High-yield savings banks finally hit by the Fed's coronavirus rate cut

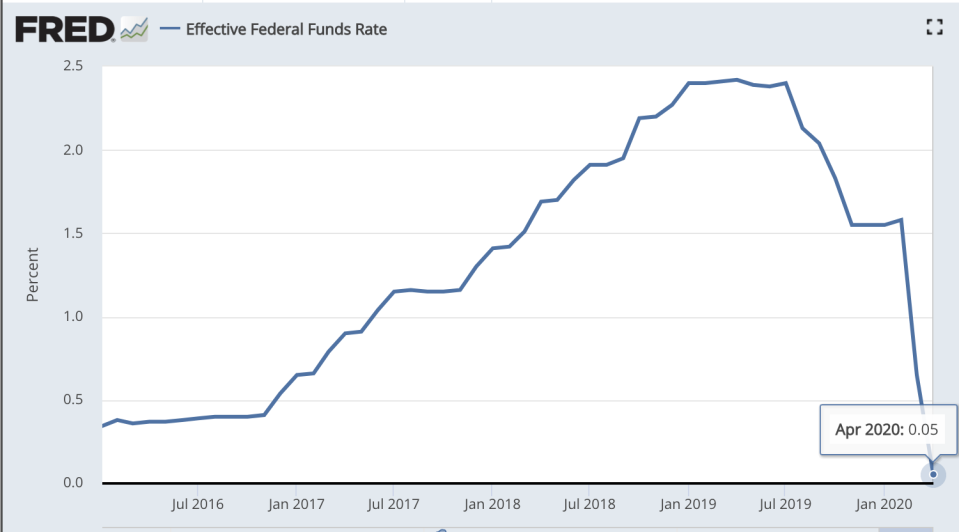

On March 15, the Federal Reserve cut interest rates to zero in an emergency announcement, as the coronavirus crisis accelerated in the U.S. The drop from 1.00%-1.25% to 0.00%-0.25% was one of the biggest rate cuts in history.

Two months later, the ripples are reaching online savings accounts, which are starting to slash their own interest rates.

In December 2018, the Federal Funds rate stood at 2.25%–2.50%, and online savings accounts were paying generously for people to park their cash; many accounts offered APYs over 2.20%.

The Federal Funds rate affects most other interest rates, including savings account rates, but it especially affects high-yield online savings accounts because they’re easy to open and close online, making its customers more sensitive to rate changes. These online savings accounts typically offer above-average rates. (The average savings account pays below-0.10% APYs.).

In mid-May, the Fed’s freefalling rates had finally caught up with online accounts, which have begun cuts of their own.

Many of the more aggressive players with traditionally higher rates have been hit hard.

Back in May 2019, when the rates were riding high, Goldman Sachs’ (GS) Marcus, CIT (CIT), Citibank (C), HSBC, and Synchrony (SYF) were all paying out over 2.25%, higher than their competitors like Ally (ALLY), Barclays (BARC), and American Express (AXP).

But now, most of these rates have been neutralized.

This week interest on Marcus accounts dropped from 1.55% to 1.30%, resulting in some online to marvel at a rare win for Ally over Marcus as Ally’s 1.50% rate remained strong.

But the win was short-lived. Hours later Ally slashed its rate to 1.30% as well, erasing the edge.

CIT and Synchrony, which have traditionally led with the highest rates available, are now in the middle of the pack with 1.30% as well.

Impressively, HSBC and Citibank are still paying well, 1.60% and 1.55%, respectively – for now at least. The flexibility of interest rates has been on display and constant refreshes are likely to continue as banks’ needs for money — good rates incentivize people to deposit — change and adjust.

“The need for deposits varies from bank to bank and can change suddenly,” wrote Greg McBride, Bankrate’s chief financial analyst, “particularly in recent months as the Fed has cut rates dramatically, credit risk has soared, corporate clients have drawn down lines of credit and there has been a flight to quality.”

Certain banks, he said, act faster than others based on their needs and priorities.

Though rates are far lower than they used to be, they still hold up well compared to the Federal Funds rate. If you track the Federal Funds rate versus these rates from online savings banks, they were fairly similar when times were good, both well above 2.20%.

But now, they’ve diverged. In fact, with an effective Federal Funds rate at 0.05% in April, Many accounts paid 1.50 percentage points better than the Fed.

“With the Fed cutting the federal funds rate from 2.25% to near zero since last summer, online savings accounts have held up relatively well,” McBride said.

He also pointed out that while rates are going lower, they’re still pretty good considering the other options.

“The average bank savings account earns 0.10%, a 3-month Treasury earns 0.1%, and money funds are in a race to near zero,” said McBride. “Even if yields on online savings accounts eventually settle around 1%, it's 10-fold what you can get on similar, risk-free, liquid savings alternatives.”

--

Ethan Wolff-Mann is a writer at Yahoo Finance focusing on consumer issues, personal finance, retail, airlines, and more. Follow him on Twitter @ewolffmann.

The US may be undercounting COVID-19 cases by a massive margin: Goldman Sachs

Why Amazon, Facebook, Disney saw their chiefs retake control

Why the unemployment rate could be 5 percentage points higher

Frontier Airlines adopts and quickly rescinds $39 to $89 fee for social distancing

Here's a list of CEOs taking pay cuts amid the coronavirus crisis

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube