Global wages fall for the first time this century

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

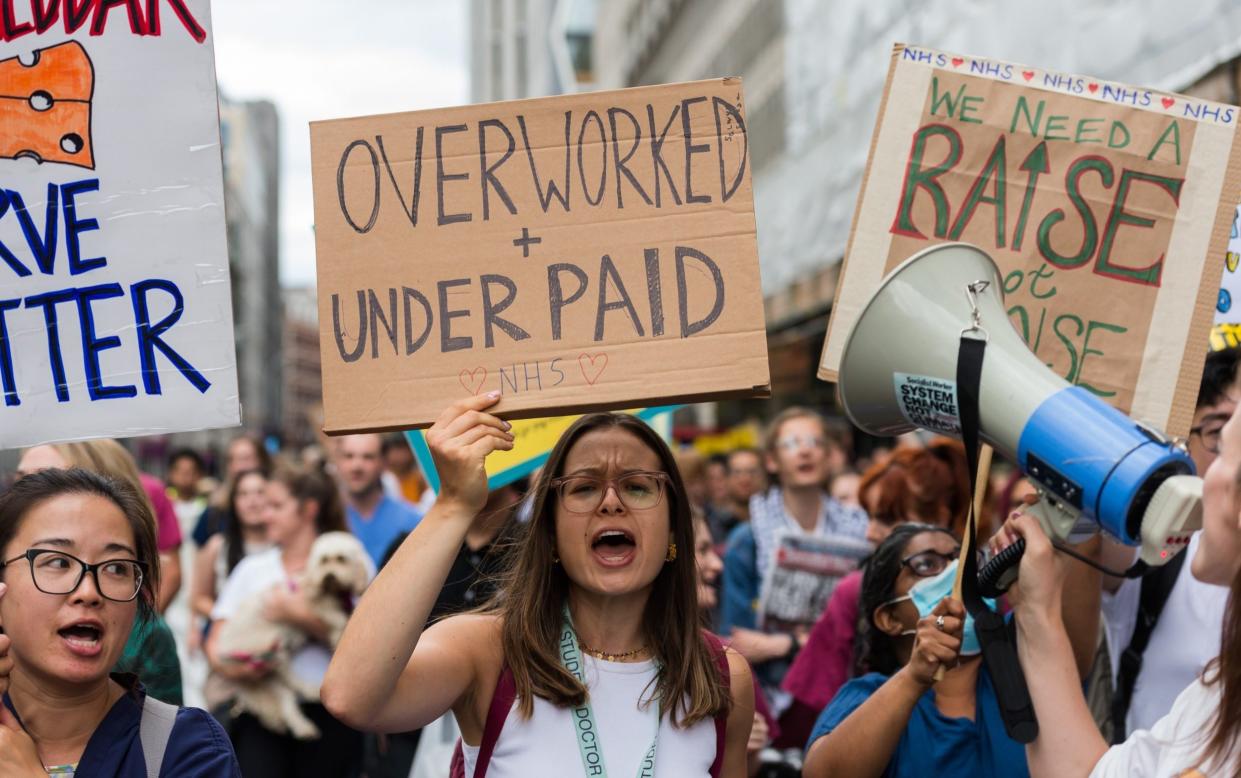

Global wages have fallen for the first time this century, with the UK suffering the second-largest drop among advanced G20 nations since the financial crisis, data has revealed.

Salaries fell by an average of 0.9pc globally in real terms during the first half of 2022, with the gap between productivity growth and wage growth reaching its widest point since the start of the 21st century.

In the UK wages remain 4pc below 2008 levels, meaning the average worker is still worse off than nearly 15 years ago, according to the figures from the International Labour Organisation (ILO).

Of the G20 advanced economies, only Italy suffered a bigger drop than the UK, with Japan also experiencing falls. Including emerging G20 countries, Mexico also recorded a bigger decline than the UK.

China experienced the strongest wage growth among the group, with the average employee in the country earning 2.6 times more than in 2008 in real terms.

Rampant inflation and a global economic slowdown, prompted partially by the war in Ukraine and the energy crisis, have caused a fall in real incomes across many countries.

Persistent price rises mean that incomes could continue to fall, says one of the report's authors.

There are still no signs that double-digit inflation in the UK has peaked, after official data showed that price rises jumped to a 41-year high of 11.1pc in October. In the eurozone, it fell for the first time in 17 months in November to 10pc.

Read the latest updates below.

06:51 PM

That's it for today

I am Gareth Corfield, and this has been the Telegraph Business liveblog for Wednesday.

Before you go, here's the latest news from the Telegraph business desk:

How Xi’s zero Covid rules squandered the life chances for a generation of Chinese youth - Tom Rees

Only one major country suffered a bigger tax rise than Britain last year - Szu Ping Chan

Google hit with £13.6bn class action-style lawsuit - James Warrington

Banks face being forced to hold back billions more in cash than EU rivals - Simon Foy

First-time buyers face losing homes in Help to Buy fiasco - Alexa Phillips

06:09 PM

EU threatens to ban Twitter unless it obeys Brussels on content moderation

A top EU official has threatened to block Twitter from being accessed inside the political bloc unless Elon Musk bows the knee to Brussels on content moderation.

Thierry Breton, the EU's internal market commissioner, made the threat to Musk personally during a video conversation earlier today, the Financial Times reported.

Breton, who shared a video of himself and Musk enthusiastically agreeing with each other over content moderation standards back in April, reportedly told the Chief Twit he must agree to an "extensive independent audit".

Twitter has lost around 5,500 employees since Musk took ownership at the end of October, including a significant number of content moderators.

The job cuts were made through a combination of compulsory redundancies and voluntary resignations, as well as repeated rounds of "code reviews" for software engineers that resulted in more job losses last week.

05:33 PM

Zelensky rebuffs Elon Musk's Ukraine peace plan and invites him to visit

Volodymyr Zelensky, the president of Ukraine, has urged Elon Musk to visit his war-torn country as he rejected the billionaire entrepreneur's previously-floated plans for a peace deal with Russia.

Musk's Starlink business played a key role in restoring Ukraine's internet connectivity after Russia's February invasion, Zelensky told the Dealbook conference in New York on Wednesday.

The Ukrainian leader said “life was maintained” thanks to the satellite communications system, which operates out of Musk's SpaceX company.

“I always say very openly if you want to understand what Russia has done here, come to Ukraine and you will see this with your own eyes without any extra words,” Zelenskiy told the conference.

“And after that, you will tell us how to end this war, who started it and when we can end it.”

05:14 PM

Airbus settles Libyan bribery investigation for €16m

French prosecutors have settled a bribery investigation into Airbus for €16m, marking the latest twist in a multinational case that began with Britain's Serious Fraud Office.

Today's €16m settlement, approved by a court in Paris, sees the Franco-German aircraft manufacturer drawing a final line under the seven-year investigation.

The SFO settled its probe into Airbus with a €991m deferred prosecution agreement struck in 2020, while the US Department of Justice said the company would pay a total of $3.9bn in penalties.

"The record fine at the time fully covered the public interest ... since then, there has been a profound internal transformation at Airbus," French prosecutors told Bloomberg today.

Airbus lawyer Gilles August told the court: "Today Airbus operates with the strictest integrity."

Airbus broke bribery laws when it sold jets to Libyan dictator Muammar Gaddafi in 2007. Similar wrongdoing occurred when the company sold helicopters and satellites to Kazakhstan.

04:30 PM

'Crypto winter' gets colder for 1,100 redundant Kraken staff

Yet more turmoil is rocking the cryptocurrency sector, this time with a fresh round of redundancies. Here's senior tech reporter Matthew Field with the details:

Cryptocurrency exchange Kraken has cut a third of its workforce as the chill of the "crypto winter" continues to rock digital coin markets.

The US-headquartered exchange said 1,100 people would lose their jobs as the cryptocurrency company "in order to adapt to current market conditions".

Jesse Powell, Kraken chief executive, said: "Since the start of this year, macroeconomic and geopolitical factors have weighed on financial markets. This resulted in significantly lower trading volumes and fewer client sign-ups."

04:19 PM

China's TikTok poses 'national security concerns' says Yellen

Taking you through into the night with today's greatest business news hits is Gareth Corfield.

Here's the latest from the Dealbook conference in New York:

US Treasury Secretary Janet Yellen has said there are "legitimate national security concerns" about Chinese-owned social media app TikTok.

Joe Biden's government is considering a ban on TikTok operating in the US under its current Chinese ownership but is weighing an alternative arrangement that would include routing US traffic to the app through servers maintained by American company Oracle.

Yellen also said Elon Musk’s $44bn purchase of Twitter would warrant a government review if deemed to raise national security concerns. This is a U-turn on previous comments where she she there was "no basis" for US government intervention into the Tesla chief executive's purchase of the social media site.

“It would be appropriate for CFIUS to take a look,” Yellen said, referring to the Committee on Foreign Investment in the US, which she leads. CFIUS has national security powers allowing it to block mergers and acquisitions.

04:03 PM

Handing over

That's all from me today. The one and only Gareth Corfield will take you through the next few hours.

03:57 PM

More rail workers to go on strike

Members of the Transport Salaried Staffs' Association (TSSA) union will strike and take other forms of industrial action in December.

The walkouts will affect Network Rail and a number of train operators in the union's long-running dispute over pay, jobs and conditions. They will take place on December 13, 14, 16, 17 and 18, but varying across different operators.

