Gold Price Retreat Is Creating an Opportunity at Newmont

Newmont Corp. (NYSE:NEM) is one of the worlds largest gold producers with operations and assets in the U.S, Canada, Mexico, Dominican Republic, Peru, Suriname, Argentina, Chile, Australia and Ghana. It is also mines for other commodity metals such as copper, silver, lead and zinc.

As of year-end 2021, Newmont had attributable proven and probable gold reserves of 92.8 million ounces, measured and indicated gold resources of 68.3 million ounces and total land ownership position of approximately 24,300 square miles.

Recent gold price movements

Spot gold prices have swooned this year from a high of overt $2,000 per ounce in March 2022 to approximately $1,700 currently. Gold is typically considered a hedge against inflation, but higher interest rates make gold and other commodities less attractive because they pay no interest. There has been additional pressure on gold prices after Federal Reserve Chairman Jerome Powells recent comments that the Fed will continue to aggressively raise interest rates.

Gold has also seen pressure from the stronger dollar, which has spiked to its highest levels since 2002. A stronger dollar makes bullion expensive for overseas buyers and international markets are an important source of gold demand.

Gold history

With government liquidity-driven inflation on consumers minds today, investors are seeking protection from these rising prices. Physical gold as well as gold mining equities are often seen as a primary hedge against inflation.

Gold is still considered a rare element and a precious metal that has been used for currency, jewelry and other industrial uses for thousands of years. The gold standard was often utilized in monetary policy in the U.S. and other countries off and on since the 1870s. But in 1971, this concept was abandoned for a fiat or paper currency that exists today.

Gold prices rose to over $2,000 per ounce in August 2020 due to government stimulus ramped up to fight the negative effects of the Covid pandemic. The commodity also reached $2,000 per ounce in March 2022 as record inflation began to take hold. Cryptocurrencies such as bitcoin were once thought to be an inflation hedge and a perhaps as a substitute for gold, but that concept has not come to fruition in any meaningful way.

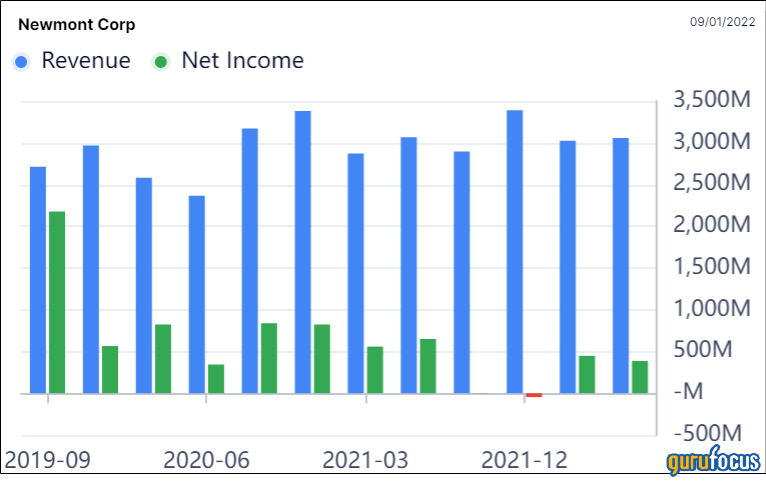

Financial review

Newmont reported second-quarter results on July 25. Revenue was flat at $3.1 billion and adjusted Ebitda decreased 28% to $1.1 billion. The companys earnings were negatively affected by higher labor, materials and consumables costs as well as higher fuel and energy costs.

Regardless, the company's balance sheet is in good shape with $4.3 billion in cash and equivalents and $5.5 billion in total debt. Total available liquidity is $7.3 billion, and the companys debt-to-Ebitda ratio is only 0.3.

Valuation

Analyst earnings per share estimates for 2022 and 2023 are approximately $3.20, which puts the company selling at 12 times forward earnings. The company trades at an enterprise value/Ebitda ratio of 6 currently. Newmont continues to develop a mining and financial plan where profitability can be achieved even at a $1,200 spot gold price. However, due to inflation, higher royalties, labor costs and increased production taxes, the company assumes an $1,800 gold price for its 2022 outlook.

Newmont maintains a unique dividend policy in which it pays a declared continual base dividend and then supplements it with an additional dividend payment based on free cash flows derived from the level of gold prices. The sustainable dividend is currently paying $1 and then the excess target is 50% of attributable cash flow above a $1,200 gold price. That resulted in a $1.20 excess payment for a total declared dividend of $2.20, which equates to a dividend yield of 5.21%.

Guru trades

Gurus who have added to their Newmont positions include Paul Tudor Jones (Trades, Portfolio) and Steven Cohen (Trades, Portfolio), while those who have reduced or sold out of their holdings include Mario Gabelli (Trades, Portfolio) and Ray Dalio (Trades, Portfolio).

Conclusion

Buying gold and gold mining stocks as an inflation hedge is a great theme, but Newmont currently produces high levels of free cash flow and high returns on capital.

Newmont is selling near 52-week lows and the stock likely has strong upside from here as rate increases eventually slow down and the dollar weakens. Gold will likely be a safe haven as the economy slows. Lastly, the above-market dividend yield should provide some stability as it attracts more income-oriented investors as compared to those investors interested in commodity plays.

This article first appeared on GuruFocus.