Further weakness as Advantage Solutions (NASDAQ:ADV) drops 6.9% this week, taking one-year losses to 62%

Even the best stock pickers will make plenty of bad investments. And there's no doubt that Advantage Solutions Inc. (NASDAQ:ADV) stock has had a really bad year. The share price has slid 62% in that time. Because Advantage Solutions hasn't been listed for many years, the market is still learning about how the business performs. Shareholders have had an even rougher run lately, with the share price down 39% in the last 90 days. But this could be related to the weak market, which is down 17% in the same period.

If the past week is anything to go by, investor sentiment for Advantage Solutions isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

See our latest analysis for Advantage Solutions

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

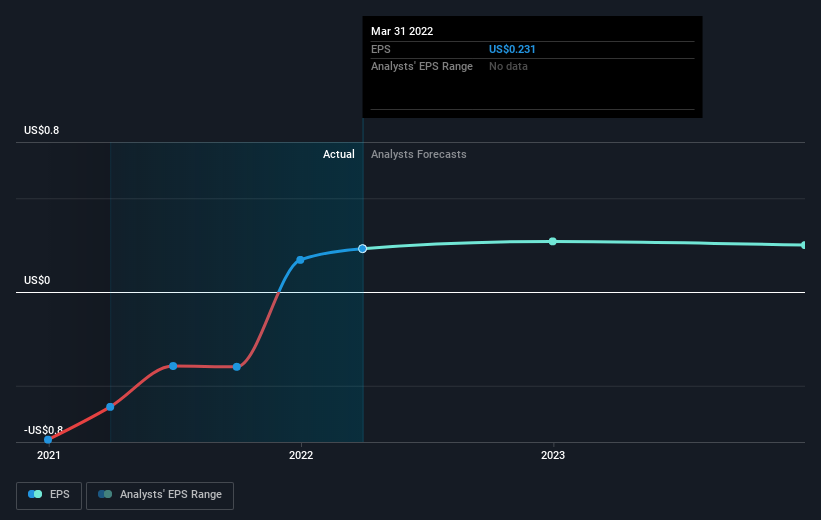

During the last year Advantage Solutions grew its earnings per share, moving from a loss to a profit.

We're surprised that the share price is lower given that improvement. If the improved profitability is a sign of things to come, then right now may prove the perfect time to pop this stock on your watchlist.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Dive deeper into the earnings by checking this interactive graph of Advantage Solutions' earnings, revenue and cash flow.

A Different Perspective

Advantage Solutions shareholders are down 62% for the year, even worse than the market loss of 20%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. With the stock down 39% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Advantage Solutions (at least 1 which doesn't sit too well with us) , and understanding them should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.