FPA Capital Exits Centene, Vonage Holdings

- By Tiziano Frateschi

The FPA Capital Fund (Trades, Portfolio) sold shares of the following stocks during the fourth quarter, which ended on Dec. 31.

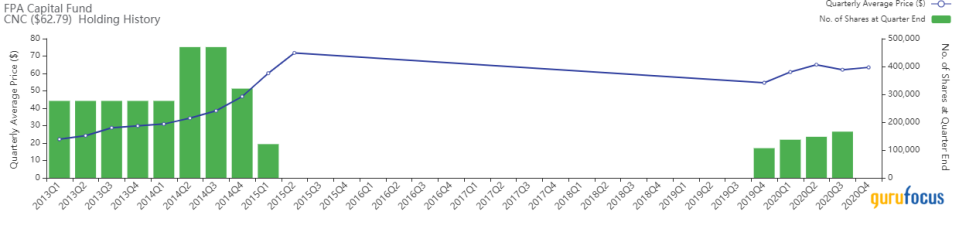

Centene

The firm closed its stake in Centene Corp. (NYSE:CNC). The trade had an impact of -9.06% on the portfolio.

The company, which provides health care plans, has a market cap of $36.37 billion and an enterprise value of $40.86 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 10.23% and return on assets of 3.64% are underperforming 63% of companies in the health care plans industry. Its financial strength is rated 6 out of 10 with the cash-debt ratio 0.76.

The largest guru shareholders of the company are Andreas Halvorsen (Trades, Portfolio) with 3.01% of outstanding shares, the Vanguard Health Care Fund (Trades, Portfolio) with 1.65% and Pioneer Investments (Trades, Portfolio) with 0.34%.

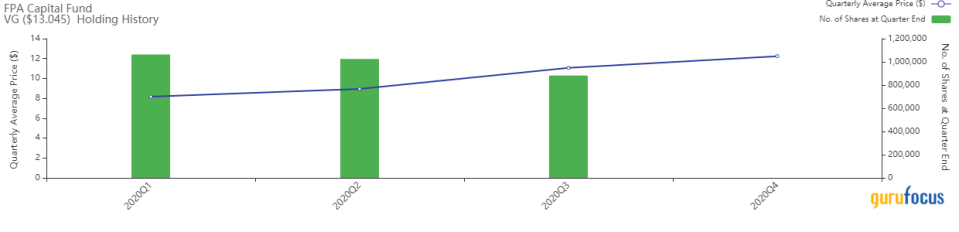

Vonage Holdings

The Vonage Holdings Corp. (NASDAQ:VG) position was closed, impacting the portfolio by -8.44%.

The telecom company has a market cap of $3.25 billion and an enterprise value of $3.77 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of -4.45% and return on assets of -1.82% are underperforming 76% of companies in the telecommunication services industry. Its financial strength is rated 3 out of 10. The cash-debt ratio of 0.09 is far below the industry median of 0.32.

The largest guru shareholder of the company is Steven Cohen (Trades, Portfolio) with 1.49% of outstanding shares, followed by Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.60% and PRIMECAP Management (Trades, Portfolio) with 0.37%.

ACI

The firm exited its position in ACI Worldwide Inc. (NASDAQ:ACIW). The portfolio was impacted by -6.82%.

The company, which develops software products, has a market cap of $4.54 billion and an enterprise value of $5.72 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of 5.58% and return on assets of 1.91% are outperforming 52% of companies in the software industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.1 is below the industry median of 2.42.

The largest guru shareholder of the company is Wallace Weitz (Trades, Portfolio) with 0.71% of outstanding shares, followed by First Pacific Advisors (Trades, Portfolio) with 0.24% and Ken Fisher (Trades, Portfolio) with 0.24%.