It comes after talks with Rail Delivery Group, which represents train operators, broke down on Tuesday. Talks with Network Rail are ongoing.

The companies involved are Cross Country, East Midlands Railway (EMR), Great Western Railway (GWR), LNER, Northern, Southeastern, TransPennine Express (TPE), Greater Anglia, Govia Thameslink (GTR), West Midlands Trains (WMT), South Western Railway (SWR) as well as Network Rail.

03:48 PM

Bulb Energy takeover given go-ahead

Collapsed supplier Bulb Energy will be sold to Octopus Energy after the deal was approved by a judge, despite last minute challenges from three rival companies.

Judge Antony Zacaroli set a date of December 20 for the sale to go through in a move that will save taxpayers hundreds of millions of pounds on running the company, which was effectively nationalised after its failure.

However, the Government's decision to grant Octopus the deal can be appealed by Scottish Power, Eon and British Gas.

The decision comes after a last minute intervention on Tuesday from the rival energy suppliers who want it to be scrutinised by judges over concerns of an alleged lack of transparency on the deal.

An Octopus spokesman said: "The High Court has rightly given the green light for the transfer to go ahead in December.

"Taxpayers will be saved from millions - even billions - of costs which could have been incurred if the process was dragged out."

03:16 PM

Yellen 'misspoke' on Musk's takeover of Twitter

US Treasury Secretary Janet Yellen said she "misspoke" when she said there was "no basis" for a government review of Elon Musk's purchase of Twitter if it was deemed the deal raised national security concerns.

Ms Yellen rowed back on previous comments that played down the need for scrutiny of the Tesla chief executive's £38bn takeover of the social network.

She told an event in New York that if there are risks in general, "it would be appropriate for Cfius to take a look," referring to the Committee on Foreign Investment in the US, which she leads.

She added she previously "misspoke" on the matter, referring to an interview with CBS News earlier this month, when she said she saw "no basis" for a review.

She also said "I think it is a good thing if Apple is looking at the content" on Twitter, following Mr Musk's accusations that the world’s largest company is threatening to pull the social network from its App Store.

03:03 PM

Crypto lenders face crunch as miners struggle to repay debt

Crypto lenders have been dealt another blow in the wake of the collapse of FTX, this time from Bitcoin miners.

Miners raised as much as $4bn (£3.3bn) to finance mining equipment when profit margins for running the algorithms that run the Bitcoin blockchain were as high as 90pc as the process allowed them to procure more of the cryptocurrency.

However, the miners are now defaulting on loans and sending back to lenders hundreds of thousands of machines used as collateral, the value of which has dropped as much as 85pc since last November.

New York Digital Investment Group, Celsius Network, BlockFi and Galaxy Digital are among the biggest providers of funding to finance computer equipment and build data centres used to mine Bitcoin.

However, they have been hit by a liquidity crunch after the values of cryptocurrencies were sent plunging following the collapse of FTX, leaving miners unable to make returns as they also battle soaring energy costs and greater competition for less Bitcoin returns.

Ethan Vera, chief operations officer of crypto mining services firm Luxur Technologies, said: "People were pouring dollars into the mining space.

"Miners ended up dictating a lot of the loan terms, so the financiers moved ahead with a lot of the deals where only the machines were collateral."

02:36 PM

Wall Street opens up ahead of Powell speech

A surprisingly positive start to the day for markets in New York as traders await US Fed chairman Jerome Powell's speech for clues on whether the Federal Reserve will slow down the pace of rate hikes.

The Dow Jones Industrial Average was up 0.1pc to 33,879.11, while the S&P 500 opened up 0.2pc to 3,965.25.

The tech-focused Nasdaq Composite was up 0.4pc to 11,032.38.

02:13 PM

Loungers 'optimistic' about Christmas despite lower profits

Cafe restaurant chain Loungers has revealed lower profits following the impact of soaring cost inflation and the end of government pandemic support but said it is "optimistic" about Christmas trading.

The company, which runs 175 Lounge and 35 Cosy Club sites, told shareholders that it has seen "positive momentum" continue over the past eight weeks.

Like-for-like sales over the financial year to November 27, are up 17.4pc against pre-pandemic levels from 2019.

The company said in a statememt: "Whilst there is no sign of the cost of living pressures abating, we remain optimistic looking ahead to trading over the Christmas period."

Chief executive Nick Collins told PA that Christmas bookings have been positive in the run up to the key trading period. He said:

Christmas is one of the few times we get much visibility because we can see through Christmas bookings and it has been really positive.

There has been no indication that customers will behave any differently and we think many will be really keen for this Christmas due to the past couple of years.

01:59 PM

Google and Alphabet sued by 130,000 businesses

Google and its parent company Alphabet have been sued in a claim by 130,000 businesses that argues the tech giant's advertising strategy has cost them billions of pounds in lost revenues.

