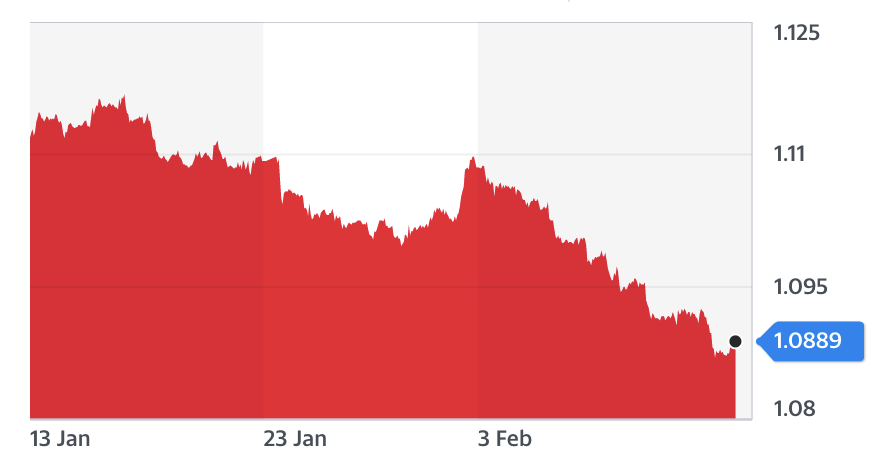

Euro close to three-year lows as EU warns coronavirus is 'mounting concern'

The euro made small gains against the dollar (EURUSD=X) on Thursday, but remained close to three-year lows as the European Union warned that the impact of coronavirus was a “mounting concern” for the bloc.

The currency steadied at around $1.088, within a range it last traded in April 2017.

The bloc’s executive arm said on Thursday that it still expected the euro zone’s economy to grow by 1.2% in both 2020 and 2021.

Referencing coronavirus, the European Commission warned, however, that new threats to economic growth had emerged in recent months, tilting the balance of risks to the “downside”.

The commission cited uncertainty around US trade policies, political unrest in Latin America, geopolitical tensions in the Middle East, and the “considerable uncertainty” around the EU’s post-Brexit trading relationship with the UK.

Read more: Markets sink again as coronavirus death toll leaps

The bloc noted that the outbreak and continued spread of coronavirus was a source of “mounting concern,” pointing to public health and economic risks.

“It has spurred uncertainty about the short-term prospects of the Chinese economy and about the degree of disruption across borders at a moment in which global manufacturing activity remains at a cyclical low,” the commission said in its winter forecast.

Industrial production in the 19-member euro zone fell 2.1% in December compared to the previous month, Eurostat, the EU’s statistics agency, said on Wednesday.

That figure was worse than expected, and came amid panic that a coronavirus-related disruption to Chinese supply chains could dent the bloc’s manufacturing sector.

“The euro continues to struggle,” said Neil Wilson, chief markets analyst at Markets.com, on Thursday.

“The disruption to supply chains from the coronavirus could hardly come at a worse time,” he said.

Europe’s crucially important auto sector relies heavily on Chinese parts.

Fiat Chrysler (FCAU) warned last week that it may be forced to halt production at one of its European factories due to related supply chain issues.

Read more: Fiat Chrysler may shut European factory over coronavirus

Meanwhile, China is the third-largest importer of goods and services from the eurozone, after the US and UK. That means that the widely predicted first-quarter slowdown in the Chinese economy is likely to spill over into Europe.

Exports from Europe to China climbed threefold between 2007 and 2018.

Ratings agency S&P Global warned on Wednesday that the slowdown in the Chinese economy could shave as much as 0.2 percentage points off euro zone economic growth in 2020.

While the commission’s Thursday forecast remained unchanged, it said that the longer the coronavirus outbreak lasts “the higher the likelihood of knock-on effects on economic sentiment and global financing conditions”.

Watch the latest videos from Yahoo Finance UK