Goldman Sachs: Stress Test Results Could Set the Stock Free

Goldman Sachs (NYSE:GS) is one of the 34 big banks that passed its stress test earlier this month, in turn causing investor optimism. The market's been unkind to Goldman stock during the past few months as its cyclical nature hasn't taken well to the bear market, but now, it appears there's cause for optimism.

Bank of America (NYSE:BAC) recently upgraded its rating on Goldman Sachs, stating that the bank's "revenue growth could see a boost from a volatile geo-political backdrop and monetary policy, both have the potential to drive elevated trading activity for the foreseeable future." Here's why I agree with Bank of America's viewpoint.

Stress test results

A bank's stress test weighs the risk it faces versus its traded assets. A high-quality stress test result conveys an ability to maximize utility to stakeholders and shareholders at minimum risk.

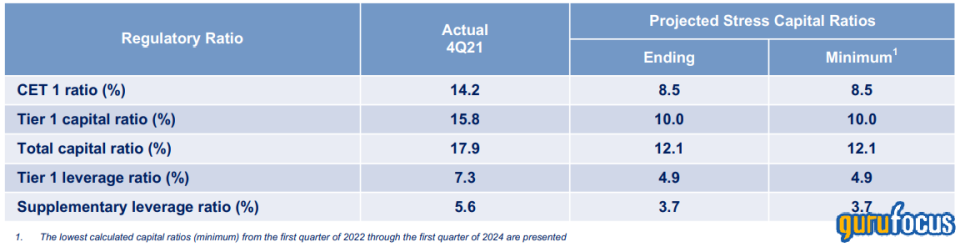

Goldman's tier 1 common equity ratio of 14.2% is well above the required 4.5%; even if economic circumstances worsen, the bank's scenario analysis conveys a minimum of 8.5%, which is still above the industry requirement.

Furthermore, Goldman's tier 1 capital ratio exceeds its required benchmark of 7.5%, and its total capital ratio also exceeds its benchmark of 11.5%.

Source: Goldman Sachs

Dividend analysis

Following its successful stress test, Goldman decided to increase its shareholder compensation package. The company declared a dividend increase to $2.50 per common share versus its previous level of $2.50.

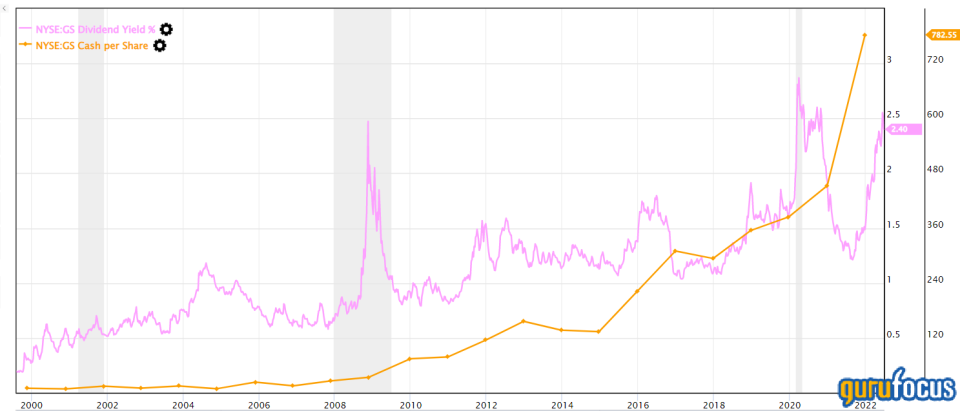

The bank's current dividend yield of 2.40% provides attractive income prospects to Goldman Sachs' investors. Moreover, the company's dividend payouts seem sustainable, with an astronomical cash per share ratio of 782.55.

Lastly, Goldman's safety ratios paint a clear picture of the company's proclivity to reward its shareholders. The stock has a dividend coverage ratio of 4.4 and boasts 22 straight years of dividend payments.

Relative valuation

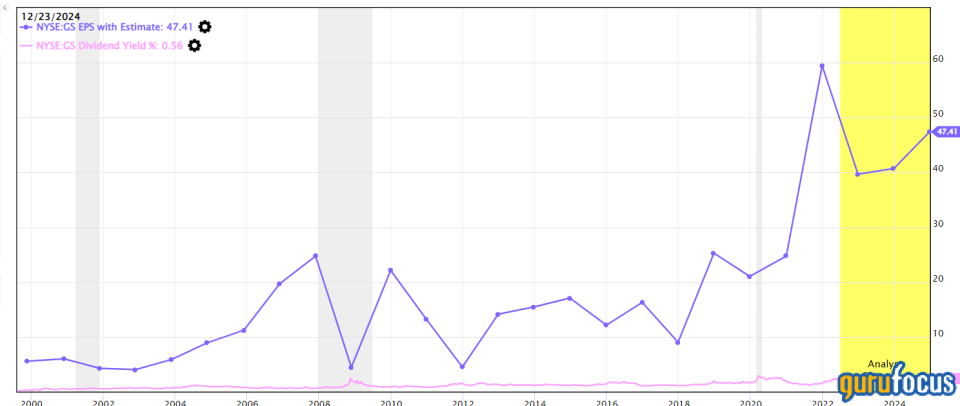

Goldman is a best-in-class banking stock based on valuation. The bank's robust earnings growth has resulted in an estimated earnings per share ratio of 47.41. In addition, Goldman's PEG ratio of 0.21 implies that the market underestimates the bank's earnings per share growth by 4.76 times.

The most critical matter to consider when valuing banks is the price-book ratio. An overwhelming amount of financial literature has supported the claim that banking stock prices oscillate around a price-book ratio threshold of 1. Banks do business by trading liquid equity and debt, causing their book values to resemble their fair market value.

Goldman's price-book is at a 6.3% discount to the fair value threshold, implying that the stock is currently undervalued. Furthermore, I expect the bank's balance sheet to recover as the equity and debt markets find calm. Thus, its current price-book ratio is probably higher than it should be.

Final thoughts

Goldman Sachs' stock seems undervalued and set for growth in my view. The bank strolled past its stress test, implying that solid growth is in the cards. In addition, the bank provides a solid dividend backed up by robust safety ratios.

This article first appeared on GuruFocus.