The claim at the Competition Appeal Tribunal accused Google and its parent of abusing its dominant position in online advertising and "earning super-profits for itself at the expense of the tens of thousands of publishers of websites and mobiles apps in the UK".

The case follows an earlier €150m (£129.6m) fine in France for mistreating companies using its online platform.

However, critics say regulatory penalties are not enough to stop the tech giant's anticompetitive behaviour.

A Google spokesman said the lawsuit is "speculative and opportunistic".

01:44 PM

Royal Mail resorts to freelance app Ryde in last-ditch effort to beat strikes

Royal Mail is using a gig economy app to recruit agency staff during postal strikes as delivery men and women stage a 48-hour walkout.

Chief business correspondent Oliver Gill has the latest:

Ryde is being used by Royal Mail to hire short-term workers to mitigate disruption to letter and parcel deliveries as a fresh wave of strikes begins today, according to the Communication Workers Union (CWU).

However, trade union chiefs have sought to thwart efforts to keep the business running by encouraging its 115,000 postal members to sign-up to work for Ryde and not turn up to work.

Ryde, which is used by delivery companies such as Gorillas and Evri, advertised for workers to complete rounds on behalf of Royal Mail.

See how the CWU posted the advertisement to its social media account.

01:25 PM

Baxters in debt talks with lenders

Soup maker Baxters is trying to thrash out a deal with its lenders as food manufacturers battle the rising cost of raw materials and energy bills.

Owned by the same family for more than 150 years, the company has appointed advisers from restructuring outfit Teneo in a bid to negotiate with lenders including HSBC.

Founded in 1868 by George Baxter, the Edinburgh-based business makes tinned soups and chutneys sold in Tesco, Morrisons, Sainsbury's and many other retailers. It also owns Wornick Foods in the US, which supplies the country's military with rations.

It counts former Scottish Tory leader Ruth Davidson among its board of directors. A spokesman said:

We regularly review our advisers and suppliers across all areas of the business including our financial partners and advisers, in this case in relation to our planned routine refinancing.

12:59 PM

Eurostar strikes to hit festive holidays

Security staff at Eurostar will go on strike later this month in a dispute over pay, potentially disrupting festive holiday plans.

The members of the Rail, Maritime and Transport union have rejected a below inflation pay offer and will walk out on December 16,18,22 and 23.

The strike action will severely affect Eurostar services and travel plans for people over the December period.

The workers, who earn as little as £10.66 per hour, are contracted out to facilities management company Mitie.

RMT general secretary Mick Lynch said:

Eurostar security staff are essential to the running of Eurostar, and it is disgraceful they are not being paid a decent wage.

They work long unsocial hours and a multimillion-pound company like Mitie can easily afford to pay them decently for the essential work they do.

We do not want to disrupt people's travel plans, but our members need a pay rise, and this is the only way management will listen.

I urge Mitie and Eurostar to come to a negotiated settlement with RMT as soon as possible.

12:51 PM

Only one major country suffered a bigger tax rise than Britain last year

Britain's tax burden rose faster than France, the US, Italy and even several Nordic states last year as high earners were forced to hand more of their wages to the taxman, new analysis shows.

Economics editor Szu Ping Chan has the details:

Taxes as a share of the economy rose by 1.4 percentage points to 33.5pc in 2021, according to the Organisation for Economic Co-operation and Development (OECD).

That was the biggest rise among G7 economies apart from Germany and was also a bigger increase than seen in Sweden, Finland and Denmark, which are traditionally high tax countries.

Britain's tax burden is now at its highest since 1988, the OECD said. The figures do not take into account Jeremy Hunt's decision to increase taxes for workers and businesses in the Autumn Statement to help pay for a bigger welfare state.

This graph shows how Britain has the highest tax burden on record.

12:31 PM

Binance buys Japanese crypto exchange

The world's largest cryptocurrency platform Binance has announced its first licence in East Asia with the acquisition of Japan's officially regulated Sakura Exchange BitCoin.

Binance has been in the spotlight since the dramatic collapse of rival platform FTX this month.

Changpeng Zhao, the Chinese-Canadian head of Binance, pledged last week to release an audit into his firm while rejecting claims he sparked the demise of FTX.

The terms of Binance's 100-pc purchase of the Tokyo-based Sakura Exchange BitCoin were not disclosed in a joint statement.

But Binance said it "aims to support a responsible global environment for cryptocurrencies" by offering Japanese-regulated services.

Japan has worked to strengthen its regulation of virtual currencies following the collapse of the Tokyo-based MtGox Bitcoin exchange in 2014.

12:09 PM

Wall Street set to open higher

US equity futures have edged higher and the dollar slipped for a second day, as investors await a speech by Federal Reserve chairman Jerome Powell for signals about the path of interest-rate increases.

