If You Had Bought Jounce Therapeutics (NASDAQ:JNCE) Shares A Year Ago You'd Have Earned 147% Returns

Unfortunately, investing is risky - companies can and do go bankrupt. But if you pick the right stock, you can make a lot more than 100%. For example, the Jounce Therapeutics, Inc. (NASDAQ:JNCE) share price has soared 147% in the last year. Most would be very happy with that, especially in just one year! On top of that, the share price is up 100% in about a quarter. In contrast, the longer term returns are negative, since the share price is 33% lower than it was three years ago.

View our latest analysis for Jounce Therapeutics

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Jounce Therapeutics went from making a loss to reporting a profit, in the last year.

When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action.

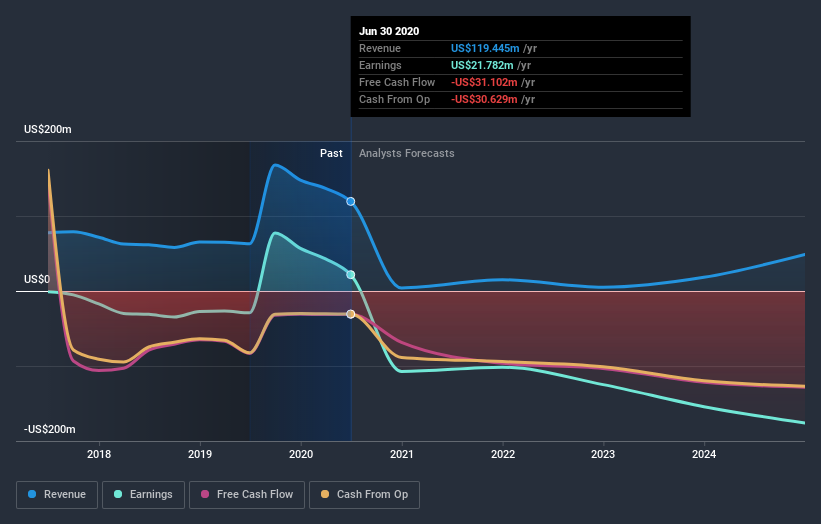

We think that the revenue growth of 86% could have some investors interested. Many businesses do go through a phase where they have to forgo some profits to drive business development, and sometimes its for the best.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We know that Jounce Therapeutics has improved its bottom line over the last three years, but what does the future have in store? It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Pleasingly, Jounce Therapeutics' total shareholder return last year was 147%. What is absolutely clear is that is far preferable to the dismal 10% average annual loss suffered over the last three years. The optimist would say this is evidence that the stock has bottomed, and better days lie ahead. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 3 warning signs for Jounce Therapeutics (1 doesn't sit too well with us!) that you should be aware of before investing here.

But note: Jounce Therapeutics may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.