Carl Icahn Loads Up on Southwest Gas in 2nd Quarter

Carl Icahn (Trades, Portfolio) is an activist investor who is known for taking bold stakes in companies and shaking up the management with the goal to create more value for investors. He manages Icahn Capital Management, a focused hedge fund with 16 stocks stocks in his 13F portfolio as of the most recent quarter's end, collectively valued at approximately $20 billion.

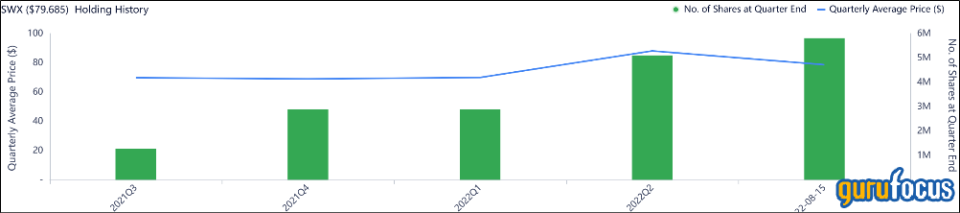

According to GuruFocus Real-Time Picks, a Premium feature, the guru was loading up on shares of Southwest Gas Holdings (NYSE:SWX), a company he has been actively involved with recently, on Aug. 15.

Icahn buys more Southwest Gas

Southwest Gas Holdings buys, holds and transports natural gas across the U.S. Icahn added to his position in the stock on Aug. 15 after having already increased his stake in the second quarter. Icahn now owns ~5.8 million shares in the company with an approximate value of $461 million. This makes him the third largest shareholder in the company with an 8.6% stake, after institutional giants Vanguard (9.93% stake) and Blackrock (14.34%).

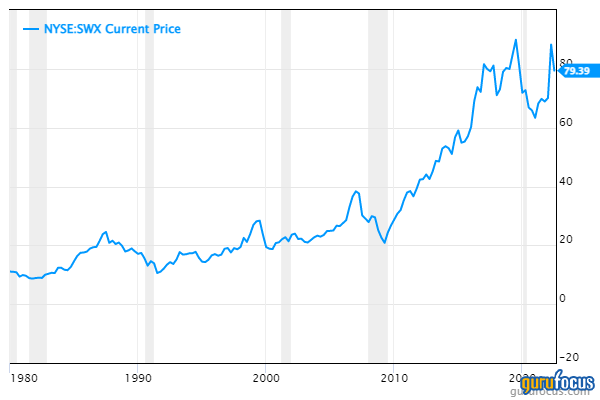

Southwest's stock price skyrocketed by ~77% between the 2020 lows and highs in June 2022. But recently, the stock price pulled back substantially by 19%; perhaps the dip was when Icahn saw an opportunity to load up cheap.

About Southwest Gas

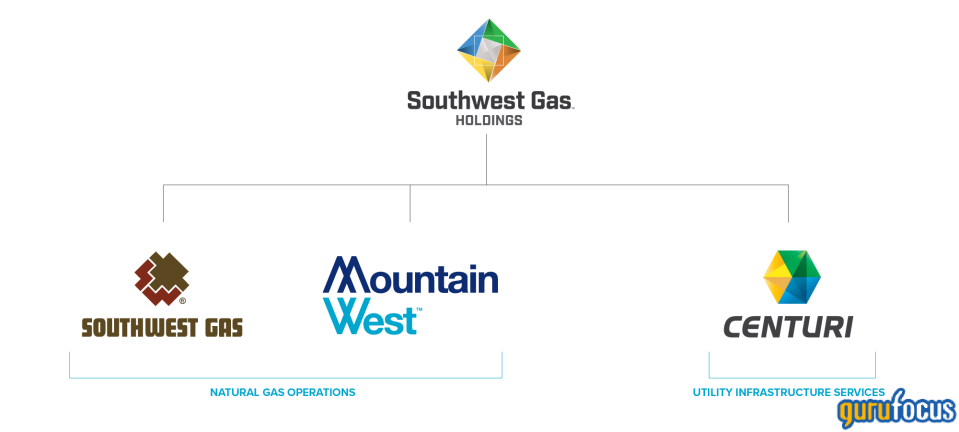

Southwest Gas owns a mix of utilities, pipelines and construction services operators. Its regulated operations include Southwest Gas Corporation, which is a natural gas utility that serves more than 2 million residential, commercial and industrial customers across Nevada, Arizona and California.