Mr Powell is widely expected to signal that the next Fed rate hike will step down to 50 basis points, though he will also likely warn that policy tightening has further to run.

Futures on the S&P 500 rose 0.2pc, while on the Nasdaq 100 they increased 0.3pc. Futures on the Dow Jones Industrial Average were little changed.

11:49 AM

China lifts Covid lockdown in 'iPhone city'

China officially lifted the lockdown on Zhengzhou last night, easing pressure on manufacturing in the area commonly known as iPhone city.

Apple's iPhone production has been estimated to have been operating at between 20 and 30pc of capacity over the last month due to restrictions on the factory run by Foxconn.

The plant was also the focal point of protests by workers last week following a Covid outbreak.

Insiders had claimed the world's most valuable company was facing a shortfall of 6m units of its iPhone Pros – its most popular product – due to China's strict zero-Covid policy.

11:34 AM

HSBC to close 114 branches

HSBC will close 114 branches across Britain from April next year, the bank has confirmed.

The bank blamed changing customer behaviour for the move, saying customers are increasingly banking online.

It follows similar announcements by peers such as Lloyds Banking Group in recent months as banks slash their networks to try and cut costs.

HSBC said it will invest tens of millions of pounds in updating and improving its remaining 327 branches.

11:21 AM

Profits washed away at water company Pennon

Water firm Pennon said its half-year profits slumped by three quarters after it was hit by a doubling of power costs amid the energy crisis.

The company said first half pre-tax profits tumbled by 75.1pc to £22.5m in the six months to the end of September, despite revenues rising by 9.3pc to £425.5m. Its shares are down 2.3pc today.

The group, which owns South West Water and Bristol Water, said its power costs jumped to around £49m from £24m a year ago, and shot up by around £23m on a like-for-like basis.

Pennon recently said it expects full-year power costs to rise to around £106m, up from £56m the previous year.

It said the group's strong balance sheet is helping to offset the surge in power bills, while it is offsetting wider cost pressures through savings across the business.

Pennon also said it is helping financially struggling customers, with more than 100,000 in its region being supported by affordability initiatives and around £78m earmarked for these programmes.

11:04 AM

The ECB 'woke up this morning and chose violence'

The ECB's blog criticising Bitcoin has gained plenty of attention on Twitter. We enjoyed some of these tweets:

The ECB woke up this morning and chose violence https://t.co/Fy95jaW7Of

— Duncan Lamont (@DuncanLamont2) November 30, 2022

Looking forward to the Bitcoin community's measured and civil response to this https://t.co/WpQsDn7IKH

— Joe Weisenthal (@TheStalwart) November 30, 2022

ECB not pulling its punches here.

- Bitcoin is rarely used for legal transactions

- Regulation can be misunderstood as approval

- Promoting Bitcoin bears a reputational risk for banks https://t.co/ukfrLKb8ZG— Katie Martin (@katie_martin_fx) November 30, 2022

10:54 AM

Bitcoin in 'last gasp' before 'irrelevance' says ECB

Perhaps feeling bullish after lower than expected inflation figures for the eurozone, the European Central Bank (ECB) has launched an attack on Bitcoin.

In its latest blog post, the ECB said the apparent stabilisation of Bitcoin's value "is likely to be an artificially induced last gasp before the crypto-asset embarks on a road to irrelevance".

The digital currency is "not suitable as an investment" according to the article by Ulrich Bindseil, director general of the ECB's market operations, and advisor Jürgen Schaaf.

They added Bitcoin's market valuation is "based purely on speculation" and warned that "regulation can be misunderstood as approval".

Read the post here:

The apparent stabilisation of bitcoin’s value is likely to be an artificially induced last gasp before the crypto-asset embarks on a road to irrelevance. #TheECBblog looks at where bitcoin stands amid widespread volatility in the crypto markets.

Read more https://t.co/Hk1LuYX2de pic.twitter.com/I3Uidks8Xo— European Central Bank (@ecb) November 30, 2022

10:44 AM

Eurozone inflation falls for first time in 17 months as hopes grow prices have peaked

Eurozone inflation has slowed for the first time in 17 months, offering a glimmer of hope as central banks in Europe and the UK struggle to quell the worst surge in prices for households in a generation.

Inflation in November stood at 10pc, according to Eurostat, less than the 10.4pc estimates from economists.

It comes as Bank of England chief economist Huw Pill said today that he expects UK inflation to start falling next year, assuming natural gas prices stabilise and then start to drop.

He reiterated that the Bank has "more to do" on raising interest rates to control inflation, but said that borrowing costs probably will not rise as much as financial markets have priced in.

The drop in inflation across the eurozone, from 10.6pc in October, was the biggest since 2020 and was thanks to slower advances in energy and services costs, even as food prices grew more quickly.

