Heathcare Stock for Bulls to Watch This June

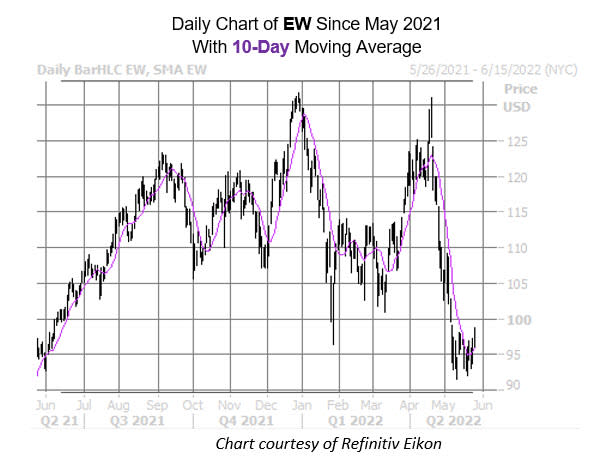

Edwards Lifesciences Corp (NYSE:EW) has taken a tumble in the second quarter, shedding nearly 25% since its mid-April peak near the $131 mark. The stock looks to have found a bottom near the $91 level, which also captured a pullback in May of 2021, and recently broke back above its 10-day moving average after several weeks below here. With the security last seen up 1.7% at $98.50 and headed for its highest close in almost three weeks, plus a promising seasonal signal flashing for the medical equipment concern, it could be time to look into a rebound for EW in the coming month.

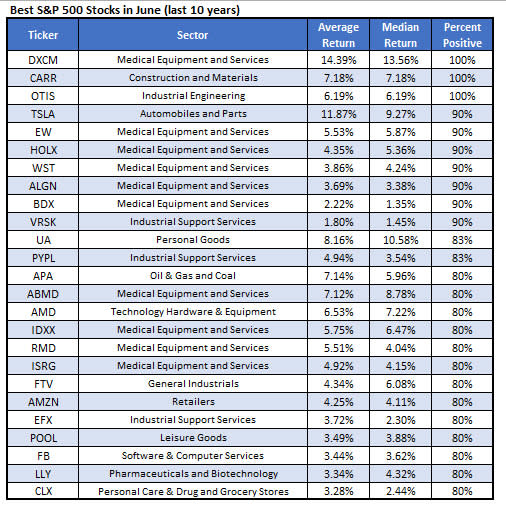

A study put out by Schaeffer's Senior Quantitative Analyst Rocky White detailing the 25 best performing stocks in the month of June shows EW high on the list. During the past 10 years, Edward Life Sciences stock has enjoyed a positive one-month return nine times, averaging a 5.5% bounce during this time period. A similar move from EW's current perch would put it just below the $104 level.

A unwinding of pessimism among options traders could create additional tailwinds. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), 3.81 puts have been picked up for every call in the past two weeks. This ratio its higher than 90% of readings from the past year, suggesting this penchant for bearish bets is unusual.

Finally, EW sports a Schaeffer's Volatility Scorecard (SVS) of 85 out of a possible 100. This implies Edwards Lifesciences stock has tended to outperform options traders' volatility expectations of late -- a good thing for call buyers.