The company also is diversified across midstream operations. Its MountainWest Business unit controls the Dominion Energy (NYSE:D) Questar pipeline. This includes over 2,000 miles of natural gas pipelines which are installed across Utah, Wyoming and Colorado.

Pipelines are one of my favorite investment types as they have high replacement costs (which deters competition). In addition, pipelines effectively act as a toll road on energy, collecting transport fees no matter the price of oil. This makes them a consistent free cash flow generator.

The companys third business unit is called Centuri, which is an unregulated utility infrastructure services company. This unit basically helps to build and maintain energy infrastructure across the U.S. Services include maintaining, installing and replacing parts of the network. Management has recently announced plans to spin off the Centuri services unit.

Source: Southwest investor materials

Icahn vs. Southwest Gas

Icahn previously offered $4.2 billion ($75 per share) to buy the entirety of Southwest Gas. Southwest Gas rejected the offer, claiming it undervalued the company. Icahn claims that the promises to spin off Centuri were designed specifically to block his attempts to take over the company. In fact, he stated in a recent letter to shareholders, Its not necessarily a step in the right direction nor is it something [Former CEO John Hester] ever wanted to do."

Icahn went on to say that former CEO John Hester is "the quintessential example of what is wrong in Corporate America.

Icahn won a boardroom battle in May 2022 and finally managed to get former CEO John Hester to leave. The new CEO is Karen S. Haller, who the board believes is the right person for the job. Ichan is allowed to appoint three directors to the board and a possible fourth if the company doesnt spin off Centuri.

Second quarter financials

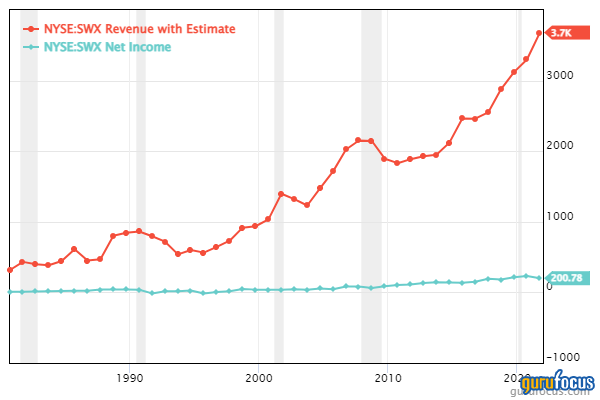

Southwest generated solid results for the second quarter of 2022. Revenue was $1.15 billion, which beat analyst consensus expectations by $115 million and rose by a rapid 39% year over year. This increase was driven mainly by higher natural gas prices and energy tailwinds. However, the company did miss on earnings per share estimates with a GAAP loss per share of $0.10, which missed estimates by $0.64. This was driven by an increase in operating expenses which ironically included $8.2 million in activist stockholder litigation expenses.

Ichan stated previously that Southwest Gas Boasted that no less than 23 attorneys in four different cities were working feverishly to help SWX prevent stockholders from being able to decide for themselves on whether to accept his $75/share tender offer and voting for its slate of board nominees."

Of course these lawyer fees rack up expenses, but that is not all. A market price decrease in the company-owned life insurance ("COLI") policy caused a cash surrender value net decline of $5.2 million or ($0.08 per diluted share) for the quarter. There was also $15 million of maintenance expenses and $4 million extra in interest expenses due to the rising interest rate environment combined with Southwest's considerable pile of debt.

The good news is Southwest added 39,000 new utility customers in the trailing 12 months and achieved a record high operating income of $1.1 billion. Its customer satisfaction score was also extremely high at 95% in the second quarter of 2022.