The data is crucial to the ECB's judgement on whether to raise interest rates by 75 basis points for a third straight month in December, or whether the pace of rate rises could ease.

Analysts seem to think it will not be as high as the 75 basis points over the last two months.

Eurozone #inflation slowed for 1st time in 1.5yrs in sign of hope for ECB. Nov CPI dropped to 10% from 10.6% in Oct while Core CPI remained steady at 5%. Money markets are pricing ~56bps of rate hike in Dec. https://t.co/h0muVh9tL6 pic.twitter.com/0D9yZak5RQ

— Holger Zschaepitz (@Schuldensuehner) November 30, 2022

Traders have been apprehensive about the ECB’s hawkish monetary policy and the hope is now that there will become a positive reflection of this in the ECB’s tone when they meet for the final time for this year and decide on their interest rate.

— Naeem Aslam (@NaeemAslam23) November 30, 2022

10:32 AM

H&M to cut 1,500 jobs

The world's second largest fashion retailer H&M has announced it will cut 1,500 jobs to reduce costs amid softening demand as consumers cope with a surge in cost of living.

The Swedish company, which employs roughly 155,000 people, had launched a plan to save 2 billion Swedish krona per year in September.

A restructuring charge of 800 million Swedish krona (£63m) would be booked in the fourth quarter, H&M said in a statement.

It said the benefits would start to kick in from the second half of next year. Chief executive Helena Helmersson said:

The cost and efficiency programme that we have initiated involves reviewing our organisation and we are very mindful of the fact that colleagues will be affected by this.

We will support our colleagues in finding the best possible solution for their next step.

10:22 AM

Elon Musk urges Apple to publish list of 'censorship actions' as spat deepens

Elon Musk has demanded that Apple reveals its "censorship actions" after conducting a poll that overwhelmingly urged the world's most valuable company to do so.

More than 2.2m people took part in the vote after Mr Musk had accused Apple of threatening to pull the social network from its App Store.

More than 84pc of users who took part in the poll said "yes" to Mr Musk’s statement: "Apple should publish all censorship actions it has taken that affect its customers."

Apple should publish all censorship actions it has taken that affect its customers

— Elon Musk (@elonmusk) November 28, 2022

It comes after Mr Musk asked whether Apple hated free speech in a flurry of tweets, saying the company had cut its Twitter advertising.

Tim Sweeney, the chief executive of Epic Games, which makes the Fortnite series of games, leapt to the defence of Mr Musk, calling Apple "a menace to freedom worldwide".

10:12 AM

Ambulance staff to hold first strike for 30 years

Paramedics and other ambulance workers are set to strike, as patients face a mounting NHS crisis in the run-up to Christmas.

Health editor Laura Donnelly has the details:

On Tuesday night, Unison, the union that represents hundreds of thousands of health workers, including ambulance staff as well as porters and cleaners, announced that 80,000 of its members had backed taking industrial action.

GMB - the largest union for ambulance staff - is also expected today to declare its members have voted overwhelmingly in favour of walk-outs. It would be the first national ambulance strike for more than 30 years.

Unions are obliged to give two weeks' notice of industrial action, meaning walk-outs affecting ambulance services could take place next month - while the nurses' strikes are already scheduled for December 15 and 20.

Read how it comes amid a growing crisis in emergency care services.

09:48 AM

Klarna's 'huge progress' toward profitability

Klarna said it has made "huge progress" toward profitability as a cost-cutting drive boosted income in the third quarter.

The buy-now-pay-later company reported an operating loss of 2.1bn Swedish krona (£166m), a 42pc improvement on the second quarter.

The Stockholm-based business said revenues rose in the UK and the US while both credit loss rates and total operating expenses fell.

Chief executive Sebastian Siemiatkowski said: "Klarna has made huge progress on our path to profitability, which we expect to hit on a monthly basis in the second half of 2023."

09:35 AM

Jeremy Corbyn joins picket line

Former Labour leader Jeremy Corbyn has joined a National Education Union (NEU) picket line outside a sixth form college in north London.

Speaking outside City and Islington College, Mr Corbyn said he is there to "support the students because of my concerns about under-funding by the Government to post-16 education". He told PA

But also to support the teachers in their perfectly reasonable demand for at least a cost-of-living pay increase.

They have dedicated themselves to our students, they have taught through all the difficulties of Covid and they should be rewarded with at least a cost-of-living pay increase.

.@jeremycorbyn speaking at our @NEUnion picket line at City and Islington college. #PayUp! #EducatorsDeserveBetter pic.twitter.com/xk1XXqpjo3

— National Education Union (@NEUnion) November 30, 2022

09:28 AM

Bank of England expects inflation to fall next year, says Pill

Bank of England chief economist Huw Pill has been speaking to businesses this morning, and said he expects UK inflation to start falling next year, assuming natural gas prices stabilise and then start to drop.

