Cisco (CSCO) Expects Software Business to Drive Revenues

At its Investor Day, Cisco CSCO provided upbeat revenue projections on the back of consistent momentum in the software and subscription business. The company expects to report a CAGR of 5-7% for revenues through fiscal 2025.

Cisco expects that emerging trends like hybrid cloud, webscale, WiFi 6 and 400G, hybrid work, cloud security, 5G deployment, full-stack observability, Internet of things (IoT) and edge computing will drive the company’s top line in the coming days.

Cisco is focused on creating a portfolio of solutions, which is “cloud-first and app-centric” to provide clients with comprehensive solutions to accelerate digital transformation. The company is also focusing on enhancing revenues from software and subscription services. Subscriptions ensure a steady stream of revenues.

The company noted that software and service revenues contributed 53% to total revenues in fiscal 2021. For the fourth quarter of fiscal 2021, software revenues were up 6% to $4 billion. Software subscription revenues increased 9%. Subscriptions contributed 81% to Cisco’s software revenues in the last reported quarter. Remaining performance obligations (“RPO”) at the end of fiscal fourth quarter were $30.9 billion, up 9%.

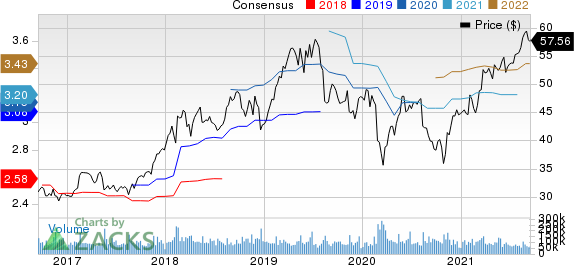

Cisco Systems, Inc. Price and Consensus

Cisco Systems, Inc. price-consensus-chart | Cisco Systems, Inc. Quote

Going forward, the company will report revenues around six new product categories — Secure, Agile Networks, Optimized Application Experiences, Hybrid Work, Internet for the Future, End-to-End Security and Capabilities at the Edge. Currently, the company reports revenues under Infrastructure Platforms, Applications, Security and Other Products categories.

Cisco also underscored its commitment to reduce greenhouse gas (GHG) emission. The company is working toward achieving net zero for GHG emissions by 2040 and net zero for global Scope 1 and 2 emissions by 2025.

Opportunities Aplenty for Cisco

Cisco is an IP-based networking company that offers products and services to service providers, companies, commercial users and individuals.

Strength in the company’s Catalyst 9000 and Nexus 9000 switch solutions is driving the top line for the company. Accelerated deployment of 5G, growing adoption of Wi-Fi 6 products and higher demand for Meraki solutions are key catalysts.

The acquisition of Acacia will help Cisco to expand its optical systems portfolio, especially coherent optical solutions to support its “Internet for the Future” strategy.

Continuation of remote work and adoption of flexible work model bodes well for the company’s enterprise communication platform, Webex. In the last reported quarter, recurring subscription revenues for Webex was up 9% year over year.

The company is constantly adding new features to Webex suite to consolidate its competitive position against the likes of Zoom Video ZM and Microsoft’s MSFT Teams App.

Cisco’s security solutions portfolio is benefitting from steady traction in cloud-based security and Zero Trust offerings as well as strong momentum for Duo and Umbrella solutions. The company’s differentiated end-to-end approach across the network, cloud and endpoints is helping it expand clientele. The company is witnessing healthy uptake of identity and access, advanced threat as well as unified threat management solutions. Recurring subscription revenues from Security business increased 13% year over year in the last reported quarter.

In fourth-quarter fiscal 2021 conference call, management had cautioned that the ongoing component shortages and resultant supply chain issues and higher costs will continue in the first half of fiscal 2022 and might carry on in the remaining half. Low demand for servers is another concern along with stiff competition from Arista ANET and Juniper in networking infrastructure domain.

In the past year, shares of Cisco have returned 42.6% compared with industry’s growth of 41.8%.

At present, Cisco carries a Zacks Rank #3 (Hold). You can see the complete list of today's Zacks #1 (Strong Buy) Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Cisco Systems, Inc. (CSCO) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Zoom Video Communications, Inc. (ZM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research