Falling Eli Lilly Stock Has Rebound Potential

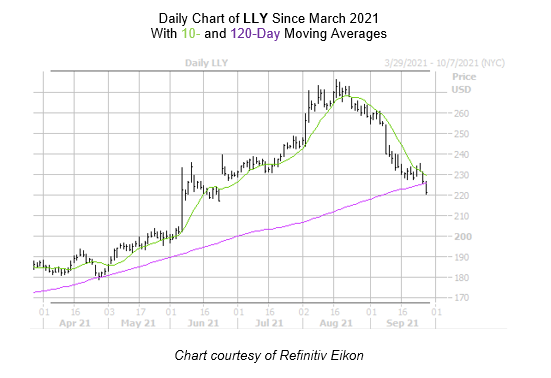

The shares of Eli Lilly And Co (NYSE:LLY) are down 2.3% at $221.14 at last check, following news that the company will cut the price of its Lispro insulin injection by 40% by January 1. Longer term, the stock has been cooling off from its Aug. 17, all-time-high of $275.87, shedding nearly 15% over the last month with pressure from its 10-day moving average. In fact, yesterday's pullback saw the equity take its biggest daily dive since Sept. 9. However, investors shouldn't worry just yet, as that pullback has the pharma giant trading near a historically bullish trendline.

More specifically, Eli Lilly stock just pulled back below its 120-day moving average, which has acted as a springboard for the equity in the past. According to data from Schaeffer's Senior Quantitative Analyst Rocky White, five similar signals have occurred during the past three years. One month later, LLY enjoyed a 5.2% gain, 60% of the time. From its current perch, a move of similar magnitude would put the security above the $232 mark.

Options traders have been slightly more bearish than unusual, so an unwinding of pessimism in the options pits could put additional wind at the equity's back. While call volume still outweighs put volume on an absolute basis, the stock's 50-day put/call volume ratio stands higher than 86% of annual readings at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), meaning puts are being picked up at a quicker-than-usual clip.

Now looks like a great opportunity to take advantage of Eli Lilly stock's next move with options. The security's Schaeffer's Volatility Index (SVI) of 25% sits in the relatively low 19th percentile of its annual range. This means the stock is currently sporting attractively priced premiums. What's more, LLY's Schaeffer's Volatility Scorecard (SVS) sits at 90 out of 100, meaning the stock has tended to exceed option traders' volatility expectations during the past year.