Here's how long it has taken for bear market losses to recover

The S&P 500 rose almost 6% on Tuesday, yet another massive move in a series of moves that has given investors a severe case of whiplash. Still, stocks are 27% off their February highs before the coronavirus became an acute crisis in the U.S.

If history is any guide — and, as the disclaimer always goes, the past isn’t any guarantee of the future — it will take a long time before investors are made whole again and reach the point where they were before the things got ugly.

According to a research note from Bank of America Securities, it has taken 1,100 trading days on average to regain the territory lost during a bear market.

There are 252 trading days in a year, so that means the average time to get back to where we were is 4.4 years.

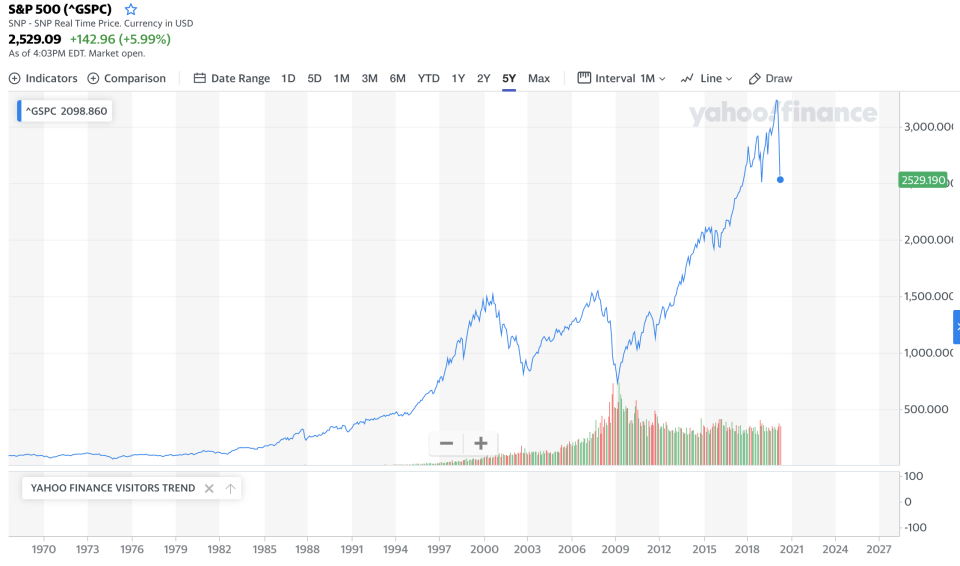

Let’s look at the market, represented by the S&P 500 index.

It’s pretty clear that looking at historical precedents might not help that much. Things are much bigger and wilder than they used to be. The recently-deceased bull market was way, way longer than its predecessors, and the crash was way faster than its predecessors in recent memory. (People knew what was coming and things sped up.)

Over the long term stocks usually go up, and most people assume we will eventually get out of this, be soon or in a while.

There are two ways to look at this, Bank of America says. Knowing that stocks will probably recover and you’ll get back the gains if you sit tight has historically been what Warren Buffett (and most long-term investing pros) has recommended when he tells people to “own the market” via low-cost and low-maintenance S&P 500 index funds.

The other? Trying to fast-forward the gains to beat the market by picking stocks or timing the market. .

Bank of America’s research note cautioned against that tactic, saying that “time is money for equities.”

“Trading stocks over a one-day period is only marginally better than a coin-flip,” the note said, also pointing out that “the best days usually follow the worst days,” which makes market-timing extremely difficult.

The research shows at least one clear playbook for many investors: waiting and dollar-cost averaging. So far, in the history of the stock market, that has worked out.

“The probability of losing money plummets to 0% over a 20-year time horizon,” the note read. The note also pointed out that equities are unique in being the only asset class that has performed really well over almost any big chunk of time.

The 2000s, which ended with a financial crisis, was the only decade outside of the 1930s that saw total negative returns.

-

Ethan Wolff-Mann is a writer at Yahoo Finance focusing on consumer issues, personal finance, retail, airlines, and more. Follow him on Twitter @ewolffmann.

Companies face fresh security risks due to people working from home

Why it's important to still own stocks at retirement — even now

Fidelity, Vanguard, T. Rowe Price to investors: 'Stay the course'

Why the US economy is particularly sensitive to the coronavirus outbreak

Coronavirus price gouging: 3 charts show Amazon's wild spikes

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.