Healthcare Stock to Target as the Broader Market Plummets

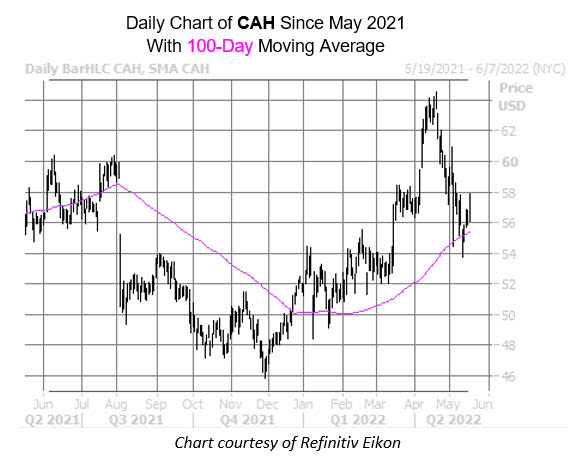

Medical retailer Cardinal Health Inc (NYSE:CAH) is eyeing relatively modest losses today, considering the severity of the broader market's selloff. The stock was last seen down 0.6% at $56.29. The stock's pullback from its April 21, three-year high of $64.53 has been comparatively tame, too, and looks to have stopped short near the $55 level, which is also home to CAH's August 2021 and February 2022 highs. This level of support has helped CAH maintain a 9.3% year-to-date lead. Plus, another technical level looks to be emerging on the charts, which could put even more wind in the stock's sails within the next few weeks.

The trendline we're referring to is CAH's 100-day moving average, which the equity just came within one standard of, according to data from Schaeffer's Senior Quantitative Analyst Rocky White. There have been seven similar moves occurring over the past three years, with 86% of these moves producing positive one-month returns. Cardinal Health averaged a 3.8% pop during that time period. From where it currently sits, this would put CAH just below the $59 level.

Possibly keeping some of the stock's gains in check is an upgrade from Evercore ISI. Earlier today, the analyst lifted its rating to "outperform," and hiked its price target to $68 from $55. Evercore ISI noted that the market has assigned no value to its medical supply business, adding that it expects inflationary pressures to ease during the back half of this year.

Even more bull notes could also be on the horizon for Cardinal Health stock. Of the seven in coverage, five called the security a "hold" or worse, coming into today. Meanwhile, the 12-month consensus price target of $60.77 is a slim 7.9% premium to current levels.