Gold Stock Could Shine Brighter, Signal Says

The shares of Newmont Corporation (NYSE:NEM) are up 0.8% at $61.70 at last check. And while the gold mining company has cooled off from its Aug. 5 all-time-high of $72.22, the security is still up 63.3% year-over-year. Even better news is that the stock's latest pullback has it near a historically bullish trendline, which could help NEM shine even brighter in the coming weeks.

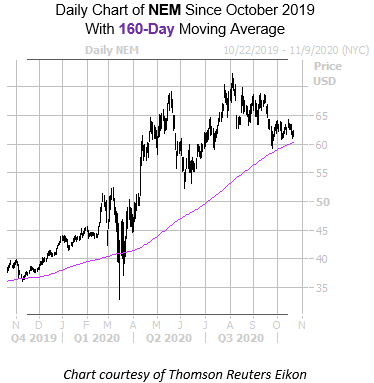

More specifically, NEM just came within one standard deviation of its 160-day moving average, after spending the last few months above the trendline. According to data from Schaeffer's Senior Quantitative Analyst Rocky White, four similar signals have occurred during the past three years. More often than not, the equity enjoyed positive returns one month after each signal, averaging a roughly 11.8% gain. From Newmont stock's current perch, a move of similar magnitude would put it just shy of $69 -- at another record peak.

An unwinding of pessimism in the options pits could send the security higher. This is per NEM's Schaeffer's put/call open interest ratio (SOIR) of 1.15, which sits in the highest percentile of its annual range -- suggesting short-term options traders have rarely been more put-biased.

For those wanting to weigh in on Newmont stock's next move, options may be the right play. The stock's Schaeffer's Volatility Index (SVI) of 40% sits higher than just 22% of readings in its annual range, suggesting short-term options are pricing in relatively low volatility expectations.