He reiterated that the Bank has "more to do" on raising interest rates to control inflation, but that borrowing costs probably will not rise as much as financial markets have priced in.

Investors expect interest rates to increase by another half-point in December and more in 2023.

Mr Pill said the Bank is concerned about tightness in the labour market, which risks fanning inflationary pressures. In a web event, he said:

We are expecting to see headline inflation tail off in the second half of next year, in fact, quite rapidly on account of those base effects.

There's a lot of uncertainty around the outlook for gas price developments.

Very low levels of unemployment and the association with the mid-1970s is not entirely reassuring from an inflection point of view.

People in the 50 to 65 age group, relative to pre-Covid levels, are having a higher level of inactivity not being in a job and not looking for work.

09:16 AM

M&S to improve personalised online recommendations with Thread takeover

Marks & Spencer has acquired the intellectual property of fashion marketplace Thread, which recently went into administration.

The British high-street stalwart will take possession of the source code and algorithms developed by the company, which will be integrated into its website.

M&S will hire 30 of Thread's former data scientists, software engineers and styling and creative teams as part of the deal.

Outfit recommendations have proved particularly valuable to the business. The "frequently bought together" recommendations on its website are estimated to have added £20m in sales over the past year, which the company anticipates will grow annually to £100m.

Co-chief executive Katie Bickerstaffe said:

The acquisition of Thread is the perfect example of a 'buy not build' approach – enabling us to accelerate our personalisation strategy by integrating the market leading tech on M&S.com in under 12 months.

We're taking personalisation to the next level to inspire our customers with tailored outfit inspiration.

08:51 AM

FTSE 100 on track for best month in two years

The FTSE 100 remains higher this morning, helped by gambling and energy stocks, although it is down from its surge at the opening bell ahead of the US Federal Reserve chair's speech later in the day.

The blue-chip index gained 0.3pc and is on track for its best month in two years.

Shares like Flutter Entertainment gained 2.1pc after JP Morgan raised the company's price target.

Energy stocks took an early lead, gaining 0.2pc as crude oil prices climbed on falling US crude inventories and a weaker dollar.

A dip in the dollar turns commodities cheaper for foreign currency holders.

The domestically-focused FTSE 250 midcap index climbed 0.3pc, with Home REIT leading the gains.

The social housing provider gained as much as 7.5pc after it said it was financially sound, dismissing allegations about its finances raised by a short-seller.

08:46 AM

Networks told to invest £22.2bn to aid electric car switch

The companies that operate Britain's local electricity networks have been told to invest to allow more homes to use electric cars and heating but will not be allowed to charge more for their services, Ofgem has said.

The regulator said the local operators of the grid will have to reduce their operating costs and tap into their profits to deliver one of the biggest transformations of the country's energy systems for decades.

The companies will have to become leaner while investing to make the grid greener, Ofgem said.

The businesses include UK Power Networks in the South East of England and SP Energy Networks in southern Scotland, among several others.

They will need to invest £22.2 billion between 2023 and 2028 to help Britain prepare for a future where more homes and businesses opt for electric cars and heating.

08:18 AM

Oil prices increase for third day

Oil has risen for a third day after industry data pointed to a substantial draw in US crude stockpiles and investors counted down to an Opec+ meeting that will be held virtually this weekend.

West Texas Intermediate climbed toward $79 a barrel after adding 2.5pc over the previous two sessions.

The industry-funded American Petroleum Institute reported inventories fell by almost 8 million barrels last week, according to people familiar with the figures. Official data follows later on Wednesday.

Brent crude is up 1.3pc today to $84.13 a barrel.

The Organization of Petroleum Exporting Countries and allies including Russia will hold an online gathering on December 4, scrapping an in-person meeting in Vienna.

Crude has retreated about 9pc this month on concern that a global economic slowdown will sap energy demand, with widely watched market metrics signaling ample near-term supply.

Traders are also tracking events in virus-hit China as Beijing pushes for more vaccinations among seniors, a move seen as crucial for an eventual reopening after a wave of protests on the weekend over the country's strict Covid Zero policy.

08:04 AM

UK markets rise at the open

It has been a positive start for the markets on hopes that China will further ease its strict Covid restrictions, which could boost demand for its manufacturing sector.

The commodities-driven FTSE 100 is up 1pc at the open to 7,552.06.

The domestically-focused FTSE 250 lifted 0.4pc 19,264.30.

07:55 AM

Minister hints at end of 'ringfencing' to kick start post-Brexit Big Bang 2.0

Britain will relax banking rules as part of a Big Bang 2.0, according to the City minister, capitalising on the long-promised freedoms provided to the financial sector after Brexit.

Andrew Griffith indicated rules would change around the "ringfencing" of banks' retail and investment arms, a policy introduced in the wake of the 2008 financial crisis.

