Dollar General: Strong Fundamentals and Price Momentum

- By David Krejca

Investment thesis

With the spread of the coronavirus pandemic and altered economic environment, discount and variety stores such as Dollar General Corp. (NYSE:DG) are poised to benefit from the stable demand for consumer staples. With excellent financials and strong undervaluation suggested by a discounted cash flow model, the discount retailer's shares are like an underappreciated gem, ready to soar as next quarters' numbers roll in.

Corporate profile

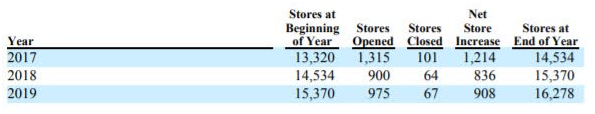

Dollar General is one of the largest discount retail chains in the U.S., operating over 16,000 retail stores located in 45 states. The company offers a broad portfolio of merchandise, including consumable everyday items, seasonal items, home products and apparel of leading national brands as well as its own private label. As of Feb. 28, the company had approximately 143,000 employees.

Source: Dollar General 2020 Annual Report.

Key insights from the latest quarterly earnings call

Despite the pandemic, the company remained in growth mode and on the lookout for new businesses. With its current store base counting over 16,000 units, the company plans to open several hundred new locations by the end of the year. During the latest quarterly earnings call, management expressed a cautionary optimistic outlook about the company's future and its core customer.

Covid-19 hit, and then obviously things changed a little bit. But the great thing is that the core consumer still had money in their pocket. As such, they were able to do a nice stock up to get their homes ready, like most Americans were doing in the face of the pandemic.

In a statement, CEO Todd Vasos said, "We're always looking to see what that next big thing is or bigger things. We don't believe in silver bullets here at Dollar General. We know that it takes a lot of smaller to midterm initiatives to continue to drive that top line and traffic."

Financial analysis

From the perspective of financial statements, the company's balance sheet holds a sustainable level of debt (58% of debt to total capital), has a high asset turnover (about 1.45) and possesses exceptional profitability metrics (12-month return on equity of 26%).

Valuation

Plugging in Dollar General's financial statement figures into my DCF template, the company's shares seem to be substantially undervalued. Under the perpetuity growth method with assumptions of a terminal growth rate of 2%, 8% annual revenue growth over the next five years and a fixed operating earnings margin of 10%, the model's estimate of intrinsic value of the stock comes in at $1,010. Under the Ebitda multiple approach of a discounted cash flow model, the intrinsic value per share value of the company stands roughly at $273 if we assume that the appropriate exit enterprise value/Ebitda multiple in five years' time is around 14.

Source: Author's own DCF model.

The bottom line

To sum up, Dollar General has a long history of operations with a strong ability to scale and generate free cash flow from its operations. A low relative valuation (12-month trailing price-earnings ratio of 22 and price-sales ratio of 1.4) coupled with a positive upside implied by my DCF model indicate the company's shares are a bargain at today's price.

Disclosure: Please note that this article has an informative purpose, expresses its author's opinion and does not constitute investment recommendation or advice. The author does not know individual investor's circumstances, portfolio constraints, etc. Readers are expected to do their own analysis prior to making any investment decisions.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.