General Electric (GE) Completes Healthcare Unit Spin-Off

General Electric GE has completed its previously announced spin-off of the healthcare business, GE HealthCare, into a separate public company.

The spun-off entity has begun trading on Nasdaq, effective Jan 4, under the ticker symbol GEHC. General Electric will continue to trade on New York Stock Exchange under the ticker GE.

As part of the spin-off, GE shareholders received one share of GE HealthCare stock for every three shares of GE stock held. GE has retained approximately 19.9% of GE HealthCare shares.

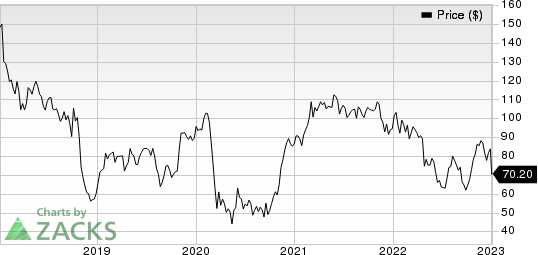

General Electric Company Price

General Electric Company price | General Electric Company Quote

The spin-off is part of General Electric’s portfolio restructuring actions to split its business into three independent companies — comprising GE Healthcare, GE Aviation (to be renamed GE Aerospace) and the combined operations of GE Digital, Renewable Energy and GE Power (to be named GE Vernova).

The spin-off of GE Digital, Renewable Energy and GE Power businesses is expected to be completed in early 2024. Following the completion of these transactions, GE plans to operate as an aviation-focused company starting in early 2024. GE’s separation into three public companies is expected to help each business to flourish through better operational focus, capital allocation policies and financial flexibility.

Zacks Rank & Key Picks

General Electric presently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks worth considering are as follows:

MRC Global Inc. MRC presently sports a Zacks Rank #1 (Strong Buy). The company pulled off a trailing four-quarter earnings surprise of approximately 103%, on average. You can see the complete list of today’s Zacks #1 Rank stocks.

MRC Global has an estimated earnings growth rate of 325.9% and 37.4% for 2022 and 2023, respectively. Shares of the company have rallied 24.1% in the past six months.

IDEX Corporation IEX presently carries a Zacks Rank #2 (Buy). The company delivered a trailing four-quarter earnings surprise of 5.7%, on average.

IDEX has an estimated earnings growth rate of 28.4% and 6.1% for 2022 and 2023, respectively. Shares of IEX have gained 24.3% in the past six months.

EnerSys ENS delivered a trailing four-quarter earnings surprise of 27.1%, on average. ENS presently carries a Zacks Rank of 2.

EnerSys has an estimated earnings growth rate of 7.2% and 26.3% for fiscal 2023 and 2024, respectively. The stock increased 23.1% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Electric Company (GE) : Free Stock Analysis Report

IDEX Corporation (IEX) : Free Stock Analysis Report

MRC Global Inc. (MRC) : Free Stock Analysis Report

Enersys (ENS) : Free Stock Analysis Report