Chevron Stock Could Remain Strong, Says Signal

Oil prices have been on the rise lately amid the Organization of Petroleum Exporting Countries and its allies' (OPEC+) decision to maintain their output targets, with the organization agreeing to cut by 2 million barrels per day (bpd) from November and through 2023. Meanwhile, the Group of Seven (G7) plus Australia finally agreed to cap seaborne Russian oil at $60 per barrel last week. While the glut of headlines have created a bit of volatility (West Texas Intermediate crude futures were last seen back below the $80 mark after trading as higher as $81.12 per barrel earlier today), energy stocks have managed to remain near their October highs.

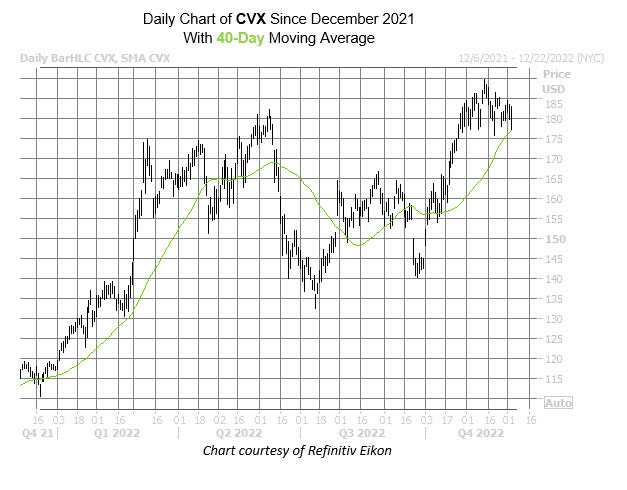

Chevron Corporation (NYSE:CVX), for instance, is cooling this afternoon, last seen down 2% at $177.49. However, any pullbacks the security has seen during the past couple months have managed to find support near the $177 level. What's more, the stock's 40-day moving average has stepped in as support. This trendline is important because similar pullbacks have resulted in upbeat monthly returns in the past.

According to a study from Schaeffer's Senior Quantitative Analyst Rocky White, CVX has seen seven similar pullbacks during the past three years. One month after these signals, the equity was higher 71% of the time, averaging a 5% return. A similar move from its current perch would put CVX at $186.36, closer to its record highs near the $189 level.

Despite its 51% year-to-date lead, CVX is just on the cusp of being "oversold." This is per its 14-day Relative Strength Index (RSI) of 38. In other words, a short-term bounce could already be in the cards for the energy name.

An unwinding of pessimism could also provide tailwinds. The stock sports a Schaeffer's put/call volume ratio (SOIR) of 1.18, which sits higher than 96% of readings from the past year. In other words, short-term options traders have rarely been more put-biased.