Coronavirus: 'War-time level deficits' as UK faces £337bn COVID-19 bill

The COVID-19 pandemic will “permanently scar government balance sheets” for at least a generation to come, a top economist has warned.

David Folkerts-Landau, group chief economist at Deutsche Bank (DBK.DE), said in a note to clients this week that governments around the world would face “war-time level deficits” for years to come.

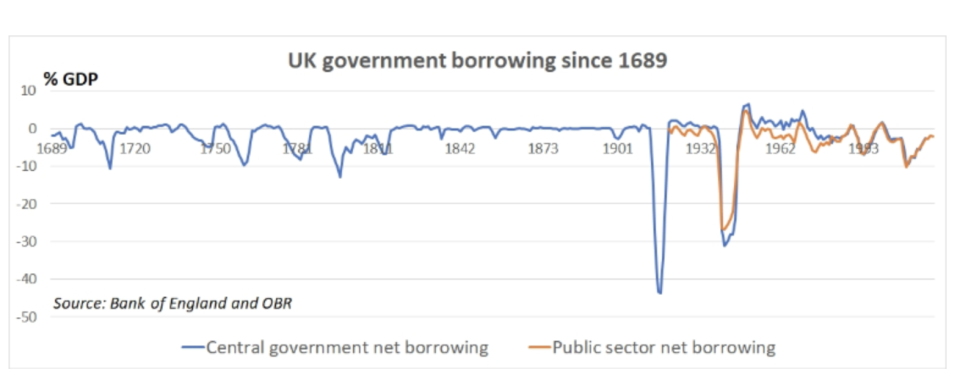

The UK government reached as high as 25% of GDP for much of Second World War and 43% during the First World War, according to Jefferies (JEF). It peaked at 10.2% during the financial crisis.

Deutsche Bank forecasts a UK budget shortfall worth 13.4% of GDP in 2020.

It came as the Telegraph reported on leaked Treasury projections suggesting the UK will face a budget deficit of £337bn ($414bn) this year. That is up from a projection of £55bn made in March.

In a “best case” scenario, the deficit would still be around £200bn this year, while in the worst case forecast it would spiral to £516bn. The government is reportedly considering slashing spending and raising taxes in response.

Read more: Bank of England predicts ‘very sharp’ fall in economic growth

A deficit of £337bn would equal roughly 12% of GDP.

“A highly uncertain and worrying outlook lies ahead, and it is likely that any short-term stability will come at a huge long-term cost,” Folkerts-Landau wrote.

The UK government has so far spent the equivalent of 6.1% of GDP — roughly £170bn — on fiscal stimulus measures in response to the COVID-19 pandemic, according to UBS (UBS). The state has also pledged to stand behind private sector loans to businesses worth £330bn.

The government launched a wide-ranging programme to support the economy through the COVID-19 pandemic in March. However, it was assumed the crisis would run for weeks, not months. Chancellor Rishi Sunak has twice been forced to extend the government’s job retention scheme, at a cost of tens of billions to the state.

As well as spiralling costs, government income is rapidly falling as the economy grinds to a halt. Expectations for future tax receipts are also worsening.

Folkerts-Landau said Deutsche Bank was becoming “increasingly gloomier on the global economy” as the pandemic dragged on. The investment bank slashed its growth forecasts for the UK economy from a slump of 5.5%, forecast in March, to a contraction of 11.5%.

Read more: UK economy saw worst slump since 2008 even before full lockdown blow

Goldman Sachs (GS) this week also cut its growth forecast for the UK. The bank now expected the UK economy to contract by 10% in 2020, citing “further delays to the announcement of any substantive exit plans” from lockdown. In late March it expected a contraction of just 1.1%.

Neither forecast is as bleak as a scenario set out by the Bank of England last week. While not a forecast, the central bank said its modelling suggests UK GDP could shrink by 14% this year. It would mark the sharpest contraction in 300 years.

Official data, published on Wednesday, shows UK GDP fell by 2% in the first quarter of the year even before the full effects of the pandemic were felt.

The government this week began urging people to get back to work, likely in a bid to get the economy moving again and avoid more pressure building on the public purse.