Got a car lease? Your vehicle could be worth thousands of dollars more than expected because of COVID-19

Sean Larson decided he didn’t need his 2019 Subaru Crosstrek anymore, but he had 16 months left on his lease, so the Seattle resident thought he was stuck.

He wasn't.

Many people with leases, such as Larson, are cashing in or turning in their cars early with no penalty. That's because their vehicles are suddenly worth a lot more than carmakers and dealers expected when they had customers sign up for leases in 2018 or 2019.

The shift in favor of leaseholders has come about because of the COVID-19 pandemic, which pushed up prices for new and used vehicles and limited their availability.

As Larson and his girlfriend considered a move to a more expensive area, they hoped to cut some expenses and realized that they could make do with her 2015 Ford Edge, which she owns.

Avoid catalytic converter theft: Tips on protecting your car as thieves target rare metals

Consumer Reports: These are the 10 most and least reliable 2021 cars, trucks and SUVs

When Larsen and his girlfriend walked into the Subaru dealership and said they were thinking of turning in the 2019 model, “I thought it was going to be a conversation with hours of negotiation and trying to get them to come down on the lease fees.”

No penalties for ending leases early

His apprehension made sense because dealers would typically charge a customer thousands of dollars in fees to get out of a lease with that much time left on the contract.

That’s no longer the case.

“There was no hesitation on his end,” Larson said. “When he said, ‘zero dollars,’ I was like, ‘Done, here’s the keys.’”

He shares his girlfriend’s Edge, working from home most days and using public transit when he needs to commute and the car is not available.

Americans with vehicle leases that expire soon are poised to score a great deal since their contracts were signed long before COVID-19 started. Dealers are desperate for more cars and trucks since a global shortage of semiconductor chips used in vehicles has hampered car production, which has forced more Americans into the used-car market and driven up prices for older vehicles.

Options for turning in your lease

Though each situation may vary, drivers of leased cars, in general, have a variety of options. They can:

►Turn in their car early – probably for no cost or potentially even for a payout – if they don’t need it anymore.

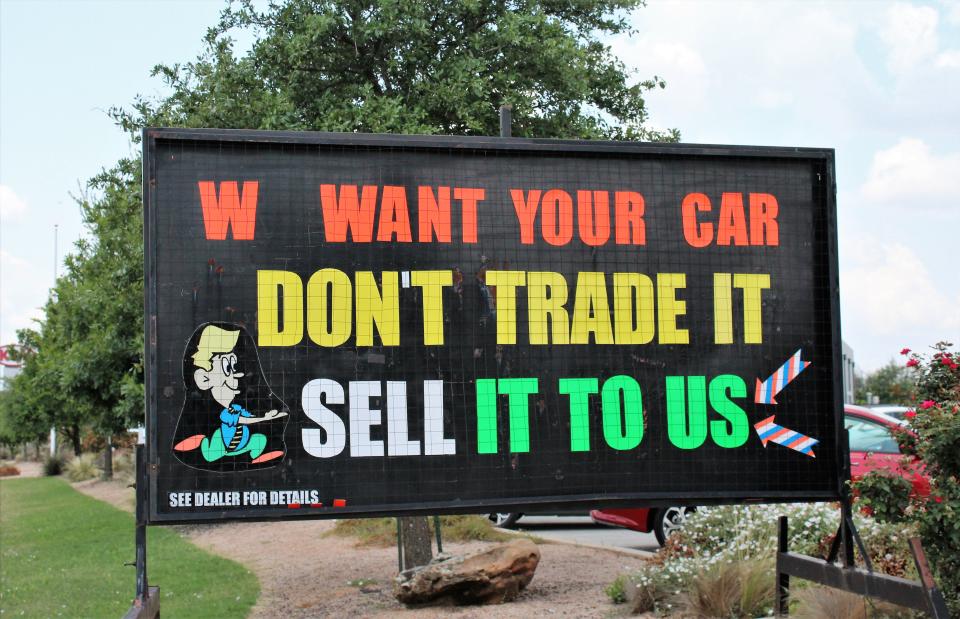

“If you have a lease, your dealership may be very interested in trying to get you out of your lease early due to the fact that there’s such tight demand for vehicles right now,” said Kevin Roberts, director of industry insights and analytics for car-buying site CarGurus.

► Buy the car for thousands less than it’s worth since purchase rates were set in their contracts a year or two before the pandemic began – and vehicles' values were lower – and keep it.

► Buy the car and sell it immediately for a profit. That’s an option for Augusto Amorim, who conducts vehicle sales forecasts for research firm LMC Automotive, part of J.D. Power.

The lease on his Volvo V60 is not up until April 2022. The dealer and the finance company that arranged his lease sent him a letter offering him a $3,500 bonus to turn it in early.

He determined that if he buys out the lease on his own and sells the vehicle to a private party, he could recoup all the money he spent on the vehicle during the first two years of the lease.

“I thought, ‘This is nuts, this doesn’t make any sense,’” Amorim said. “A lot of people don’t realize that they have this cash sitting in their garages.”

He’s not sure what he’s going to do. “I’m really debating it,” he said.

Cars worth more than what's owed

It was an easy decision for Mackenzie Phillips.

She had worked from home in Alabama for a mortgage company but needed to move to Philadelphia this summer as her new employer is reopening its office.

With a three-year lease on a 2019 Toyota Corolla set to expire in 2022, she visited her dealer in Auburn to assess her options.

“It was worth more than I owe by about $1,200,” she said.

As a result, the dealer told her she could terminate the lease a year early without paying anything.

Realizing that the automotive market had flipped on its head, she called a dealership in Philadelphia, where she would be moving. The dealer didn’t make a formal offer but said that if she wanted to explore it, she could probably get more for the vehicle in that market.

“They would love to have it,” Phillips said.

For the sake of convenience and the fact that the Alabama dealership had locked in an offer, she took that deal. She calculated that she would save about $7,000 in car payments and insurance by giving up the Corolla early.

“Their lot was empty compared to what it was a year or two ago," she said. "You could just tell that they didn’t have any inventory.”

A shrinking inventory of new vehicles has led to a sharp increase in the prices of used cars as buyers snap up any option they like. The average price for used vehicles reached a record $25,410 in the three-month stretch from April through June, up 21% from the same period in 2020, according to car-research site Edmunds.

Turn in your lease, then what?

That’s the upside and the downside for lessees. Yes, you can cash in on your vehicle – but only if you’ve got access to another car or can go without one. Otherwise, you’ll be forced into the pricey used-car market just like everyone else.

“You can sell it for a profit, but if you're looking to get into another leased vehicle, with how tight new inventory is, it's going to be harder to find,” CarGurus expert Roberts said.

Lessees at least have options that others might not. Many of them haven’t driven their car much since they took out the lease, as the pandemic led to more remote work and less travel.

Larson, the Seattle resident, drove his Subaru Crosstrek much less than he expected after his employer, a company that makes hydration tabs for drinks, let its employees work from home.

His three-year lease would have allowed him to drive up to 39,000 miles. About two years in, he had driven about 14,000. That means the vehicle is worth even more than it would’ve been had he driven it the full amount allowed.

He knows he probably could’ve made money on the car if he had waited until his lease expired but at total costs of about $600 per month.

“My main priority," he said, "was just shutting down those monthly payments.”

You can follow USA TODAY reporter Nathan Bomey on Twitter @NathanBomey and subscribe to our free Daily Money newsletter here for personal finance tips and business news every Monday through Friday morning.

This article originally appeared on USA TODAY: Car prices soar and that makes turning in a leased vehicle profitable