"We can make the UK a better place to be a bank, to release some of that trapped capital over time around the ringfence," Mr Griffith told an event hosted by the Financial Times.

The rules were brought in to protect household customers from economic shocks caused by bankers in other areas of the business.

However, critics have argue that the ringfencing rules are inefficient because they need banks to hold separate pots of capital to absorb potential losses in different parts of the bank.

The original Big Bang took place in the 1980s, when the London Stock Exchange was deregulated under Margaret Thatcher.

07:44 AM

Mulberry hit as shoppers tighten purse strings

Luxury handbag maker Mulberry has swung to a half-year loss as it revealed sales tumbling by 10pc across the UK as the economic uncertainty and cost-of-living crisis knocked shopper confidence.

The group reported a pre-tax loss of £3.8m for the six months to October 1 against profits of £10.2m a year ago.

Results a year earlier were boosted by business rates relief support as well as profits on the sale of a store lease in Paris, but even with these stripped out, Mulberry sank to an underlying £2.8m half-year loss from profits of £4.5m.

Mulberry saw UK retail sales drop 10pc to £34.1m, with trading in the second quarter particularly impacted by the "more challenging macro-economic environment".

Online UK sales also fell 24pc as customers switched back to stores.

It said trading had improved in the eight weeks to November 26, though it warned over ongoing cost and economic pressures.

07:28 AM

Strikes today across Britain

A fresh wave of strikes will be held today as the year of industrial unrest continues across the country.

Royal Mail workers, university lecturers and sixth-form college staff will take action on one of the biggest walkouts on the same day.

Picket lines will be mounted outside universities, colleges and Royal Mail centres while more strikes are planned in the run-up to Christmas.

Members of the Communication Workers Union (CWU) are also planning seven more strikes in December, including Christmas Eve.

National Education Union (NEU) teacher members who work in 77 sixth-form colleges in England will be on strike in a dispute over pay.

The University and College Union (UCU) is following up a 48-hour strike last week with a 24-hour stoppage among university staff and is holding a rally in London.

07:13 AM

Lockdowns hit China's factory output

China's factory activity shrank for a second straight month in November, official data showed, as large swathes of the country were hit by Covid-19 lockdowns and transport disruptions.

The Purchasing Managers' Index (PMI) - a key gauge of manufacturing in the world's second-biggest economy - came in at 48, down from October's 49, according to data from the National Bureau of Statistics (NBS). A score above 50 indicates growth, while a score below suggests contraction

China is the last major economy welded to a zero-Covid strategy of eliminating outbreaks with strict quarantines and mass testing even as infections reached record highs this month, dragging down demand and business confidence.

Its manufacturing PMI has been in contraction territory for all but four months of the year so far, as a summer of heat waves was bookended by Covid lockdowns in major cities during the spring and autumn.

06:59 AM

Good morning

Food inflation reached levels never seen before in November, with a shortage of eggs a major driver due to fewer hens being reared and avian flu.

The sharp drop in the supply has forced some supermarkets to ration egg sales. Prices have climbed 20pc in just a fortnight as the supply crisis deepens.

Helen Dickinson, chief executive of the BRC, said winter looked "increasingly bleak".

"While there are signs that cost pressures and price rises might start to ease in 2023, Christmas cheer will be dampened this year as households cut back on seasonal spending in order to prioritise the essentials."

5 things to start your day

1) Hinkley Point nuclear plant faces risk of 11-year delay - Flagship project may not be ready until 2036, new contract suggests

2) Apple warned not to ‘nuke’ Twitter in free speech row with Musk - Conflict highlights tech behemoth's role as gatekeeper of content for hundreds of millions of people

3) Bankrupt crypto lender BlockFi sues Sam Bankman-Fried over shares in trading app Robinhood - Two sides battle over control as FTX fallout triggers wave of litigation

4) British households forced to pay £1,800 each to subsidise railways - Size of the subsidy comes as striking rail unions lose public support

5) Germany agrees deal with Qatar as it races to replace Russian gas supplies - Qatar will ship two million tons of liquefied natural gas to Germany for at least 15 years

What happened overnight

Asian shares rebounded as investors pinned hopes on China eventually reopening its economy despite growing Covid lockdowns that pushed its factory and services sector activity deeper into contraction.

Europe and Wall Street were also set to open higher with FTSE and S&P 500 futures up 0.4pc and 0.2pc respectively.

MSCI's broadest gauge of Asia Pacific stocks outside Japan reversed morning losses to gain 0.7pc. At current levels, the index is set to post its biggest monthly gain since April 1999.

Hong Kong's Hang Seng Index and China's benchmark CSI300 Index also bounced back, rising 0.8pc and 0.1pc respectively, as investors largely ignored an official survey that showed China's factory activity contracted at a faster-than-expected pace in November.