Here is how Etsy's (NASDAQ:ETSY) Growth Strategy Creates Value for Investors

This article was originally published on Simply Wall St News

Long term investing can be life changing when you buy and hold the truly great businesses. And we've seen some truly amazing gains over the years. For example, the Etsy, Inc. (NASDAQ:ETSY) share price is up a whopping 327% since 2019, a handsome return for long term holders. It is clear that this is a combination of a great business model and the online shopping catalyst. In this article, we are going to examine the growth potential of Etsy and how can that impact the stock.

The Etsy Ecosystem

Most investors will know Etsy as an ecommerce company focused on handmade and vintage items. The company sells a wide range of products and has even branched off with additional brands into three categories:

Depop - apparel brand

Reverb - covers musical instruments

elo7 - general Brazil brand

Etsy estimates that the Total Addressable Market in Gross Merchandise Sales with their general brand and branches is US$1.7t, which gives them quite the room for growth. Just for comparison, Etsy posted US$3b in GMS for the last quarter, which translated into US$529m revenue.

Interestingly, the posted TAM does not include India, which is their next target expansion geography. We should also note that the TAM is just an estimate and may be a bit optimistic unless the company plans to expand into different segments.

For example, Etsy's apparel segment is the strongest, and according to the Federal Reserve data, the yearly sales for apparel in the U.S. makes up about US$270b, of which and increasing number is now being made online. Even if we add in the additional gift, vintage, unique items, musical instruments, categories, it is hard to see how this number can surpass US$500b. Of course, these estimates vary between analysts and computation methodology, and the real number may indeed be US$1.7 TAM.

Valuation Implications

At the end of the day, if we trust Etsy's numbers and build an intrinsic value off that, we get a fair value of US$27.3b, which is some 1.3% below the current Market Cap. This assumes that the company will continue to grow revenues at a high rate.

If we take a more conservative approach, and set the target revenues at US$6b at the end of a 10-year period, we instead get an intrinsic value of US$17b, which is in-line with the July to December 2020 trading price. The main difference here, is that we expect that growth rates will continue, but the 2020 pandemic effect will stop and dampen them between 15% to 20% in the next 5 years.

The Bottom Line

Now it's worth having a look at the company's fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business.

See our latest analysis for Etsy

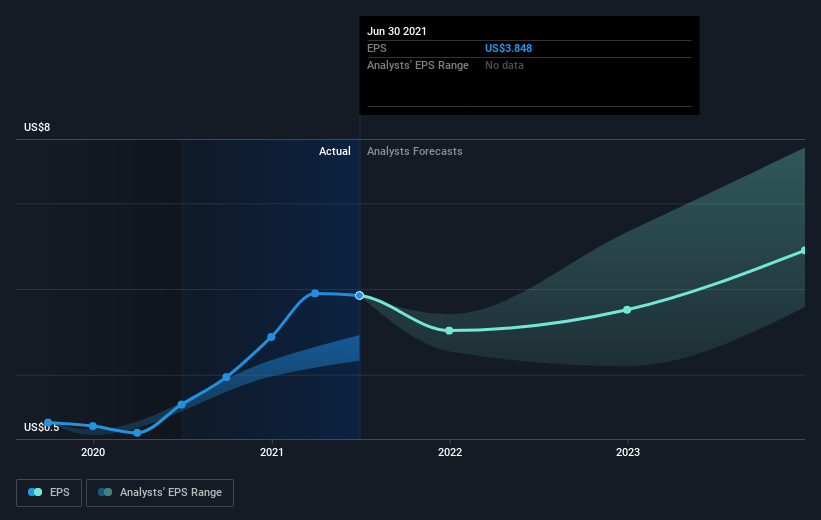

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the five years of share price growth, Etsy moved from a loss to profitability.

EPS is up 75% per year. This EPS growth is higher than the 62% average annual increase in the share price over the same three years. So you might conclude the market is a little more cautious about the stock, these days. Of course, a P/E ratio of 55.25, paints a very optimistic market.

The image below shows how EPS has tracked over time (if you click on the image, you can see greater detail).

The company was profitable before 2020 and exacerbated profits from the online purchasing catalyst in 2020. Analysts estimate that these profitability levels will be dampened but sustained in the next 2 years.

Dive deeper into the earnings by checking this interactive graph of Etsy's earnings, revenue and cash flow.

Key Takeaways

It's nice to see that Etsy shareholders have received a total shareholder return of 89% over the last year. Therefore, it seems like sentiment around the company has been positive lately.

The company has successfully branched off into 3 additional brands. One of them is currently targeting Brazil and Etsy will likely replicate the same strategy in order to expand into India.

The localized and specialized platforms seem to be a great tool for sustaining high profitability for Etsy.

Etsy's total addressable market outlines an opportunity for high growth for investors, and our current valuation models reflect that the company is near fair value. If the company keeps delivering on growth, investors will be satisfied with their future returns.

To understand Etsy better, we need to consider many other factors. We've identified 2 warning signs with Etsy , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com