Here's Why We Think Oakley Capital Investments (LON:OCI) Might Deserve Your Attention Today

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Oakley Capital Investments (LON:OCI). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Oakley Capital Investments with the means to add long-term value to shareholders.

View our latest analysis for Oakley Capital Investments

How Fast Is Oakley Capital Investments Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. To the delight of shareholders, Oakley Capital Investments has achieved impressive annual EPS growth of 43%, compound, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

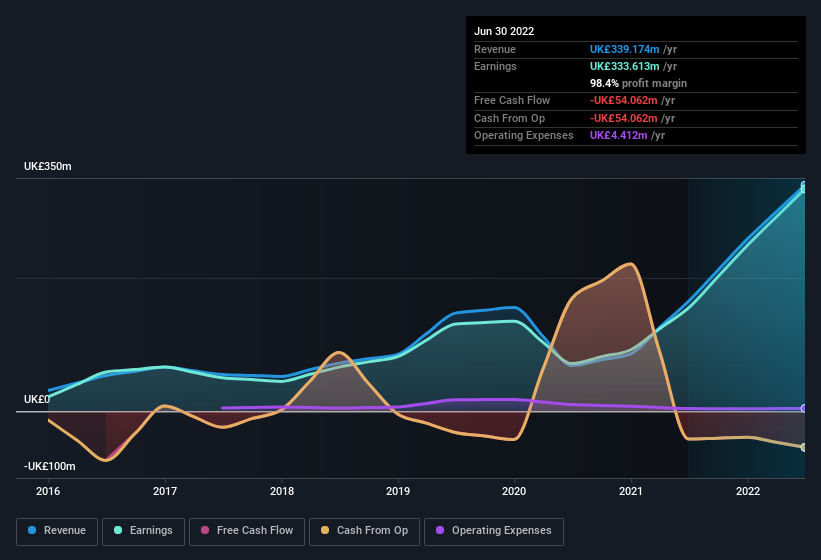

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of Oakley Capital Investments' revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. EBIT margins for Oakley Capital Investments remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 105% to UK£339m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Oakley Capital Investments' balance sheet strength, before getting too excited.

Are Oakley Capital Investments Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The real kicker here is that Oakley Capital Investments insiders spent a staggering UK£1.7m on acquiring shares in just one year, without single share being sold in the meantime. The shareholders within the general public should find themselves expectant and certainly hopeful, that this large outlay signals prescient optimism for the business. Zooming in, we can see that the biggest insider purchase was by Founder Peter Adam Dubens for UK£601k worth of shares, at about UK£3.78 per share.

Along with the insider buying, another encouraging sign for Oakley Capital Investments is that insiders, as a group, have a considerable shareholding. Indeed, they have a considerable amount of wealth invested in it, currently valued at UK£84m. This suggests that leadership will be very mindful of shareholders' interests when making decisions!

Should You Add Oakley Capital Investments To Your Watchlist?

Oakley Capital Investments' earnings per share have been soaring, with growth rates sky high. Just as heartening; insiders both own and are buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Oakley Capital Investments deserves timely attention. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Oakley Capital Investments , and understanding this should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Oakley Capital Investments, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here