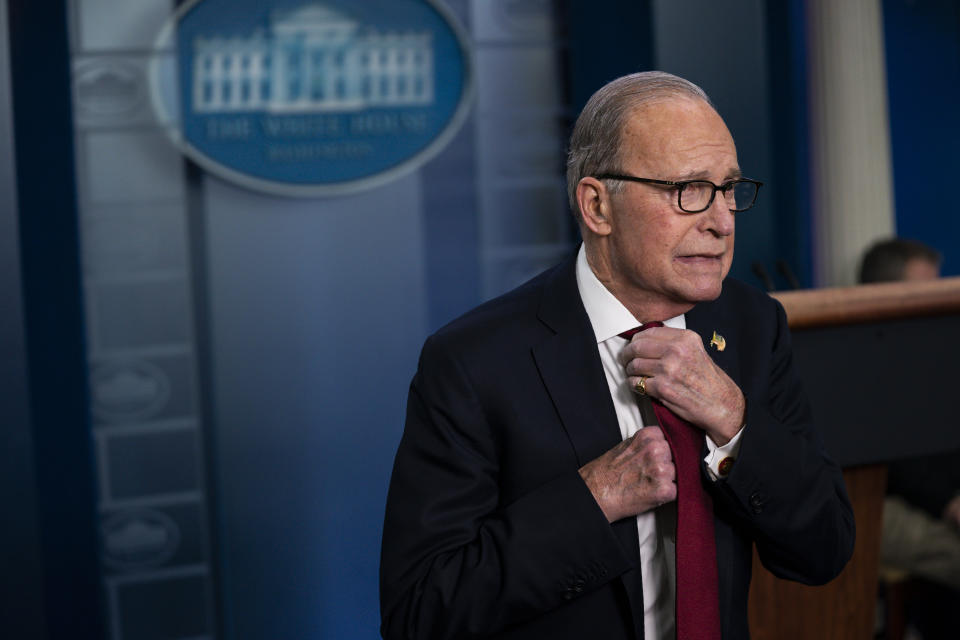

America’s worst financial adviser

The Kudlow Portfolio is tanking.

On Feb. 25, Larry Kudlow, director of the White House’s National Economic Council, suggested it was a good time to buy stocks. “The virus story is not going to last forever,” Kudlow said on CNBC around 2:30 p.m. “To me, if you are an investor out there and you have a long-term point of view, I would suggest very seriously taking a look at the market, the stock market, that is a lot cheaper than it was a week or two ago.”

At the time, the S&P 500 (^GSPC) index was around 3,128. Two weeks later it closed at 2,746. If you took Kudlow’s advice, you were the dumb money buying in a selloff. You’d be down more than 12%.

Kudlow hedged his suggestion with the “long term” reference. But it was still a foolish thing to say, and Kudlow’s not the only one saying it. Trump himself is a frequent stock-market commentator (always buy, never sell) who is now dismissing the recent plunge in stocks as a panicky reaction to “fake news”—the coronavirus outbreak. Treasury Secretary Steven Mnuchin has been another occasional up-talker of stocks. We all know the game: Trump’s minions must say anything to goose stocks and aid Trump’s reelection odds.

We know now that Kudlow issued his buy recommendation in the early stages of a worsening downturn that might end the bull-market rally that stretches all the way back to 2009. The coronavirus has unnerved investors because nobody can gauge the severity and duration of an epidemic forcing closures, cancellations and lost business worldwide. On top of that, a spat between oil producers Russia and Saudi Arabia led to a crash in oil prices and new worries about energy firms going bust.

Kudlow couldn’t have known all this, right? Shouldn’t he get a pass for an innocent mistake? How about no. Kudlow’s recommendation came with stocks down 7.6% from their peak, which might sound like a nice dip-buying opportunity in normal times. But this was at a time when the coronavirus death toll in Italy hit double digits, the mayor of San Francisco declared a state of emergency and public health experts were warning of an exponential spike in infections. The volatility index (^VIX) which measures uncertainty in financial markets, had doubled in a week and was well into the range often associated with market turmoil.

Kudlow, 72, is not an economist, even though he served as “chief economist” at investing firm Bear Stearns in the 1980s. Kudlow was a successful Wall Street salesman who capitalized on an upbeat personality to land a job as a commentator and show host at CNBC, starting in 2002, which made him famous. He’s a fervent supply-sider favoring tax cuts and laissez-faire policies as the best path to a strong economy, one reason Trump tapped him to replace Gary Cohn at the White House in 2018.

Kudlow has produced some famously bad predictions, however. “Larry Kudlow is usually wrong and frequently absurd,” housing analyst Bill McBride, who pens the Calculated Risk blog, wrote in 2016. In 2005, for instance, Kudlow, argued that “bubbleheads” predicting real estate crashes in Las Vegas and Florida were “dead wrong.” Kudlow turned out to be dead wrong. An epic housing bust began right around that time, with gigantic losses in Las Vegas and Florida. In 2007, Kudlow wrote, “there is no recession.” In reality, a terrible recession began that very month.

Kudlow was one of several Trump officials who predicted the 2017 Republican tax cuts would produce a surge of economic growth, perhaps hitting 4% for the first time since 2003. It hasn’t happened. Growth under Trump peaked at 3.3% in the second quarter of 2018 and drifted down to 2.3% by the end of last year. Most economists think the economy was growing at around 2% before the coronavirus crisis, which will undoubtedly slow the economy.

Kudlow might be able to argue that he’s simply a sunny analyst eager to see the bright side. But he has a giant conflict of interest when commenting on financial markets, because it’s in his interest and Trump’s that markets do well this year, to help Trump with reelection. If everybody loses their shirts the day after the election, who cares.

What about Obama? It’s a fair question. On March 3, 2009, when markets were reeling from the Great Recession, President Obama said, “What you’re now seeing is profit and earning ratios are starting to get to the point where buying stocks is a potentially good deal, if you’ve got a long-term perspective on it.” That was a buy recommendation, just like Kudlow’s. Obama should have kept his mouth closed and let the market sort itself it, but history has treated him kindly. Stocks bottomed out six days later—down a nauseating 56%—triggering a bull market that continues to this day.

Yahoo Finance reached out to the White House to ask if Kudlow still recommends buying stocks, or has any regrets about his Feb. 25 buy recommendation. We got no response. That sounds about right.

Rick Newman is the author of four books, including “Rebounders: How Winners Pivot from Setback to Success.” Follow him on Twitter: @rickjnewman. Confidential tip line: rickjnewman@yahoo.com. Encrypted communication available. Click here to get Rick’s stories by email.

Read more:

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.