Coronavirus: easyJet and BA shares crash amid major flight cancellations

Shares in easyJet (EZJ.L), one of the largest low-cost airlines in Europe, and British Airways-owner International Consolidated Airlines Group (IAG.L) are crashing in early trading after the airlines warned of rolling cancellations due to the uncertainty over the coronavirus pandemic.

In a statement on Monday 16 March, easyJet said “due to the unprecedented level of travel restrictions being imposed by governments in response to the Coronavirus pandemic and significantly reduced levels of customer demand, easyJet has undertaken further significant cancellations.

“These actions will continue on a rolling basis for the foreseeable future and could result in the grounding of the majority of the easyJet fleet.

“easyJet will continue to operate rescue flights for short periods where we can, in order to repatriate customers. To help mitigate the impact from COVID-19 we are taking every action to remove cost and non-critical expenditure from the business at every level. Aircraft groundings will remove significant levels of variable costs.”

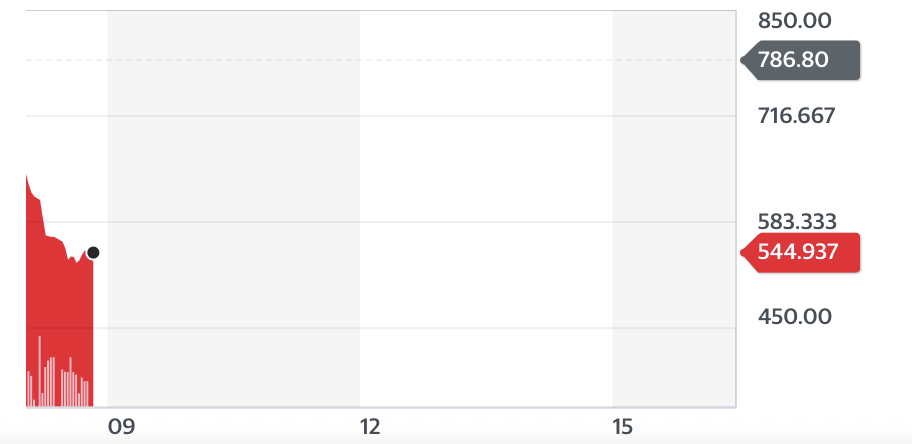

The easyJet stock price tumbled over 30% as of 9.10am local time:

"At easyJet we are doing everything in our power to rise to the challenges of the coronavirus so that we can continue to provide the benefits that aviation brings to people, the economy and business,” said Johan Lundgren, CEO of easyJet.

“We continue to operate rescue and repatriation flights to get people home where we can, so they can be with family and friends in these difficult times.

"European aviation faces a precarious future and it is clear that coordinated government backing will be required to ensure the industry survives and is able to continue to operate when the crisis is over."

Read more: European stocks fall as US Fed’s surprise stimulus puts investors on edge

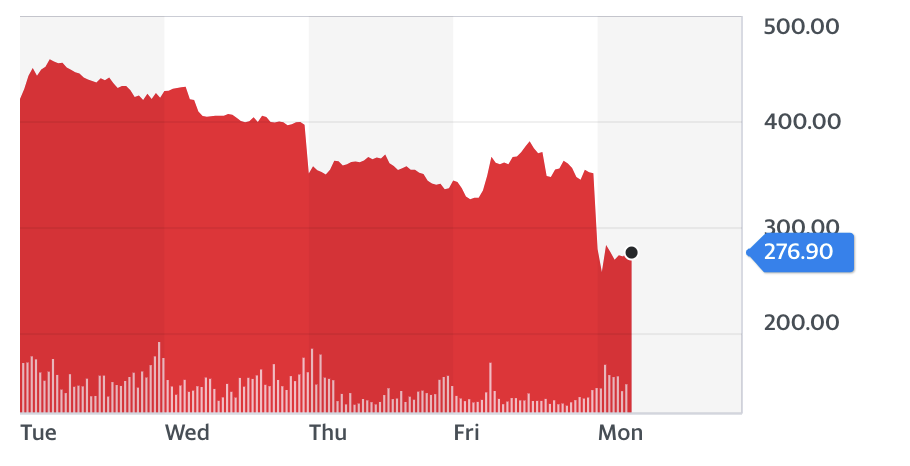

Meanwhile, IAG shares tumbled by over 20% by 10.19am local time after it said that it is cutting the British Airways flights capacity by 75% in April and May this year:

However, BA-owner IAG stopped short of asking for government backing. Its CEO Willie Walsh has publicly opposed, over a long period of time, any government help for airlines.

Earlier on Monday, multinational travel and tourism company TUI (TUI.L) announced that it will be suspending all package holidays, cruises, and hotel operations due to the coronavirus pandemic.

It confirmed in a statement that it is also withdrawing the guidance it is giving to investors about how it sees its financial results for 2020 and that the executive board has “decided to apply for state aid guarantees to support the business until normal operations are resumed.”

Read more: Coronavirus: TUI suspends all package holidays and cruises and asks for state aid

The International Air Transport Association (IATA), an aviation industry trade group, said that airlines could lose between $63bn (£50bn) and $113bn in revenues as a result of the coronavirus outbreak.

The prediction represented a sharp jump from last month, when it estimated that the industry would only lose $29bn.

Yahoo Finance

Yahoo Finance