GICS Tweaks Could Impact ETFs

Key Takeaways

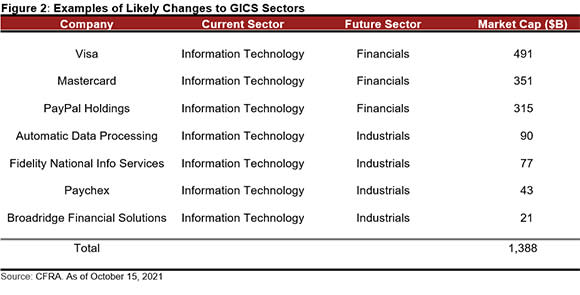

Pending changes to the GICS classification of stocks within the data processing and outsourced services subindustry could shake up three of the largest U.S. sectors.

If implemented, Mastercard (MA), PayPal Holdings (PYPL) and Visa (V) would be among the top 10 stocks within the financial sector in 2022, after leaving information technology, while Automatic Data Processing (ADP) and Financial National Information Services (FIS) would shift to the industrials sector.

Such changes would provide diversification benefits to the Financial Select Sector SPDR (XLF) and the Industrial Select Sector SPDR (XLI), but not the Vanguard Information Technology ETF (VGT).

CFRA believes understanding what is inside an ETF is as important as its past performance.

Fundamental Context

Some of the largest information technology companies in the S&P 500 Index could be changing sectors in early 2022. S&P Dow Jones Indices, together with MSCI, have co-developed the Global Industry Classification Standard (GICS) as a structure for classifying companies into sectors, industries and subindustries across global benchmarks.

Periodically, the index providers consultation with the investment community in advance of making significant changes, such as when they carved out real estate as the 11th sector, or moved companies like Alphabet and Facebook from information technology and Comcast and Netflix into the same renamed communications services sector as AT&T and Verizon.

A new GICS consultation just got underway that involves potential changes within many of the sectors, but to us there’s one major one that involves companies shifting from the information technology sector to either financials or industrials. We expect the changes to occur in 2022.

The largest U.S.-listed sector ETFs track either an S&P or an MSCI index. Led by the $51 billion MSCI-based VGT and $45 billion S&P-based Technology Select Sector SPDR Fund (XLK), there’s more than $100 billion in ETF assets that hold only the stocks inside a GICS-based information technology index, according to CFRA’s ETF data.

While there are no plans to shift Apple (AAPL) and Microsoft (MSFT), at least seven of the sector’s large cap constituents are potentially moving to a new sector. These companies are all currently in the data processing and outsourced services subindustry.

According to the GICS consultation document, many of these companies support activities that are closely aligned with the business support activities covered under the industrials sector rather than the information technology sector, or with the financials sector, in the case of payment processors.

Digging Into The Changes

Under the proposed changes, MA, PYPL and V would move to the financials sector as part of newly created transaction and payment processing services subindustry, and finally be in the same sector as consumer finance companies American Express (AXP) and Capital One Financial (COF).

MA, PYPL and V recently represented a combined 9.6% of XLK’s assets according to CFRA, and their removal from the tech sector is likely to result in increased exposure for the ETF to Adobe (ADBE), Cisco Systems (CSCO), Intel (INTC) and salesforce.com (CRM) as well as other more moderately sized tech stocks.

Separately, ADP and Paychex (PAYX) would move to the human resources and employment services subindustry, while Broadridge Financial (BR) and FIS would remain classified as data processing and outsourced services companies. All four would shift to the industrials sector from information technology.

These changes would impact VGT and XLK as well as the Fidelity MSCI Information Technology ETF (FTEC) and the Invesco S&P 500 Equal Weight Technology ETF (RYT), though in different ways. RYT owns roughly the same amount of assets in PAYX as V, unlike its market-cap-weighted ETF peers.

Banks would no longer dominate broad financial ETFs. At 38% of assets for the $45 billion XLF, banks are easily the sector ETF’s largest industry group, but would change if V, PYPL and MA are moved as planned into the sector. With a recent market capitalization of $490 billion, V would be similarly sized as J.P. Morgan (JPM), XLF’s second largest position, with an 11% weighting.

Meanwhile, MA and PYPL, when combined, are bigger than Bank of America (BAC) and Wells Fargo (WFC), and would be poised to be in the top five positions in XLF. Their addition would likely result in XLF and other broad financial sector ETFs paring stakes in AXP, Citigroup (C) and Morgan Stanley (MS). The Vanguard Financials ETF (VFH) and the Fidelity MSCI Financials Index ETF (FNCL) would also make changes to their holdings, as they track MSCI indexes.

We think the pending impact to industrials ETFs will be relatively muted but noteworthy. If ADP and FIS were currently classified as industrials companies, they would be the 11th and 13th largest positions in XLI, respectively, just ahead of and behind CSX Corporation (CSX).

XLI and peer Vanguard Industrials ETF (VIS) are relatively diversified across industries, with industrials conglomerate Honeywell (HON), road and rail company Union Pacific (UNP), air freight and logistics firm United Postal Service (UPS), and aerospace and defense company Raytheon Technologies (RTX) as the top positions.

The addition of current information technology stocks would provide some additional diversification for cap-weighted industrials ETFs, but we think the impact would be less than it would for financials.

(For a larger view, click on the image above)

(Use our stock finder tool to find an ETF’s allocation to a certain stock.)

Conclusion

CFRA provides star ETF ratings on sector funds such as VGT and XLF based in part on what’s inside, and does not rely solely on past performance. We believe a fund’s prospects are driven in part based on the reward and risks of its holdings, but that’s particularly relevant when the stocks inside a fund in 2022 should look very different than what’s been there the last three years. Assuming the proposed GICS changes occur as planned, we’ll subsequently focus on what ends up part of the portfolio.

All of the views expressed in this research report accurately reflect the research analyst’s personal views regarding any and all of the subject securities or issuers. No part of the analyst’s compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in this research report. For more information and disclosures, please refer to CFRA’s Legal Notice at https://www.cfraresearch.com/legal/.

Copyright © 2021 CFRA. All rights reserved. All trademarks mentioned herein belong to their respective owners.

Recommended Stories