Fairholme Capital Exits Occidental Petroleum, Trims Berkshire Hathaway

- By Tiziano Frateschi

Bruce Berkowitz (Trades, Portfolio)'s Fairholme Capital Management sold shares of the following stocks during the third quarter, which ended on Sept. 30.

Occidental Petroleum

The firm closed its stake in Occidental Petroleum Corp. (NYSE:OXY). The trade had an impact of -1% on the portfolio.

The independent oil and gas producer has a market cap of $14.68 billion and an enterprise value of $62.24 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of -54.21% and return on assets of -14.56% are underperforming 80% of companies in the oil and gas industry. Its financial strength is rated 2 out of 10. The cash-debt ratio of 0.05 is below the industry median of 0.4.

The company's largest guru shareholders are Dodge & Cox with 13.03% of outstanding shares and Carl Icahn (Trades, Portfolio) with 9.52%.

Kraft Heinz

The Kraft Heinz Co. (NASDAQ:KHC) position was trimmed by 39.59%, impacting the portfolio by -0.93%.

The food and beverage manufacturer has a market cap of $39.86 billion and an enterprise value of $65.68 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of -0.98% and return on assets of -0.49% are underperforming 73% of companies in the consumer packaged goods industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.1 is below the industry median of 0.5.

The largest guru shareholder of the company is Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway with 26.63% of outstanding shares, followed by First Eagle Investment (Trades, Portfolio) with 0.59% and Pioneer Investments (Trades, Portfolio) with 0.15%.

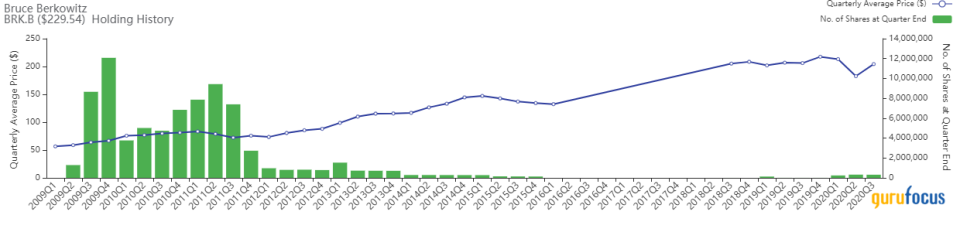

Berkshire Hathaway

The firm curbed its position in Berkshire Hathaway Inc. (NYSE:BRK.B) by 0.18%. The portfolio was impacted by -0.23%.

The insurance conglomerate has a market cap of $538 billion and an enterprise value of $623 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 8.95% and return on assets of 4.5% are outperforming 56% of companies in the insurance industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.25 is below the industry median of 2.28.

The largest guru shareholder of the company is Bill Gates (Trades, Portfolio)' foundation trust with 2.01% of outstanding shares, followed by Diamond Hill Capital (Trades, Portfolio) with 0.11%.

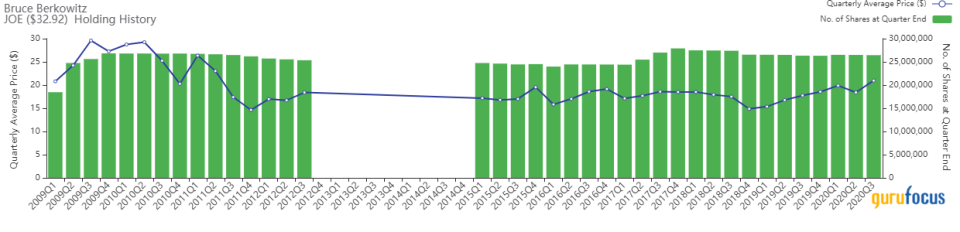

St. Joe

The firm trimmed its The St. Joe Co. (NYSE:JOE) holding by 0.18%, impacting the portfolio by -0.15%.

The U.S. landowner has a market cap of $1.94 billion and an enterprise value of $2.17 billion.

GuruFocus gives the company a profitability and growth rating of 4 out of 10. The return on equity of 6.55% and return on assets of 3.64% are outperforming 62% of companies in the real estate industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.32 is below the industry median of 0.28.

The largest guru shareholder of the company is Berkowitz with 44.91% of outstanding shares, followed by the Fairholme Fund (Trades, Portfolio) with 37.72% and Mario Gabelli (Trades, Portfolio)'s GAMCO Investors with 2.15%.

Disclosure: I do not own any stocks mentioned.

Read more here:

Pennant Investors Exits Johnson & Johnson, Cuts Amazon

Maverick Capital Cuts Netflix, Facebook

Pioneer Investments Cuts Amazon, Apple

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.