"Don't Always Listen To Older Generations" And 20 More Money Lessons Millennials Learned The Hard Way

A while back, we asked millennials in the BuzzFeed Community to share the money lessons they hope Gen Z'ers can learn from them. And when we shared the responses, we got even more great money tips in the comments.

CBC / Via giphy.com

Here are even more money lessons that millennials have learned so far:

1."Strive to make sure you can pay your own way. Couples split up and roommates leave, so try to get to the point where you can pay your own way by yourself as soon as you can. It takes a lot of pressure off. I couldn’t do it until my mid-30’s, but, if I had to, I could’ve rented a one-bedroom by myself and paid for my car. Keep that goal forever. You don’t want to be stuck in a toxic environment because you can’t afford to leave."

Sony Pictures Releasing / Via giphy.com

—anonymous

2."Don't pay fees to banks, and score benefits when you can. My mom helped me open my first bank account with her old bank just because, but there's so many credit unions and online banks with easy to avoid fees, overdraft protection, and even things like legit interest on high yield savings. Shop around and bank with someone that won't bleed you dry."

3."It wasn't until I started working in finance that I realized your credit card utilization matters nearly as much as your payment history. For years as a young adult, I couldn't figure out why my credit score wasn't great, even though I had a perfect payment history. Yeah, my credit cards were mostly near the limit. A late payment won't report to the credit bureaus until you're at least 30 days late. Paying your bills on time is only a small part of it. Keep those balances under 10% of your limit."

"You can find this info online these days, but not when I was 18. Why don't they teach this stuff in schools??"

4."Research programs that pay off student loans. My spouse is an independently licensed social worker. There is a program called the National Health Service Corps where, if your occupation qualifies and you sign a contract to work in a high-needs area for two years, they will pay a portion of your student loans. We moved across the country to the highest-need area (the higher the need, the more money you can get towards your loans). She worked in her field, earning an actual income, and when accepted, she got $50,000 to pay towards her student loan."

"She did tons of research, and as long as you understand the terms of the contract, it’s pretty low-risk. It was not taxed as income, and she earned an income and experience. It sucked moving away from family, but the outcome was worth it. We’re now completely debt-free, which wouldn’t have happened if she didn’t do it."

Psst, speaking of student loans, the Public Service Loan Forgiveness Program has waived certain requirements until October 2022, which means more people now qualify. Even if you've been turned down in the past, you can reapply now.

5."Don’t always listen to older generations about money. I’m a geriatric millennial; I was always told by Baby Boomers that owning a house builds equity. The housing market crash in 2007 showed me you can lose money. If you pay $300K for a house and the market crashes and your house is now valued at $120K, you have lost money. I know people that bought right before the 2007 crash when housing prices were high, and it took 13 years for their home to be valued what it was before the crash. They had retired and wanted to downsize, but had to wait before they could sell because it would have been a big loss."

"Now, we’re seeing record home prices again — a very inflated market in many areas. And with the pandemic, people are relocating to fit their needs. Renting and not being tied down with a mortgage can be a really big asset right now, and my boomer family members are actually starting to see that, too."

6."I learned too late that car loans aren’t evil. It’s a lot easier to budget for a car loan you can afford than repairs on a junker, or missing work because your car is unreliable. Plus with good credit, the 3% you pay on a car loan is better than not having a cash reserve and using credit cards for emergencies. I took out a loan on my last car even though I didn’t need to, and the money I left in my brokerage account earned a lot more than I paid in interest. My parents acted like car loans were the worst thing in the world, but if I had used them earlier it would have saved me a lot of stress."

7."Get a credit card with points or cash rewards and never ever leave a balance. I have never seen a credit card bill. I go into the app every few days and pay the entire balance. This makes my credit score awesome and also gives me a few free dollars every month. Do not ever use your credit card to finance anything. Pay it off every day if you need to."

STXfilms / Via giphy.com

8."Sign up for a 401(k) plan if it is offered, even if you think you can't afford it. Just put the minimum percentage in. The tax savings will make the amount taken out seem like it is less than it is. Even if you think you will leave the company soon, get it. If you leave, you get to take it with you by transferring it into an IRA. You often get a company match up to a certain percentage, so that's free money!"

"Having money in the plan and invested will teach you about investing money and help make you more comfortable doing so. If you don't know how to invest it, I suggest putting it all into an S&P 500 index fund, which is diversified in the stocks of the 500 largest companies in the US. It is usually a very efficient fund choice."

