How Far Can BRP Run?

- By Nicholas Kitonyi

Shares of Canadian recreational vehicles manufacturer BRP Inc. (NASDAQ:DOOO) gained 3% on Wednesday. The company announced third-quarter 2021 earnings that topped analysts' estimates.

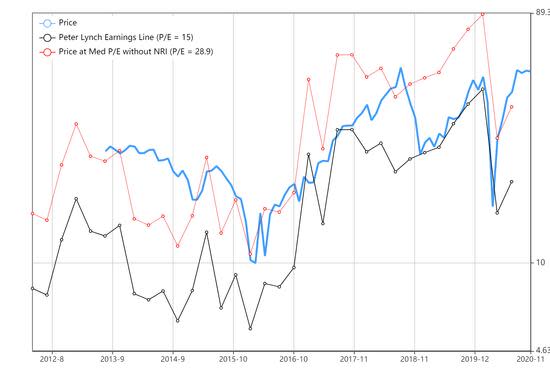

Shares of BRP are now up nearly 290% since bottoming in late March, but the net gain for the year stands at about 18% due to the sharp decline experienced between February and March. The surge in price over the last eight months has pushed the stock to overvalued territory based on the Peter Lynch earnings line.

BRP witnessed a significant surge in sales as more people sought to vacation following the three-month lockdowns that occurred around the world. CEO Jose Boisjoli told Yahoo Finance that sales for the summer quarter were boosted by a surge in new entrants.

"You know, in Q3, we had new entrants," he said. "Typically, we have about 20% of new entrants coming into our industry. And in Q3, we [had] 34%, which is 70% more."

Highlights from the recent quarter results

In the third quarter, BRP's revenue grew marginally by 1.9% to $1.67 billion year over year.

Net income grew by $63.4 million from the same period last year to $198.7 million, or $2.22 per diluted share. Boisjoli said the company now expects earnings per share growth of 31% to 37% for the full year.

"We are very pleased with our results as our strong line-up continues to gain market share globally," he added. "The surge in demand for our products has offered a major opportunity for us to continue this pace and we are working hard to maintain it."

Despite BRP's slight top-line growth, it is unlikely to post growth for the full year after seeing a net decline of 6.7% for the nine-month period. The company's revenue fell by $299 million to about $4.14 billion, down from about $4.44 billion. It now expects a total decline of about 1% to 5%, which is a significant improvement from the previous guidance of a 5% to 9% decline. Net income for the year is expected to range from $225 million to $250 million.

Valuation

Shares of the company are trading at a trailing 12-month price-earnings ratio of 38.89, which is significantly high based on the Peter Lynch fair valuation ratio of 15. The company's high price-earnings ratio does not compare well to its close peers' valuation multiples.

Thor Industries Inc. (THO) trades at a price-earnings ratio of 21.58, while Winnebago Industries Inc.'s (NYSE:WGO) is 27.30. On the other hand, Lincolnshire, Illinois-based Camping World Holdings Inc.'s (NYSE:CWH) equivalent is 14.54.

Even when we factor in expected earnings growth for the next 12 months, BRP still appears to be relatively overvalued with a forward price-earnings ratio of 11.29 compared to Camping World's 9.01 and Winnebago's 10.32. Thor Industries is slightly more expensive than BRP with a forward price-earnings ratio of 12.76.

Conclusion

In summary, BRP appears to have benefitted from the summer quarter amid a ramp up in sales. This could slow down in the colder months of the year, thereby affecting fourth-quarter sales. The company still expects a top-line squeeze for fiscal 2021 from last year, despite an impressive performance from the most recent quarterly results. Therefore, the upside potential appears to be limited.

Disclosure: No position in stocks mentioned.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.