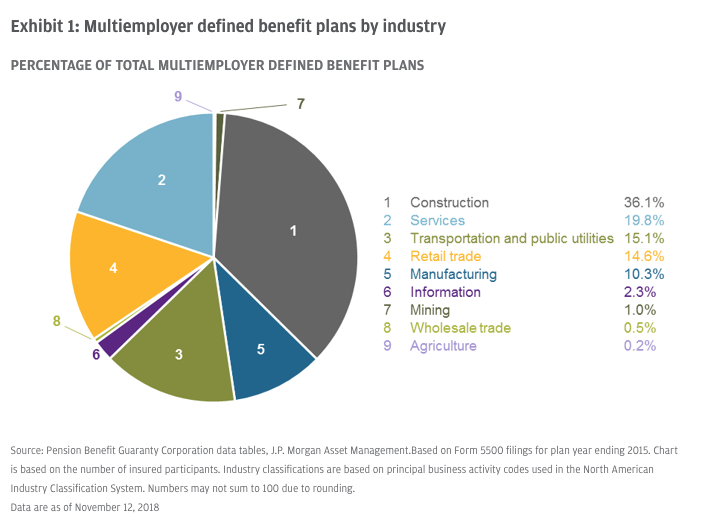

Multiemployer pension plans are pensions sponsored by more than one

employer and maintained as part of a collective bargaining agreement. About 3.1% of all pension plans – covering 28% of plan participants – are multiemployer plans, according to the Congressional Research Service. Nearly all of the remaining pension plans are maintained by a single employer. In 2016, there were 1,296 multiemployer plans covering approximately 10.3 million participants.

Joshua Gotbaum, with the Brookings Retirement Security Project, told Yahoo Finance there are a variety of reasons multiemployer pension plans are failing.

First, he told Yahoo Finance actuaries weren’t cautious enough in planning what they could deliver for retirees — and did not give themselves a cushion in case the plans didn’t perform as well as they had hoped.

Secondly, he said many companies have gone out of business, leaving the pension plans to cover the benefits of retirees whose employers are no longer contributing.

As of 2015, multiemployer plans had a total of $560B in unfunded liabilities, according to a Congressional Research Service study.

“All of the employers are jointly and severally liable for all of the promised benefits. So if a business goes bankrupt, the remaining businesses are obligated to pay the bills. They call it ‘the last man standing’ because if a couple of them go bankrupt, then the liability on the remaining ones gets so bad that others go bankrupt — and the last man standing owes all of the benefits from all of the companies,” Scott said in an interview with Yahoo Finance.

Scott and Gotbaum warn that’s why the pension crisis will not only hurt workers, but also jeopardize businesses around the country.

“This is a disaster. Let’s just put it this way — this is a tidal wave that is coming very slowly, but which we want to solve before it arrives,” said Gotbaum.

Gotbaum also served as the director of the Pensions Benefit Guarantee Corporation from 2010 to 2014. When pension plans fail, the PBGC pays at least a portion of the pension benefits promised to retirees, up to legal limits set by Congress. Last year, the PBGC paid $153 million in financial assistance to 81 insolvent multiemployer plans. If nothing changes, its Multiemployer Program is likely to run out of money by the end of 2025.

“These pension plans are going to run out of money and the PBGC won’t have enough money to pay even reduced benefits,” Gotbaum said. “What you’ll see is more than a million people, instead of having a pension, will have nothing. You’re throwing more than a million people and their families into poverty.”

The Butch Lewis Act

The House-passed legislation is also known as the Butch Lewis Act, in honor of a truck driver and Ohio Teamster who died of a stroke in 2015, while fighting to save struggling pension plans.

“The Butch Lewis Act delivers justice for 1.3 million workers and retirees facing devastating cuts to pensions earned over a lifetime of work,” said House Speaker Nancy Pelosi on the House floor.

The bill would create a Pension Rehabilitation Administration within the Department of Treasury to provide long-term loans to multiemployer pension plans facing insolvency. The Treasury would sell bonds and lend the money to pension plans at a low interest rate. The plans would pay the loans back over the course of 30 years.

“They'll be able to invest the money and be able to grow the fund to the point where they can gradually become solvent — at which time they will be paying the loan back. This will allow the businesses to survive, it will allow the workers to receive their pensions,” Scott said.

Twenty-nine Republicans voted with Democratic lawmakers to pass the Butch Lewis Act, but conservative critics called the bill a “bailout” on the House floor before the vote.

“This is one of the most reckless, fiscally irresponsible pieces of legislation I’ve ever seen,” said Rep. Jodey Arrington (R-TX). “Yes, we need to help those workers, they were the real victims. And the culprits? The unions and the employers for making benefit promises that they knew good and well they couldn’t deliver on. Who’s now going to hold the bag? Our children and grandchildren.”

Like so many other issues, Republican and Democratic lawmakers agree on the problem, but don’t agree on a solution. House Ways and Means Ranking Member Rep. Kevin Brady (R-TX) said the bill doesn’t address the root cause of the problem.

“This bill doesn’t take any steps to make these failing plans more stable, it won’t end underfunding, and it doesn’t make them solvent over time,” Brady said on the House floor. “Our biggest worry, as Republicans, is that is doesn’t solve the problem. And so these same workers years down the road are going to be in the same problem. Our workers deserve better.”

‘Show me the plan’

Congress has been trying to figure out how to deal with the situation for years. Scott challenged critics to present an alternative.

“Show me the plan. This is the only plan pending... the fact of the matter is it gets worse every day, because every day the plans are closer to insolvency,” said Scott. “The bottom line is this is the only game in town, and it costs a lot less to do something than to do nothing.”

Scott argued retirees who lose their pensions will pay less in taxes and eventually need government assistance.

The bill is unlikely to make it through the Republican-controlled Senate.

Sen. Sherrod Brown (D-OH) has been fighting for the Butch Lewis Act in the upper chamber. Last year, he co-chaired a special bipartisan committee designed to solve the multiemployer pensions problem, but that group didn’t manage to get a solution through the Senate.

Brown is still working on the issue with Sen. Rob Portman (R-OH).

On Wednesday, Brown and other Democratic senators reintroduced the Butch-Lewis Act in the Senate.

“We must solve this crisis for the workers, retirees and small businesses who are counting on us, and the Butch Lewis Act is one way to do that,” said Brown.

Jessica Smith is a reporter for Yahoo Finance based in Washington, D.C. Follow her on Twitter at @JessicaASmith8.

Amazon, Facebook each spent more than $4M lobbying DC last quarter

House votes to raise minimum wage to $15 an hour

Maxine Waters wants Mark Zuckerberg to testify about Libra before Congress

GOP lawmaker: Innovation should not go to Washington ‘to die’

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.