9."Believing in love is fine. It's a beautiful thing to think two people can grow old together. But no matter how much you love someone, don't ever pay their way. Car insurance, rent, every meal, etc. Chances are it won't last, and you just spent a pretty penny on an investment you'll never get back."

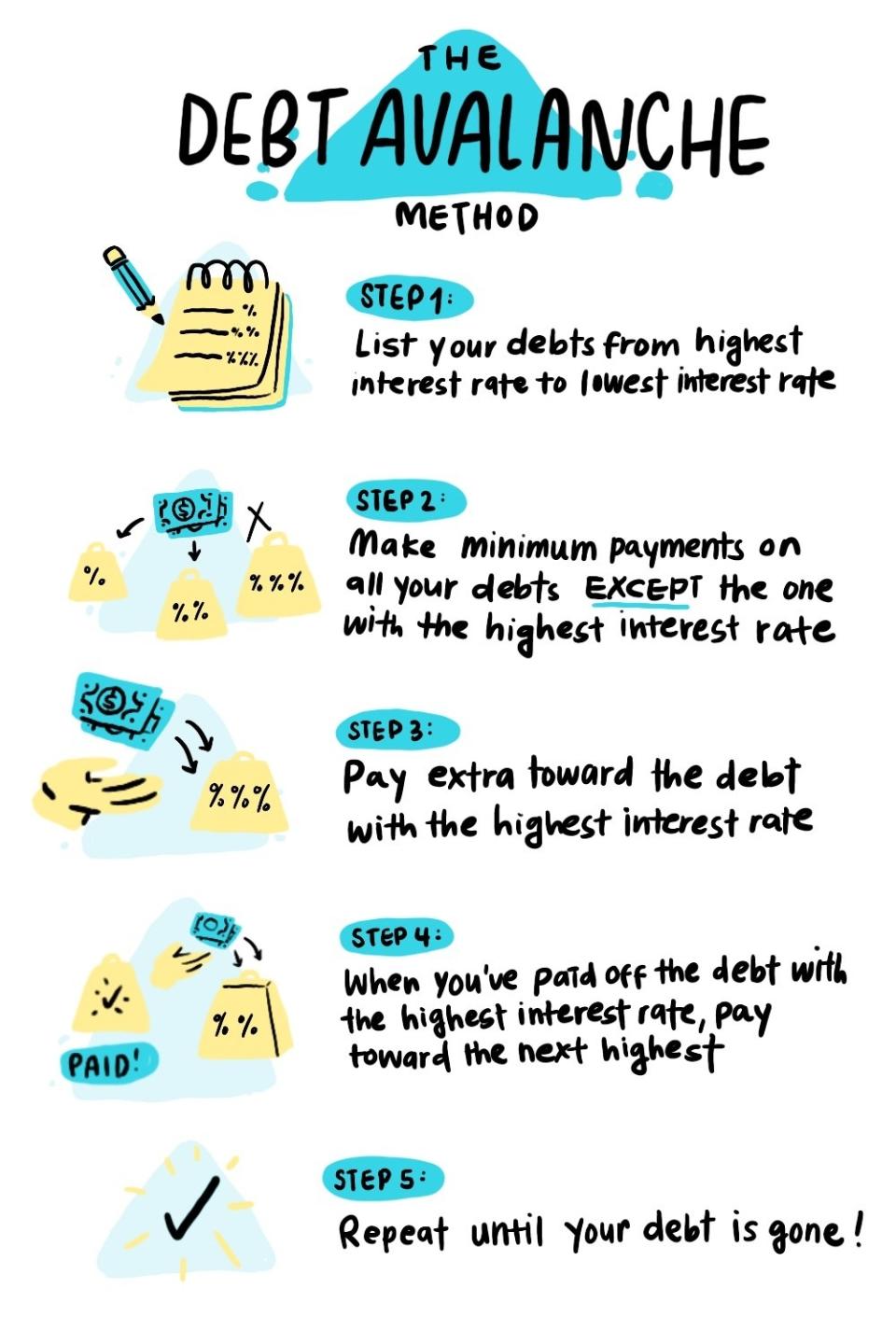

10."It's not just about paying more than the minimum on credit cards. If you have more than one that you're working to pay off, use the avalanche method. Add up the minimum total payments for all and figure out how much extra you can pay. Then pay the minimum monthly payment on all but the one with the highest interest rate — on that one you add the 'extra.' Continue until that one is paid off and then move that 'extra' plus the minimum from that paid off card to the next highest interest rate card."

