DOGE Nearly Reaches New All-Time High on DOGE Day

Dogecoin (DOGE) holders are suggesting to acknowledge April 20th by naming it DOGE day. In light of this event, we will take a look at the price movement and attempt to determine where the token is heading next.

DOGE has failed to reach a new all-time high on its second attempt. Despite this, the bullish structure is still intact.

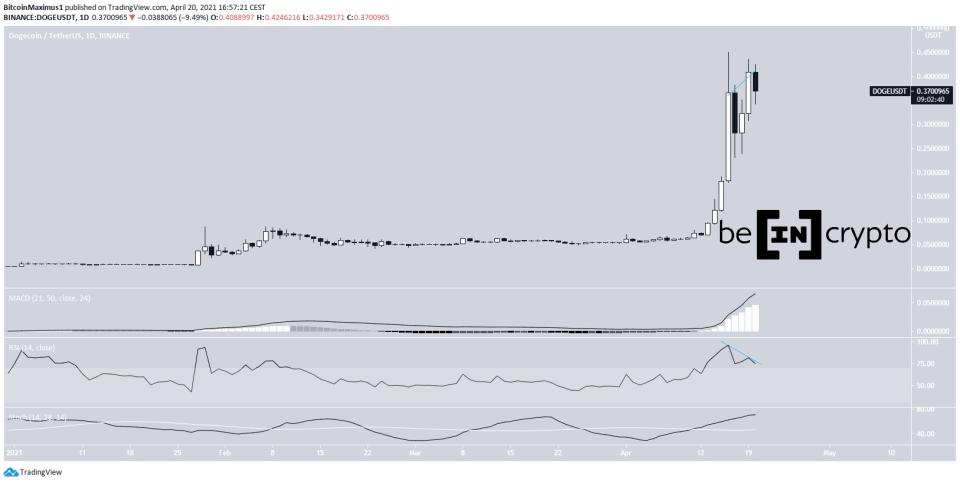

DOGE Reaches All-Time High

DOGE increased considerably between April 15-16. In about 24 hours, it moved upwards by 254%. This led to an all-time high price of $0.45 on April 16.

After decreasing, the token began another upward movement. This, however, has been slightly weaker than the previous one. It only reached a high of $0.434. Nevertheless, the daily close of $0.408 was the highest in history.

Currently, it has potentially created a double-top pattern, which is also combined with a bearish divergence in the RSI.

This suggests a rejection will follow, at least in the short-term.

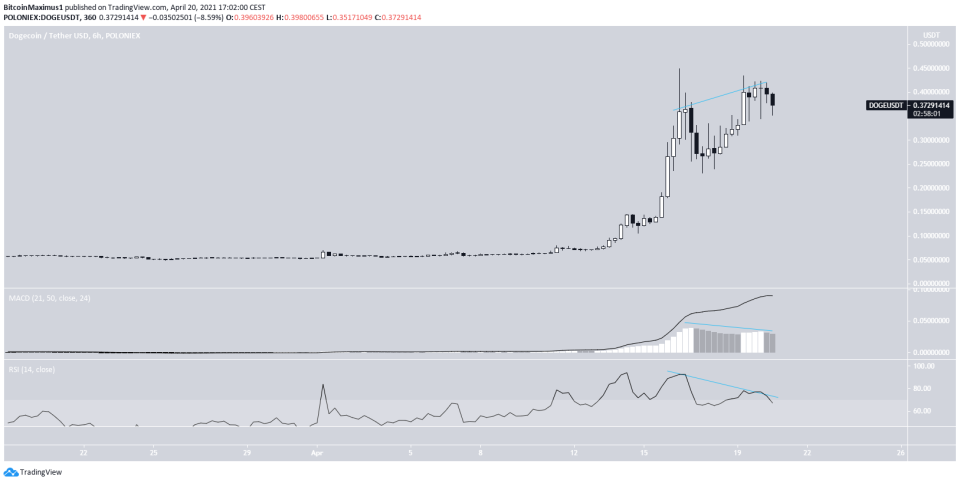

Short-Term DOGE Movement

The shorter-term six-hour chart supports this assessment. Like the daily time frame, there is a pronounced bearish divergence in the two most recent tops.

Furthermore, the divergence is even present in the MACD, which was not visible in the daily time frame.

Therefore, a short-term decrease is also supported by the six-hour time frame.

Indicators in the two-hour time-frame are similarly bearish.

However, there is also a potential ascending triangle in place, which is considered a bullish pattern.

The support line of the triangle is found at $0.31.

While readings from all time-frames suggest that a short-term drop is expected, DOGE could find support above this ascending support line.

If it does, the bullish structure would be considered intact.

As a result, after further consolidation, another upward move would be likely.

Conclusion

To conclude, DOGE is not expected to reach a new all-time high in the current attempt.

Rather, a decrease towards the support line seems like the most likely option. Afterward, another upward movement could transpire.

For BeInCrypto’s latest bitcoin (BTC) analysis, click here.