Southwest has a healthy forward dividend yield of 3.11% and it has grown dividends at a 12% average growth rate over the past five years.

The company has $216 million in cash and cash equivalents with a substantial $790 million in accounts receivable. I would estimate this is from gas provided to customers and payment owed at the end of the month. The company does have high total debt at ~$6 billion, but only $41.3 million is short term debt (due within the next two years). Utility companies are known for having high debt levels and thus this isnt a major surprise or worry in my eyes.

For fiscal 2023, management is guiding for a return on equity of over 8%, in addition to a 5% to 7% compounded annual increase in the utility base rate and five-year capital expenditures of a staggering $2.5 to $3.5 billion which are related to system optimization and pipeline replacement projects.

Valuation

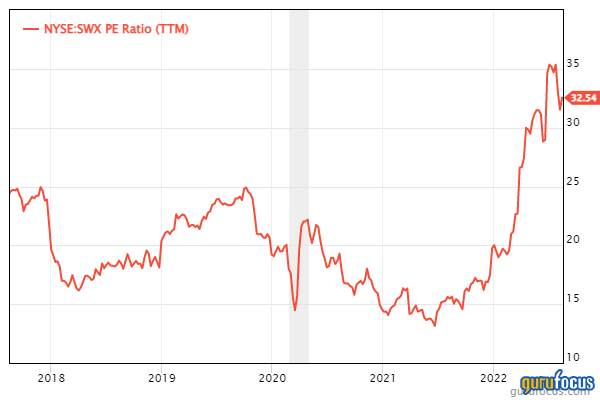

Southwest Gas Holdings is trading at a forward price-earnings ratio of 19.42, which is ~6% cheaper than the utility sector average of 20.8. It is also trading close to its five-year average price-earnings ratio of 19.13.

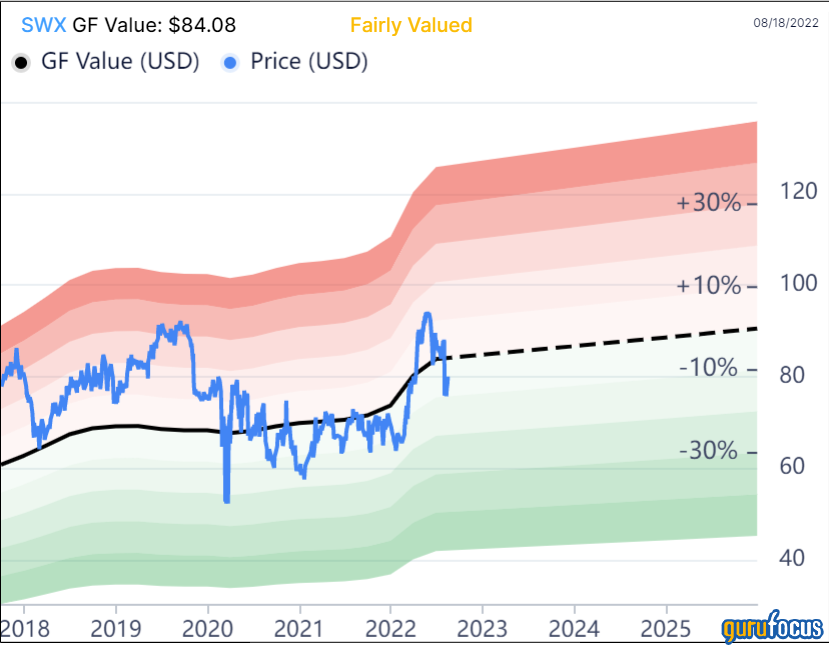

The GF Value calculator indicates a fair value of $84 per share and also gives a fairly valued rating at the time of writing.

Final thoughts

Southwest has a diversified mix of utilities, pipelines and construction related services. The company is poised to benefit from the increased energy security demanded by nations and customers alike. Given the geopolitical turmoil from the Russia-Ukraine war and the record high energy prices, Southwest is in a strong position. As Ichan is a large investor, that should help to ensure management is focused on shareholder value creating activities.

This article first appeared on GuruFocus.