China can’t afford to worry about inflation right now

China’s central bank kicked off the week with a big surprise: cutting a key lending rate by 10 basis points—despite signaling just a few days before that it had no immediate plans for rate cuts.

The about-face caught markets and analysts off guard, and indicates just how challenging an economic situation Beijing faces as it battles covid flare-ups, imposes pandemic lockdowns, and contends with a real estate meltdown.

The unexpected rate cut comes after the People’s Bank of China hinted strongly in a report last week (link in Chinese) that it wouldn’t flood the economy with excessive liquidity and that the country must not “let down our guards easily” against the risks of inflation.

Will rate cuts boost China’s economy?

Official economic data for July published on Monday paint a worrying picture.

Retail sales, industrial output, and fixed asset investment last month all missed expectations by a wide margin. Home sales were down 28.6% year-on-year, and property investment shrank 12.3% over the same period, according to data from the National Bureau of Statistics. Crude steel output slumped 6.4%. Youth unemployment climbed further to a record 19.9%.

That means banking authorities’ worries about inflation must now take a backseat to the more urgent task of trying to rev up the country’s economic engine.

“With growth struggling and demand for credit cratering, the People’s Bank of China has made clear that it’s [economic] recovery” that must be prioritized, wrote Bloomberg columnist Daniel Moss. “Price increases might be worrying, but are a second order problem—for now. Beijing must consider the outlook dire.”

More rate cuts may be coming. Whether such monetary easing will help boost economic activity in China is another question.

“A cut to the Loan Prime Rate (LPR) later this month is now a given and we expect additional easing measures further ahead, though it’s far from clear that this will be sufficient to drive a revival in credit growth,” Julian Evans-Pritchard of Capital Economics wrote in a note today.

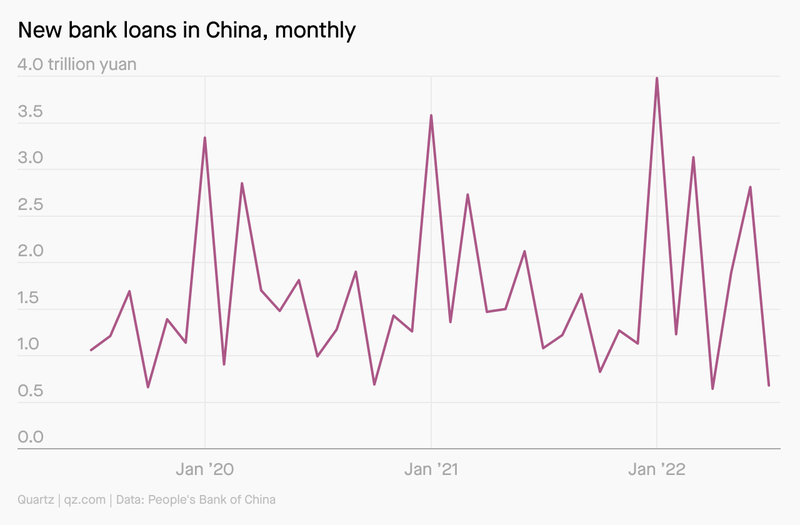

Lousy bank lending data indicates underlying gloominess that won’t be dispelled by rate cuts alone. Last month, Chinese banks extended 679 billion yuan ($101 billion) in new yuan loans, less than a quarter of June’s amount. Yet economic uncertainty, driven in large part by the unpredictability of China’s covid lockdowns, means businesses are reluctant to borrow, invest, and hire. Cheap credit won’t fix that problem.

“Businesses and households seem to be cutting back on their borrowing because of their concerns about economic weakness,” wrote Michael Pettis, senior fellow at the Carnegie Endowment for International Peace.

“The problem, in other words, is lack of domestic demand, not expensive capital.”