Dividend Growth Juggernaut Texas Instruments Is Undervalued

Shares of Texas Instruments Inc. (NASDAQ:TXN) have lost nearly 13% year-to-date as the technology sector has been one of the worst performers for the year. Rising interest rates are likely one of the key reasons why, as the market anticipates that a slower growth environment will impact technology companies more than other sectors.

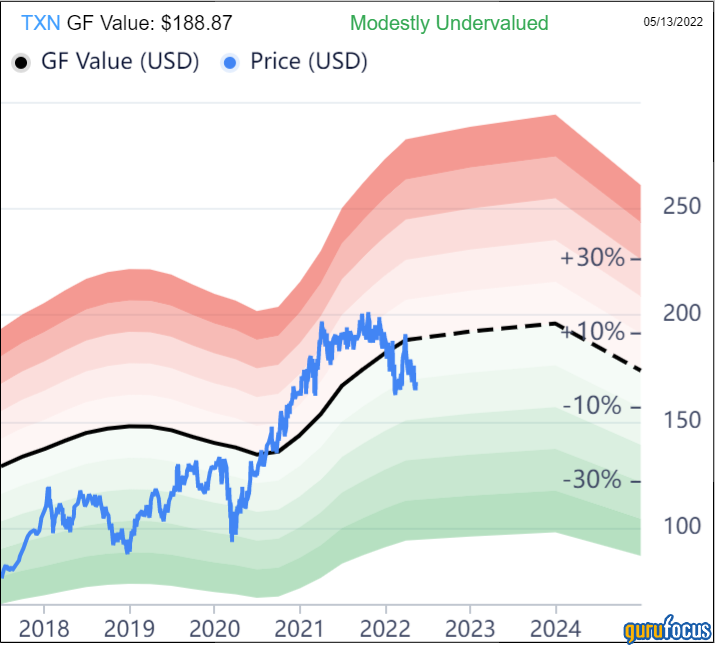

But for long-term investors, now could be a good time to add high-quality names like Texas Instruments to their portfolios. The pullback has now put Texas Instruments valuation below its long-term average multiple and its GF Value. Texas Instruments is one of the most consistent and aggressive dividend growth companies in the technology sector. The stocks yield is also very attractive.

Dividend Growth Juggernaut Texas Instruments Is Undervalued With a GF Value of $188.87, Texas Instruments has a price-to-GF-Value ratio of 0.89. Reaching the GF Value would result in a 11.8% gain before factoring in the stocks current yield of 2.7%. The chart above shows that Texas Instruments hasn't traded this far below its GF Value since late 2020. Shares are rated as modestly undervalued by GuruFocus.

Final thoughts

Texas Instruments maintains a strong leadership position in its industry and has performed very well for long periods of time. The company is not recession proof, but Texas Instruments performance following the 2007 to 2009 period shows the strength of its business.

The company has also been an aggressive grower of its dividend over multiple periods of time, with shareholders enjoying extremely high dividend growth rates. The payout ratios are close to the averages and allow for future increases as well.

Finally, Texas Instruments is trading below both its long-term historical average earnings multiple and its GF Value. Adding it all up, not only is Texas Instruments a dividend growth juggernaut, it is also offering double-digit total return potential from the current price by my estimates.

This article first appeared on GuruFocus.