Lucid Group, Inc. (NASDAQ:LCID), the SPAC backed by the P.I.F. of the Kingdom of Saudi Arabia is Developing the Concept of Post Luxury, with an Ambitious Model

This article was originally posted on Simply Wall St News

There are a few issues one can observe in the way Lucid Group, Inc. ( NASDAQ:LCID ) presents itself - it is too early to state anything, but a great time to start questioning. Investors can notice a lot of footnotes and estimates, which is a great starter, but when the company touts being first place in multiple categories and comparisons, this adds risk to the plausibility of their pitch.

For example:

In page 17 , among other metrics, they point out:

20M Real-World Vehicle Miles Driven - They clarify , that these miles are driven by vehicles using the Lucid battery technology, not their Lucid Air.

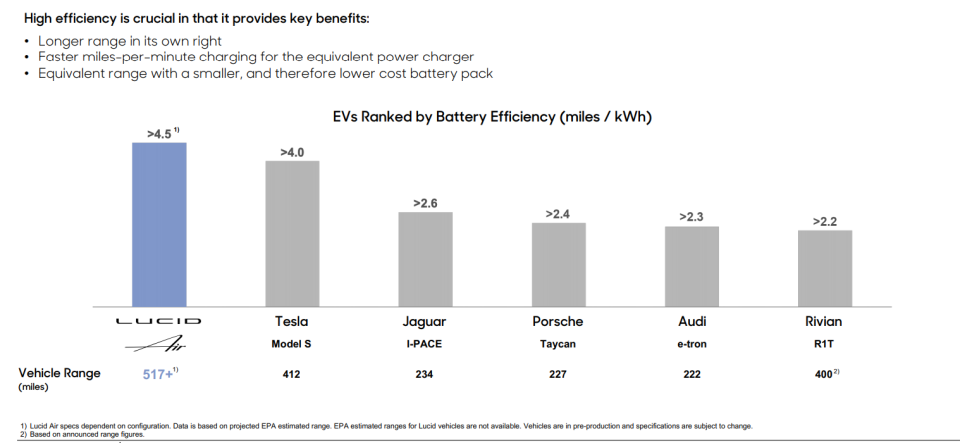

>4.5 Miles per kWh - They clarify: "Projected range, performance and specifications are for the Lucid Air Dream Edition are based on Lucid testing data. Miles per kWh is calculated for Lucid Air Grand Touring based on projected range. Projected range based upon manufacturer’s projected EPA estimated range. EPA estimated ranges for Lucid vehicles are not available. Vehicles are in pre-production and specifications are subject to change"

They further compare the Mi/kWh performance to other auto manufacturers ( page 31 ):

When comparing, it is fair to do so within the same class and rely on a "comparable" metric. If someone is producing luxury vehicles, you cannot disqualify your competitor from the luxury category, while simultaneously comparing their product to your own. Conversely, we compare actual numbers to actual numbers, and estimates to estimates. Perhaps their statements are true, and their capacity is far superior to established competitors, but investors need to know that, at this stage, the company is only in a position to post estimates.

In page 14 , the company states that Lucid’s first product, the Lucid Air, is on track for expected production and deliveries in 2H 2021. Also, their Advanced Manufacturing Plant (AMP-1) in Casa Grande, Arizona is scheduled to begin production in 2H 2021. This means that the end of 2021 will be the first time the company puts wheels on the road, and our first chance to evaluate the product and customer feedback.

Lucid has a market cap of US$40b, with negligible sales, it is understandable that investors are valuating companies based on their future cash delivering capacity, but these moves may be expecting cash flows that are further off than investors might anticipate.

Let's move over to the shareholder structure, and see who is backing Lucid Group, Inc.

Our analysis of the ownership of the company, below, shows the different ownership groups for Lucid Group, Inc.

Check out our latest analysis for Lucid Group

The company's largest shareholder is The Public Investment Fund of The Kingdom of Saudi Arabia, with ownership of 63%. This essentially means that they have extensive influence, if not outright control, over the future of the corporation. In comparison, the second and third largest shareholders hold about 3.2% and 0.5% of the stock.

General Public Ownership

The general public holds a 33% stake in Lucid Group. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders. It is also interesting that the general public has been able to gain a portion faster than the institutions. It is usually the so-called "smart money" that gets a piece first. Their absence may involve possible liquidity issues, restrictions or lack of demand.

Conclusion

Lucid Group, Inc. is a new, and ambitious EV company, whose goal is to redefine and target the luxury EV market. While they have the backing and capital from small and large investors, their concepts and ideas remain to be put on the road and tested in front of buyers.

The company is making some bold statements about their capacity, performance and is already attempting to position itself as a leader in multiple categories. Cautious investors will know that companies have a difficult time being a leader in one segment, and finding a company that is the best across the board is fairly hard.

The largest shareholder is The Public Investment Fund of The Kingdom of Saudi Arabia, with 63% of shares. This effectively makes Lucid a Saudi Arabian controlled company, whose interests may diverge from the interests of retail shareholders.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Lucid Group better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Lucid Group (at least 1 which is significant) , and understanding them should be part of your investment process.

Of course this may not be the best stock to buy . Therefore, you may wish to see our free collection of interesting prospects boasting favorable financials.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com