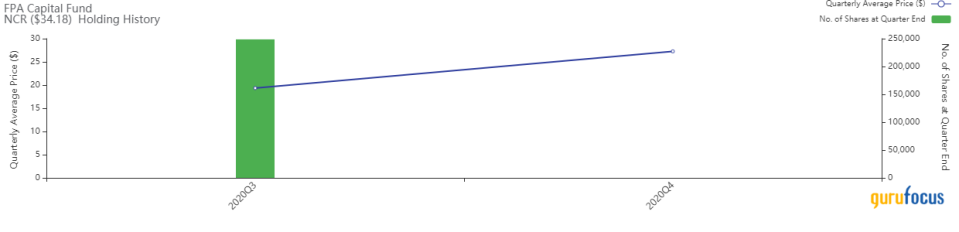

NCR

The NCR Corp. (NYSE:NCR) stake was closed, impacting the portfolio by -5.15%.

The company, which is a global vendor of ATMs, has a market cap of $4.33 billion and an enterprise value of $7.96 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of 30.87% and return on assets of 4.99% are outperforming 64% of companies in the software industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.33 is below the industry median of 2.42.

The largest guru shareholder of the company is David Einhorn (Trades, Portfolio) with 1.09% of outstanding shares, followed by Richard Snow (Trades, Portfolio) with 0.36% and First Pacific Advisors (Trades, Portfolio) with 0.19%.

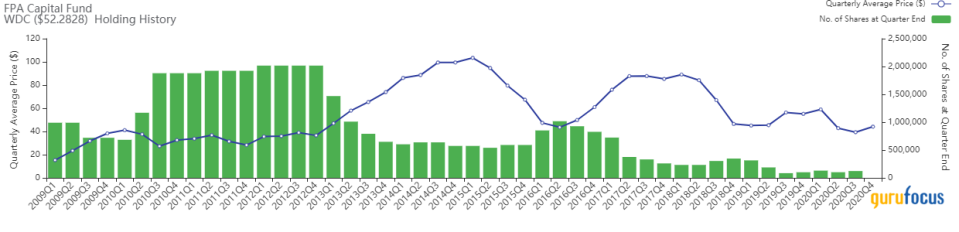

Western Digital

The firm exited its position in Western Digital Corp. (NASDAQ:WDC). The portfolio was impacted by -4.20%.

The company, which makes hard-disk drive and flash memory products, has a market cap of $15.93 billion and an enterprise value of $22.30 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of -0.36% and return on assets of -0.13% are underperforming 66% of companies in the hardware industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.32 is below the industry median of 1.28.

The largest guru shareholder of the company is Parnassus Endeavor Fund (Trades, Portfolio) with 0.69% of outstanding shares, followed by PRIMECAP Management with 0.43% and Simons' firm with 0.31%.

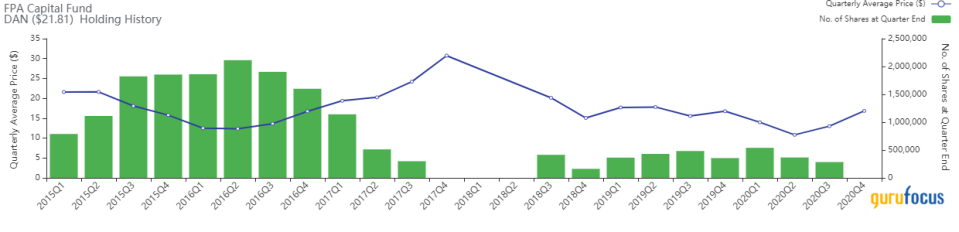

Dana

The firm exited its Dana Inc. (NYSE:DAN) stake, impacting the portfolio by -3.27%.

The company, which provides driveline, sealing and thermal-management technologies for vehicles, has a market cap of $3.13 billion and an enterprise value of $5.31 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of -0.34% and return on assets of -0.08% are underperforming 60% of companies in the vehicles and parts industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.32 is below the industry median of 0.54.

The largest guru shareholder of the company is Richard Pzena (Trades, Portfolio) with 2.38% of outstanding shares, followed by Mario Gabelli (Trades, Portfolio) with 2.24%.

Disclosure: I do not own any stocks mentioned.

Read more here:

5 Tech Stocks Beating the Market

The T Rowe Price Equity Income Fund Cuts Qualcomm, Fox

5 Undervalued Stocks Boosting Earnings

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.