"This way, you're always paying the same amount to your credit cards each month, but you're paying down one at a time, and then moving that amount to the next one until they're all paid off. It's faster than just putting a little over the minimum to each card, and you get the satisfaction of getting rid of the balances one by one."

11."Treat savings like a bill. Even if you’re only able to save $10 per week, open a higher APY savings account and set up auto payments directly into that account. I recommend having this account at a different institution than your main checking account (to make it harder to transfer from savings back to checking). If you don’t take any money out, you can start growing your savings and let the interest help you out."

"Diversification is also important. If you have a goal, like saving for a car, you’ll need to have access to that money relatively shortly. This would be liquid savings/cash, meaning you will have access to it when needed. But, if you just want to save for a long-term goal, you can look at CDs or other savings options with higher APYs that have a maturity date (i.e. possible penalty for early withdraw). Have different accounts for your different goals."

12."It sounds obvious, but don't pay for what you can't afford. I was all about only using my credit card for 'emergencies' and that got out of control really quickly. A bunch of non-essential purchases add up really, really fast. I'm not saying don't buy yourself anything ever (we're not Dave Ramsey here), but ask yourself, 'Do I really need this right now?'"

13."If your company offers to match your 401(k) contribution but you need to put in a certain percentage DO IT. They are literally giving you money towards your future retirement. I could kick myself for all those years I didn’t take advantage, it makes such a difference."

Paramount Network / Via giphy.com

14."Take the time and energy to learn about things you know you don’t understand. When I did my exit counseling from college, I had no idea what questions to even ask — you don’t know if you don’t know. After I missed a payment and had to borrow money from family to help pay a loan, I sat down and educated myself as much as possible so I never had to do that again."

15."Get a pre-purchase inspection before you buy a used car. They usually cost up to a couple hundred dollars which feels like a lot when money is tight, but they're absolutely valuable. If you're looking at two cars that are similarly priced and one of them needs $8,000 worth of repairs to be safe and the other is okay to drive while you save up for smaller non-critical issues, the inspections already paid for themselves many times over. Just make sure that whatever shop is doing the inspection is familiar with the car. If you're thinking about buying a Fiat but the shop is full of only Toyotas, they probably won't know what common issues to look for."

"I have only ever bought used cars, but I am a mechanic and know what to look for. I bought my last daily driver for $3300 and all it ever needed was basic maintenance/wear items. Most car payments cost more per year than I spent over the eight years I drove it."

16."Make sure you understand your partner’s debt and their working knowledge of finances before opening joint accounts. An ex-partner had been married previously, had thousands in debt from their first marriage, and had to declare bankruptcy in their 20s. They really pushed commitment far before I was ready, and often talked about moving in and combining finances. They only gave me bits and pieces, and when I said I wouldn’t join finances until I understood their debt, they were offended. We had only dated a few months; I wasn’t going to risk ruining my credit for them."

17."Don’t be like me. Get second and third opinions before surgeries. The wrong doctor could really set you back in life experiences and cash."

18."I live by the advice that if I see something I want, I should wait at least two days before getting it. Probably 90% of the time you will forget about whatever that thing you NEEDED was!"

19."If you ever find yourself with some extra cash, a good chunk, pay off as much debt as you can. Credit card debt can eat you alive and many people just make the minimum payment. I know, it's not fun or exciting, but trust me, paying it off is better."

E! / Via giphy.com

"My husband still struggles with paying off credit cards. We got a nice windfall the other week, and he was so adamant about putting it into the house, doing this, doing that. I told him flat out NO, we need to pay off the cards and we have enough left over to do what we want to do and build our savings back up. We now have credit cards paid off and a nice little chunk in savings to do with as we please when the time is right."

20."If your job offers any kind of retirement plan, apply even if you think it's temporary. You might find yourself still there 10 years later."

21.And finally, "Many of the jobs people end up with after getting a bachelor's could have been had with an associates degree for much cheaper. A second point to add to this is many companies have education assistance as part of their benefits package, which means you can get them to pay for your bachelor's part time. Sure that takes longer, but, honestly, it is much better having that full time professional paycheck when your classmates say, 'let's go for pizza and beer after class.'"

Note: Submissions have been edited for length and clarity.

What's a money tip you wish you'd known when you were younger? Tell us all about it in the comments!

And for more stories about life and money, check out the rest of our personal finance posts.